Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

So I'm a total beginner and am struggling to get my head around logging payment and matching transactions.

I have several hundred standing order payments going into my bank accounts in January and I need to set these payments against the invoices raised.

So far, I've done a whole bundle by logging the payment manually, via the receive payment option. If I now go through and match the bank receipts to the invoices, will it record the payment twice?

Alternatively, if I match a bank receipt to a raised invoice, will it automatically log the payment as received and adjust the customer's account accordingly.

Sorry to ask such rookie questions but I am stuggling to get a grip on this.

Solved! Go to Solution.

I'd be glad to add some information about recording and matching transactions, @RFBSDot.

After you connect your bank and credit card accounts, QuickBooks automatically downloads the latest transactions. It tries to match them with transactions you've already entered into QuickBooks. If it can't find a match, it creates a new transaction record for you. All you have to do is approve the newly created transaction.

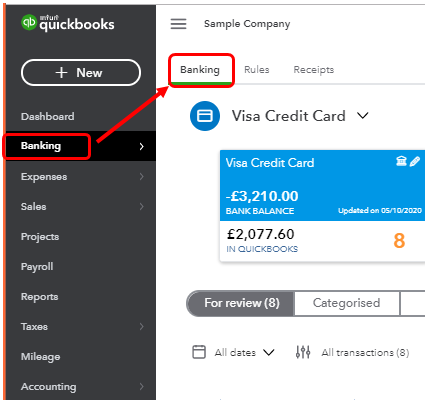

Let's match the downloaded transaction with the one you already entered, so you don't get duplicates. Here's how:

You may also check this article for more information: Categorise and match online bank transactions in QuickBooks Online.

Additionally, I'll be adding this to guide you to use bank rules: Setup bank rules to categorize online banking transactions in QuickBooks Online.

Please don't hesitate to leave a comment down below if you have other concerns. I'll be happy to help you. Have a wonderful day.

I'd be glad to add some information about recording and matching transactions, @RFBSDot.

After you connect your bank and credit card accounts, QuickBooks automatically downloads the latest transactions. It tries to match them with transactions you've already entered into QuickBooks. If it can't find a match, it creates a new transaction record for you. All you have to do is approve the newly created transaction.

Let's match the downloaded transaction with the one you already entered, so you don't get duplicates. Here's how:

You may also check this article for more information: Categorise and match online bank transactions in QuickBooks Online.

Additionally, I'll be adding this to guide you to use bank rules: Setup bank rules to categorize online banking transactions in QuickBooks Online.

Please don't hesitate to leave a comment down below if you have other concerns. I'll be happy to help you. Have a wonderful day.

Many thanks for the reply - that's really helpful.

So I have a number fo payments that I've added manually rather than by matching on the banking list. Presumably, if I can't now match these payments otherwise they'll appear twice in my records. So how do I clear them from my "reveiw" list?

Do I exclude them?

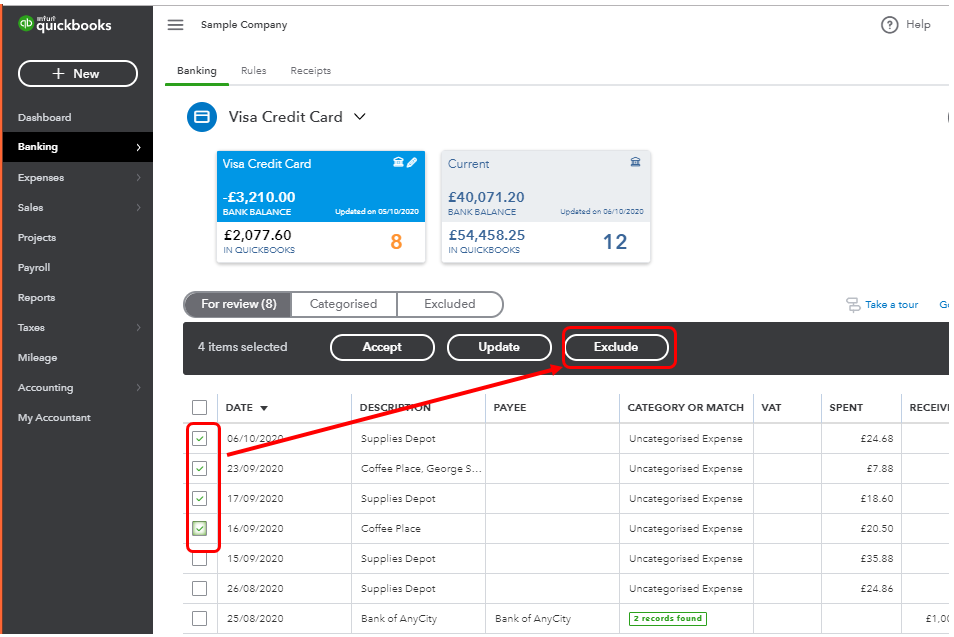

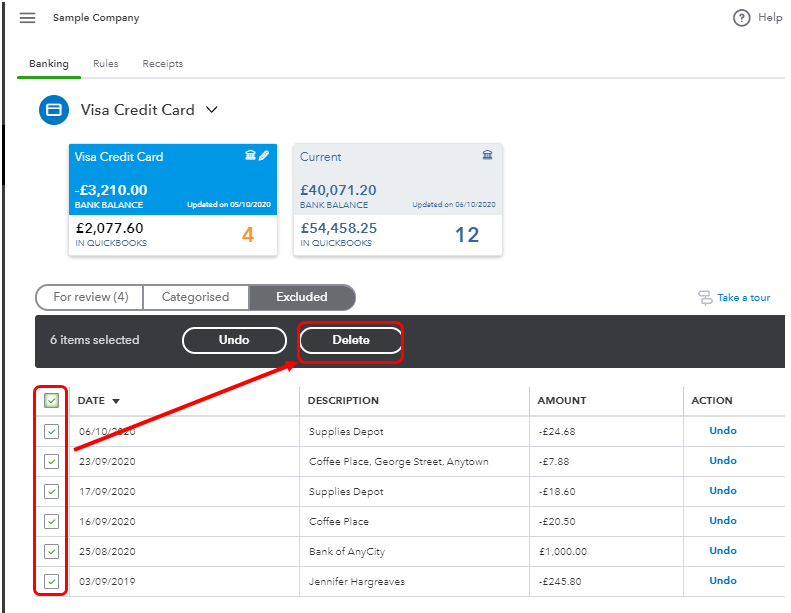

Yes, you can delete the transactions that are appearing twice on your QuickBooks Online records, RFBSDot.

You can follow the step-by-step process below in excluding the transactions,

You can get more details about this process in this article: Exclude a bank transaction you downloaded into QuickBooks Online.

Additionally, you can always visit our Banking Help Articles in QuickBooks Online for your reference. This will provide you links to help you with your account-related issues as well as steps in reconciling your statements. Doing so will help you ensure the accuracy of your financial records.

Keep in touch if you have any other banking concerns or if you have other questions in mind about QuickBooks. I'll make sure to get back to you as quickly as I can. Have a nice day!

Thanks, that's all really helpful.

I have another question. I have a number of customers who, for various reasons, have two accounts. Sometimes they have outstanding invoices in both accounts and send a single payment to cover both account balances.

Can you advise on the best approach for dealing with this situation?

Thnaks.

Hello RFBSDot, By two accounts do you mean they show as 2 separate customers with separate invoices, how do you show the fact they have 2 accounts in QuickBooks and we can certainly help with how best to record that?

I have some individuals who have two customer numbers. They have separate invoices recorded against both customer numbers, but have made a single payment (either by BACS which I'd want to match to the bank transaction) or by cheque, which I might want to add manually.

Hi there, RFBSDot.

I appreciate you for coming back to provide additional information about your concern in recording payments. I suggest recording the single payment in the Receive payment page to one customer. Then, create a journal entry to transfer the Accounts Receivable from one customer to the other.

Here's how to record receive payment:

For additional information, you can click this article: Record invoice payments in QuickBooks Online.

Once done, you can no create a journal entry. I suggest consulting an accountant before performing the process. They can provide suggestions on how to properly handle the account, especially with the category to use for the debit and credit. Please follow the steps below on how to record JE.

Please refer to this article to see steps on how you can create and review adjusting journal entries to adjusts an account's total balance: Make adjusting journal entries in QuickBooks Online Accountant.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be always around ready to lend a helping hand.

I don't really want to go down the journal entry route - I'm not an accountant and I have quite a lot of these dual account transactions in any financial year. They are a normal part of our accounting processes and so I need to find a more everyday way of dealing with them.

Could I record the payment manually againt the accounts but then exclude the bank transaction so the amounts don't get recorded twice? Would that work?

Hello RFBSDot, thanks for coming back to us. Yes that will work, you can record the payment manually against the account and then on the banking transaction, you can just exclude it, if you don't want to do it by the journal entry.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.