Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

My Current Account transactions are automatically synced with QBO, and I have a couple transactions that were refunded but I can't figure out how to categorise them. If someone can assist with this please?

Thanks

Solved! Go to Solution.

Thank you for providing additional info on your concern, @KevinCr.

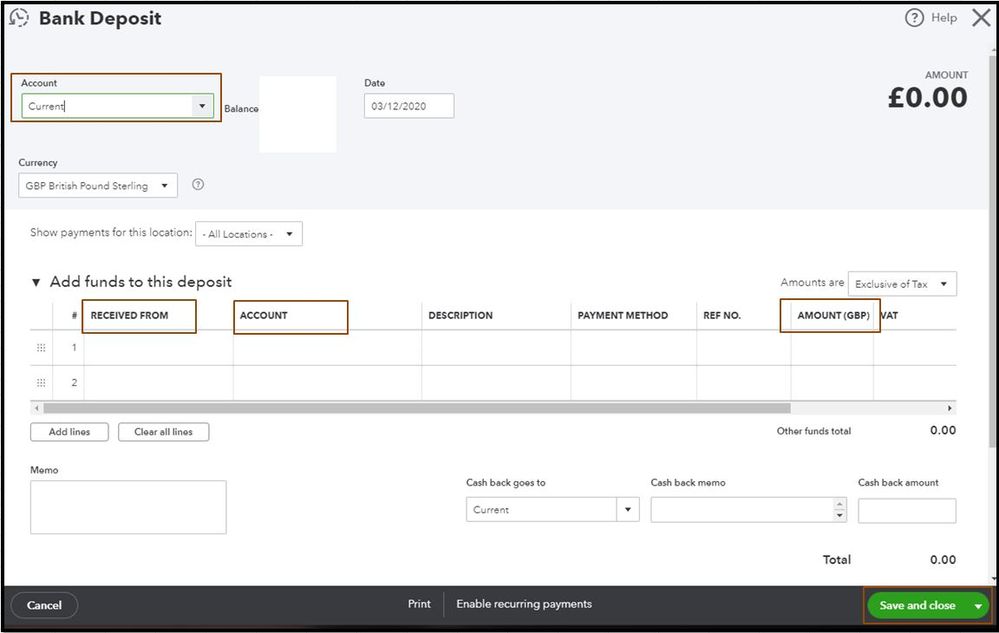

To record the supplier refund in QuickBooks, you have to create a supplier credit and link it to the expense account you use for this supplier. To start, enter the supplier refund cheque in the Deposits screen:

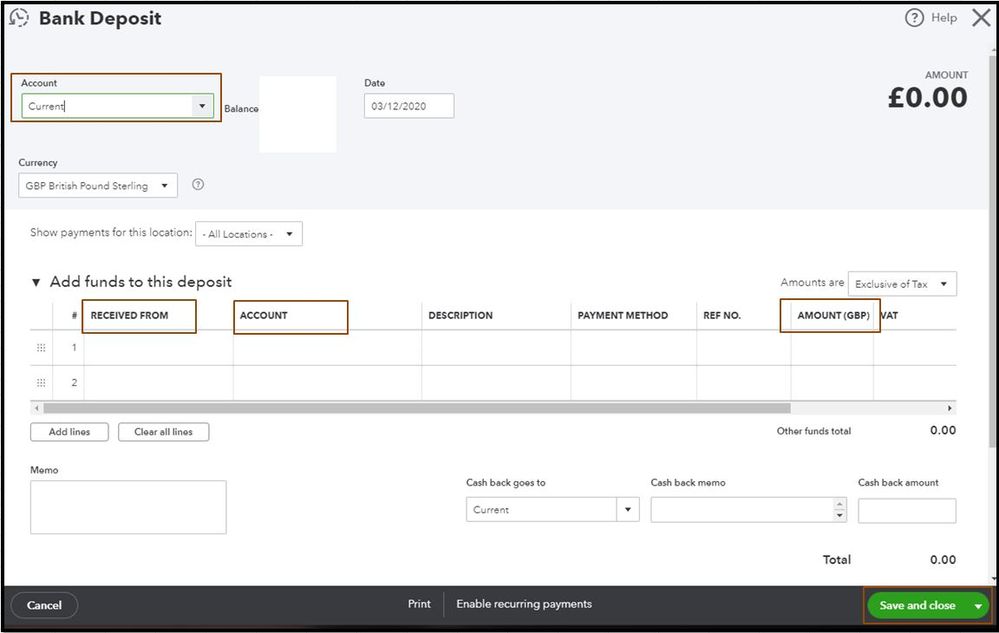

Then, link the deposit to the supplier credit:

Here's the article that will provide more details about the process: How do I handle supplier credits and refunds?

Also, if you need further assistance about recording the supplier refund, I suggest consulting your accountant to ensure the accuracy of your data. If you don't have one, you can utilize our Find an Accountant tool.

For handy articles that will guide you while working with QuickBooks such as for reports and accounting, banking and bank feeds, account management, inventory and projects, etc. Please head to the QBO help articles page at this link.

Feel free to post here again if you have follow-up questions about recording refund transactions in QuickBooks Online. I'm always here to help. Have a good one.

Hello, user Kevin Are these customer or supplier refunds? Are those payments already attached to invoices/bills as paid? Also, have you done any supplier/customer credits? We can go through the process with you we just need a bit more information.

Hi EmmaM,

Thanks for your reply, here are the answers to your questions.

They are supplier refunds, the transactions are mostly software and services I had bought, and were either fully or partly refunded.

They are not attached to bills as they were purchased from the internet directly, maybe I should link them to their receipt? Enlighten me on this one.

I'm not quite sure how the credit thing you're talking about works sorry.

To be fair, I was using another accounting software before, and it was easier than QBO, I'm completely lost now.

Thank you for providing additional info on your concern, @KevinCr.

To record the supplier refund in QuickBooks, you have to create a supplier credit and link it to the expense account you use for this supplier. To start, enter the supplier refund cheque in the Deposits screen:

Then, link the deposit to the supplier credit:

Here's the article that will provide more details about the process: How do I handle supplier credits and refunds?

Also, if you need further assistance about recording the supplier refund, I suggest consulting your accountant to ensure the accuracy of your data. If you don't have one, you can utilize our Find an Accountant tool.

For handy articles that will guide you while working with QuickBooks such as for reports and accounting, banking and bank feeds, account management, inventory and projects, etc. Please head to the QBO help articles page at this link.

Feel free to post here again if you have follow-up questions about recording refund transactions in QuickBooks Online. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.