I'm here to help and guide you on how to submit your tax return and make a payment, Unsure_VAT. Let's proceed to the VAT section to complete these tasks.

The information shown on the VAT return is based on transactions recorded in QuickBooks Online (QBO). You'll need to enter your sales and other transactions so that they appear on the tax form.

After that, let's go to the VAT screen to file the form. Here's how:

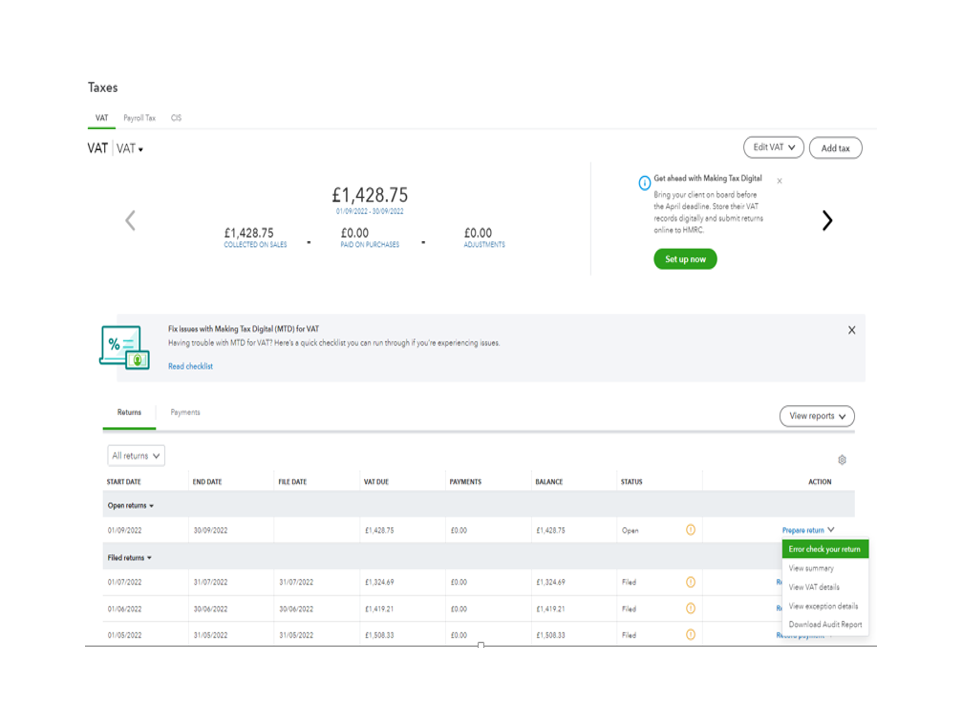

- Navigate to the Taxes menu on the left panel of your company and select VAT.

- In the Returns tab, go to the Open returns section and click the Prepare return link to view more details.

- Select Prepare return.

- Check the figures in each box or use the VAT error checker in the Actions drop-down menu to ensure that everything is posted correctly.

- When you're finished, click Submit to HMRC.

- Then, read the declaration and select the I declare the information is true and complete box to agree, followed by Submit to HMRC.

- Wait for the confirmation message to appear. Do not close this page until you see the receipt confirmation message.

- When HMRC accepts your submission, click Done to close the window.

After filing the form, follow these steps to process your payment:

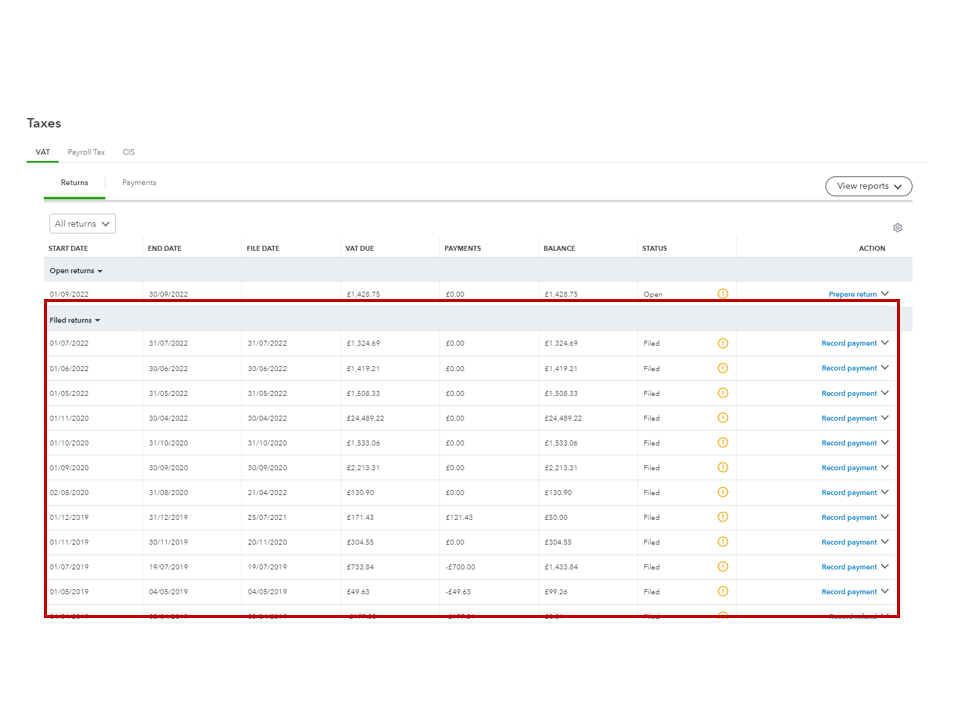

- Go to the Taxes menu on the left panel and choose VAT.

- In the Returns tab, head to the Filed returns section and look for the amount you wish to pay.

- Click the Record payment link to open the Record VAT payment screen.

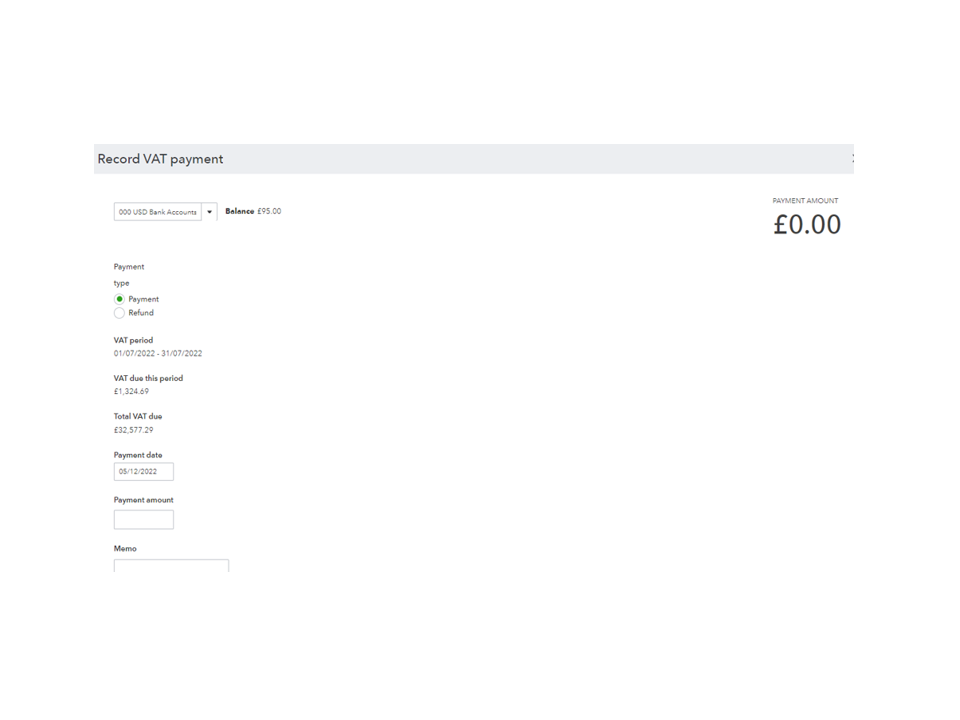

- Select the bank account you've used to pay HMRC.

- Enter the payment date and amount in the appropriate fields.

- Add a memo if needed, and press the Save button.

If you are still unable to see the Record payment link after completing these steps, could you send a screenshot? This will help us in determine the source of the issue. To keep your account secure, make sure to gray out any personal information.

You can read the following articles to learn more about submitting your tax return and handling tax payments:

Furthermore, the Taxes guide includes a list of resources that will help you manage your VAT, set up different tax codes, troubleshoot MTD issues, and other tax-related processes.

Feel free to visit the Community again if you have other QuickBooks concerns or additional questions about VAT. I'm always ready to answer them for you.