Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi

So, for Q2 I just file return for actual amount for Q2 and for HMRC to respond for refund?

Hello Geetika Khanna,

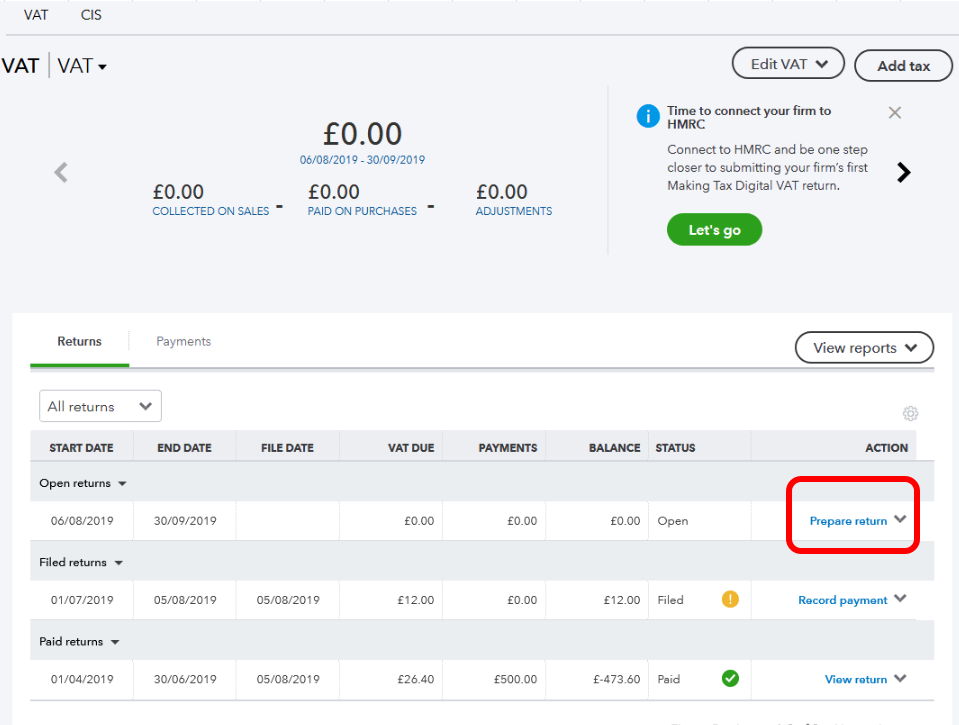

You can edit the payment recorded against the Q1 filing by going to Taxes > Payments and selecting that payment. Select delete at the bottom, go back to Taxes and select Record payment against Q1. Record the full payment you made in real life against this return, i.e. double the amount - this will then be taken into account and either reduce the balance you are due to pay on your next return or show as a refund.

Thanks,

Talia

Thank you for the quick response Geetika.

On further reflection of your query I think it might be best for us to take a look into this transaction for you, would it be possible to include a screenshot of the payments which have been recorded and the period on the VAT 100 for the next quarter where the payments should be. If you do not want to provide this information in a public page another option would be to call our Care Team on the number here, if you do call our team will be able to view the information via screen share and directly check the transactions.

Please let us know how you wish for us to assist further with this query as a whole.

Hi Geetika

We are unable to access the screen shot you have provided.

We would be grateful if you can PM us on FaceBook or DM us on Twitter with the screen shot and state your community name.

Hi

I posted my query through direct message on Twitter with screenshot.

Please check and reply.

Thank for sharing a screenshot, Geetika Khanna.

Based on the details you've provided, two possibilities might happen on the overpayment to HMRC. It's either they'll provide a refund or inform you to apply it on your next return as a credit.

If you receive a refund, you can record it by following the steps below:

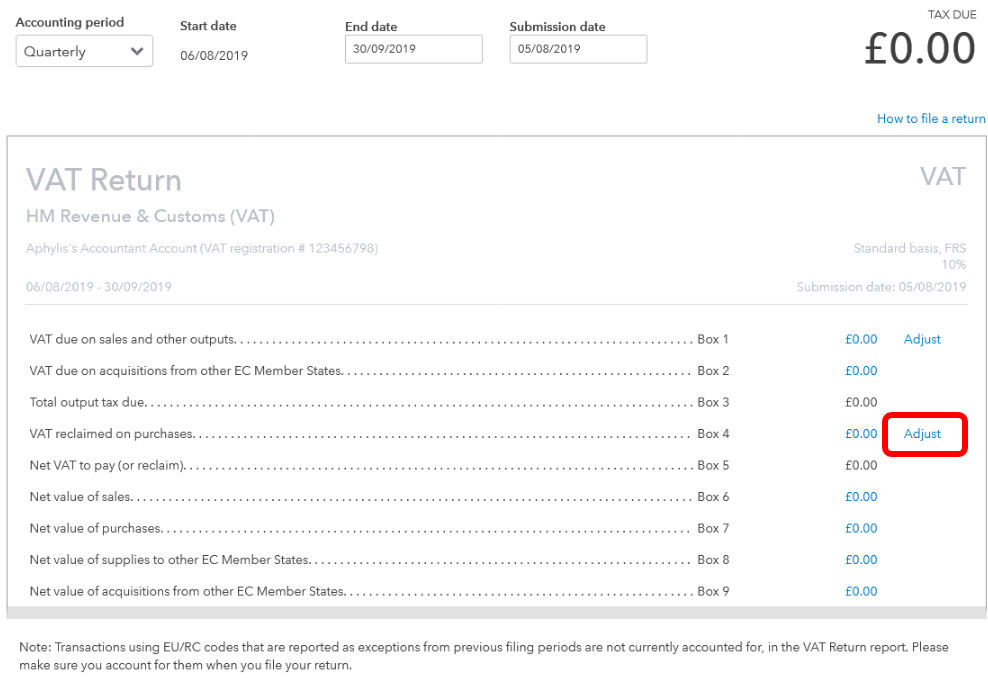

However, if you'll apply this credit to your next return, you can create a VAT Adjustment. Here's how:

Once done, let's record the VAT adjustment and select the account you've previously used in the expense transaction. Here's how:

I'm including articles that provide more details about VAT payment:

If you're unsure what account to use, please reach out to your accountant for the best advice.

Let me know if you have other questions about QBO. I'm always glad to help. Have a good day!

Hi

So, for Q2 I just file return for actual amount for Q2 and for HMRC to respond for refund?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.