Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Good day, stewtonplumbing.

When preparing VAT, please make sure to check this article for more information about reclaiming the VAT: Set up and record purchase taxes. Please take note that backdating and reclaiming your VAT on purchases has an expiry date. You can visit the HMRC website here for more information about this process.

After setting up the rate for VAT on Purchases, you can record your Purchase VAT by following these steps:

Please leave a reply on this thread if you need more help with VAT in QuickBooks. Thanks.

Good day, stewtonplumbing.

When preparing VAT, please make sure to check this article for more information about reclaiming the VAT: Set up and record purchase taxes. Please take note that backdating and reclaiming your VAT on purchases has an expiry date. You can visit the HMRC website here for more information about this process.

After setting up the rate for VAT on Purchases, you can record your Purchase VAT by following these steps:

Please leave a reply on this thread if you need more help with VAT in QuickBooks. Thanks.

Hi RenjolynC,

I am in the same position. I am trying to add VAT which needs to be reclaimed from purchase prior to our VAT registration therefore need to adjust Box 4 on the return. The advice below seems clear until point 5. What do you mean by 'choose an income account that you create for this purpose'? I am very new to Quickbooks and running our family business so I apologise if this seems a silly question.

Thanks in advance for your help!

Hi there, lucy24.

Thank you for posting here in QuickBooks Community.

The choose an income account that you create for this purpose means you'll need to select an income account. This is to track the adjustment you have for the credit. And, you owe less VAT to them.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Hi I am doing the same, do I need to upload all the relevant receipts from the last four years?

Welcome to the Community, @Lazza.

Yes, you’re right! You have to upload all the relevant receipts of your sales transactions. When reclaiming VAT on your Purchases, you’ll want to ensure that the necessary details are displayed. These details are as follows:

Refer to Reclaiming VAT on your Purchases in this article as your reference: Set up and record purchase taxes

Let me know if you need further assistance with taxes. The Community always has your back. Stay safe!

Hello, this doesn't make sense to me. Do I just make an one line adjustment against my vat return in Box 4 and have a spreadsheet listing all the vat I am claiming back pre-Vat registeration? If I was to enter all these adjustments as expenses then my VAT return wouldn't pull in these expenses as I am on cash basis.

Hi,

I'm in the same position: I'm trying to record purchases from the past years to make my first VAT return.

As part of this, I need to include the VAT rate of purchases/suppliers. How do I add the relevant VAT rate and VAT number to suppliers and/or transactions? There doesn't seem to be a way to add the suppliers VAT number either to the supplier, or to the transaction. Therefore: how can I compile a complete VAT return? Don't I need to assign the correct VAT amount/rate/number for each purchase to the appropriate supplier?

Thank you.

in your email below, your instructions say to: " set up and record purchase taxes'. There is no way to do this in my QB.

I'd appreciate your assistance.

I'll guide you in recording the purchases, trDuilleog.

You can assign the correct VAT rate for each transaction to complete your return. First, make sure to set up the correct rates for your purchases in the Tax Center by following the steps below:

After that, enter your previous purchases as you'd normally do. Then, add the newly created VAT item in the VAT column. If the transactions wouldn't be pulled up in your return, you can create an adjustment to reclaimable amounts in Box 4. Here's how:

For more tips in preparing and filing your VAT return in QuickBooks Online, you can read these articles:

Stay around if you have any other concerns or follow-up questions about VAT. Have a great rest of the day.

Hi KlentB,

Just want to double check. So if i have to include the purchase invoices prior VAT registration, doesnt QB gives me an option to include the invoices which falls before the first VAT period. Do i have to manually make the adjustment always?

Thanks for joining the thread, @Susan152.

I'll chime in to share some insight about the VAT concerns in QuickBooks Online.

Since the purchase invoices are older than the VAT registration, there is no need for you to modify the previous transaction. VAT will start to acquire on your registration date.

Before submitting your VAT return to HMRC, QuickBooks enables you to edit adjustments. Your VAT control and/or VAT accounts will be impacted by any manual changes you make to your return. So it would be best to speak with accounting professionals.

Moreover, your accountant can look over your books, perform any necessary adjustments, and work with you on any tax issues. Check out this article if you need to invite them: Invite an accountant to review your books in QuickBooks Online.

I'm also adding this article for your guide on how to modify your VAT liability: Make VAT adjustments in QuickBooks Online.

In addition, here's a list of frequent VAT codes created for you by QuickBooks Online: VAT codes.

Linger around if you have any additional queries or concerns regarding VAT. Enjoy the rest of your day.

Hi @ChristineJoieR @KlentB ,

So to include my pre-registration invoices, i would have to manually include the figure in the VAT return. Am i correct? In other words, use the "Adjust" feature in the VAT return

Please could you confirm at the earliest.

Thanks for taking the time to scour our Community space for potential solutions, Susan152.

Yes you are right, then the VAT will start to acquire on your registration date. QuickBooks enables you to edit adjustments before submitting your VAT return to HMRC. Any manual changes you make to your return will impact your VAT control and/or VAT accounts so I'd suggest consulting your accountant. Also, we can use the "Adjust" feature in the VAT return to recording your Purchase VAT. Here's how:

Here's an article you can refer to for more details about setting up and recording purchase taxes. Please take note that backdating and reclaiming your VAT on purchases has an expiry date. Just visit the HMRC website here for more information about this process. For more tips in preparing and filing your VAT return, check out these articles:

Would like some assistance in preparing tax returns? Let me know the details and I'll gladly lay down the solutions. Also, if you have other concerns, let me hear you out. I'll see you again soon.

I'm really new to this - trying to complete my first VAT return, so I've got a few things that I can claim VAT back on from before I was VAT registered. Is the 'Adjustment Date' the date you make the adjustment - or the date you purchased the goods?

Hello DPCO101, thanks for posting on this thread, so it will be the date you purchased the goods so it will show as exceptions for you.

Thank you :)

I've followed the steps shown - and clicked save - but my adjustments are showing as £0.00 - not sure what I'm doing wrong?

Good day, @DPCO101.

Any manual adjustments you make to your return will impact your VAT control and or VAT suspense account.

If you are not sure about making an adjustment, I'd recommend reaching out to your accountant. That way, they can guide you in adjusting your VAT liabilities and correct your past returns.

Please check out this article for additional reference in making VAT adjustments and the things to remember before you submit a VAT return: Make VAT adjustments in QuickBooks Online.

If you haven't added any accountants to QuickBooks, here's how to invite them so they can review your books: How to add your accountant to QBO.

For more tips in preparing and filing your VAT return in QuickBooks Online, you can check these articles:

Please let me know if you have any other concerns or follow-up questions about VAT. Take care and stay safe.

Hi there,

New to this, like a lot of you, and very confused.

Our VAT registration date in 1st April and we have to submit our first return for the 1st April-30th April period. We have been in business since July 2024, so we have quite a lot of purchases we can backdate (given the 4 year backdating possibility). I have updated the receipt and VAT details on all relevant past purchases on QB, but how does QB “pull” this backdata when making a manual adjustment to the VAT submission? Surely otherwise, there is no supporting data other than the memo note?

You're correct, Cobbles. QuickBooks utilizes the Memo note as a supporting detail for adjustments.

You can edit the Memo note to add more information but know that QuickBooks doesn't provide other supporting details.

Since you need additional supporting data, you can gather your receipts as references.

When making manual adjustments, it's best to consult your accountant to ensure compliance and accuracy.

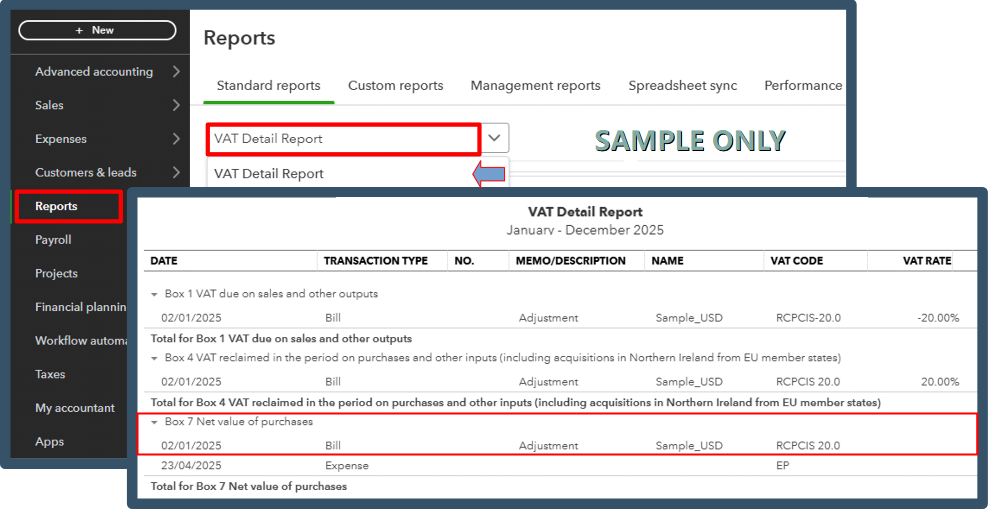

To review your adjustments, we can run the VAT Detail Report by following these steps:

You can also export this report as a reference or proof of adjustments.

Please feel free to return to this thread if you have any questions or thoughts to share about VAT.

Thank you. This does seem bizarre to me given the wealth of supporting data to a claim period. How do the HMRC know what is a legitimate claim or not without any data or supporting evidence? This must be a very common occurrence given their guidelines on the ability to backdate up to 4 years?

For a more technical question, when making the adjustment to box 4, would the adjustment date be the first eligible backdated expense (in our case 15th March 24)? Does the adjustment amount override box 4 or its this purely the backdated adjustment?

As an example, VAT registration date is 1st April.

VAT return period 1st April- 30th April.

VAT due for the period £100.

Backdated amount of VAT prior to registration date: £500.

Would the adjusted amount I input be £500 for the backdated amount, or £500 less the £100 owed for the VAT return period?

We have asked our accountant these questions but they are not coming back to us and our deadline is looming. Your help is really appreciated.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.