Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

You can count on me, @userorbitonixcompany.

First, the "We can't connect to HMRC right now" error occurs when:

I've got the steps needed to fix the issue you're getting. To start, let's ensure to use the correct login credentials when submitting your VAT return.

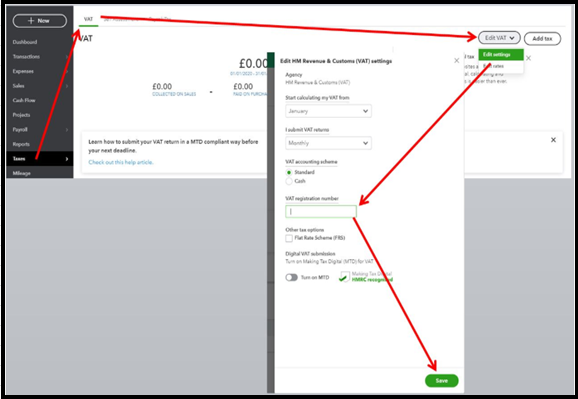

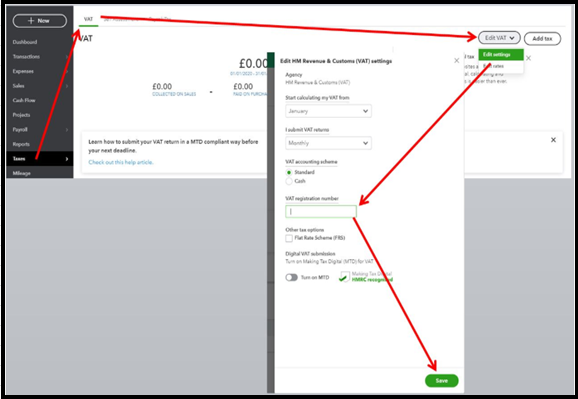

Also, please make sure that the QuickBooks filing period or date matches with that in HMRC. Then, we'll also need to check if the VAT registration number is correct.

To do that:

If the issue persists, let's disconnect and then reconnect the MTD to refresh the connection.

To disconnect your MTD:

Once done, reconnect your MTD. Then, submit your VAT returns again as you normally would.

If everything's fine, you can run some VAT-related reports to keep track of all your returns. To achieve this, go to the Taxes menu, and then select the desired report from the View reports drop-down.

I've got your back if you have some follow-up questions about managing your VAT in QuickBooks. Have a good one.

Hi userorbitonixcompany Is this the first time that you are attempting to submit your VAT via MTD?

Yes, it's a first time. I'm going to submit first company's VAT return and tried to connect QB with HMRC. And everything seems to be ok, I received email from HMRC. But nothing change and a status is

"We can’t connect to HMRC right now". Could you please help?

Hi userorbitonixcompany What's the date range of the return that you are wanting to submit?

Period indicated in HMRC cabinet is August-September 2020. But I indicated in QB quarterly option. Maybe problem in VAT periods?

Hi userorbitonixcompany can you go to the vat settings and change the month to August and see if that aligns the dates.

Hi userorbitonixcompany Are there already periods that have been marked as filed but not submitted within QuickBooks?

No, it is the first period for filling. There are no already periods that have been marked as filed. The first period is August-September 2020(deadline was November,7)

You can count on me, @userorbitonixcompany.

First, the "We can't connect to HMRC right now" error occurs when:

I've got the steps needed to fix the issue you're getting. To start, let's ensure to use the correct login credentials when submitting your VAT return.

Also, please make sure that the QuickBooks filing period or date matches with that in HMRC. Then, we'll also need to check if the VAT registration number is correct.

To do that:

If the issue persists, let's disconnect and then reconnect the MTD to refresh the connection.

To disconnect your MTD:

Once done, reconnect your MTD. Then, submit your VAT returns again as you normally would.

If everything's fine, you can run some VAT-related reports to keep track of all your returns. To achieve this, go to the Taxes menu, and then select the desired report from the View reports drop-down.

I've got your back if you have some follow-up questions about managing your VAT in QuickBooks. Have a good one.

Thank you very much for your reply. But I think the problem is that the period in QB doesn't match with HMRC period. The period at HMRC is 1 August-30 September 2020. But I am not able to choose such a period in QB. Is there anything I can do to make the periods coincide?

Now seems that everithing is ok. Many thanks for your help.

Hello Userorbitonixcompany, Thanks for letting us know, that is great news:smiling_face_with_smiling_eyes: Any other questions at all we're happy to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.