Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

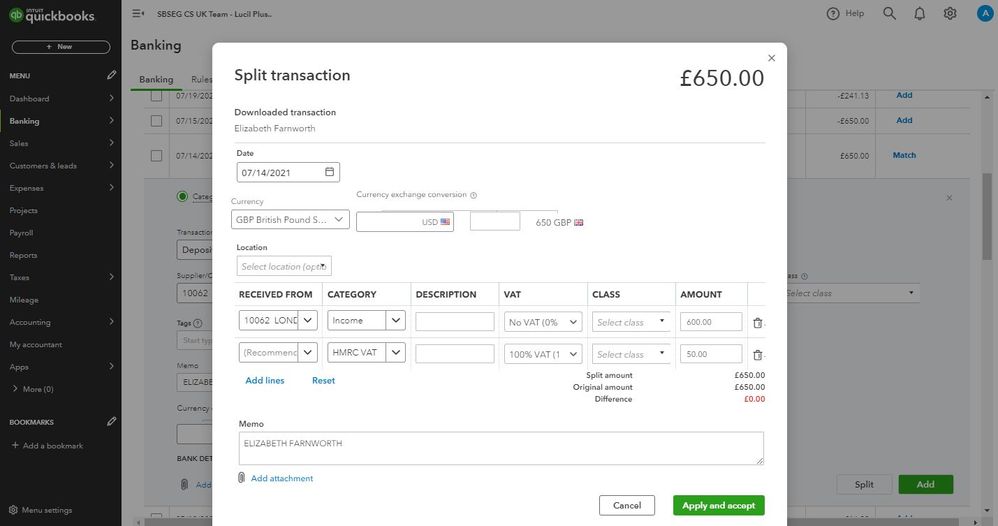

I need to find a way of splitting a transaction into "Income" and "100% VAT"

For example: Split: £2300 into £2000 income and £300 pure 100% VAT payment.

The company I am currently working for has me invoicing for VAT separately but due to payroll structure I will be payed Week 3s salary with week 2s VAT payment (for example). So far I have been unable to find a way to make QBO accept this structure though I confess I am fairly novice.

Any ideas or solutions would be greatly appreciated.

Solved! Go to Solution.

You're always welcome here with the VAT category concern, @BridgesJnr. I'll walk you through the steps of setting up so you can select it when splitting bank transactions.

You'll need to set up the 100% VAT from the Taxes section to select it when categorising transactions on the Banking page. Please know that VAT rates will show according to Tax Agency and Sales or Purchases field you specify. To proceed, follow the steps below:

I'm adding some screenshots for reference:

See this article to learn more about adding VAT and its calculation: Set up and edit VAT settings, codes, and rates in QuickBooks Online.

Feel free to check out these resources for more tips about matching and reconciling transactions in the program:

This should help you select the 100% VAT rate on the banking page. If you need more help managing bank transactions, add a comment below. I'll be here to help you.

Thank you very much for your reply, are you able to explain how you are able to select 100% VAT as a VAT category? From my dropdown menu I am not able to select that option.

Thanks!

You're always welcome here with the VAT category concern, @BridgesJnr. I'll walk you through the steps of setting up so you can select it when splitting bank transactions.

You'll need to set up the 100% VAT from the Taxes section to select it when categorising transactions on the Banking page. Please know that VAT rates will show according to Tax Agency and Sales or Purchases field you specify. To proceed, follow the steps below:

I'm adding some screenshots for reference:

See this article to learn more about adding VAT and its calculation: Set up and edit VAT settings, codes, and rates in QuickBooks Online.

Feel free to check out these resources for more tips about matching and reconciling transactions in the program:

This should help you select the 100% VAT rate on the banking page. If you need more help managing bank transactions, add a comment below. I'll be here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.