November product updates

New client overview for accountants – inside QuickBooks Online

As an accountant or bookkeeper in Australia, you know how challenging it can be to assess a prospective client’s books with limited knowledge about their history or business. You’re trying to determine the time required to clean up the books and what to charge, but understanding the state of the books is a time consuming process itself, and mistakes or surprises can lead you to under price your services, which means time wasted and money lost in the short and long run.

What if there was a powerful solution to speed up this entire process and give you confidence to price your services more accurately? With the release of the new Client Overview feature inside QuickBooks® Online (QBO), there is!

Benefits for you and your clients

Client Overview enables you to look at a prospect’s QBO file and quickly estimate how much work will go into cleaning up and maintaining the books. Of course, reviewing any business’ books has always been possible, but Client Overview speeds up the process and offers big benefits:

- A better understanding. Get a high level understanding of the state of the books with a unified view of relevant setup, banking and account data.

- Take control of your pricing. Better estimate the pricing for initial cleanup, with upfront visibility into how updated the books really are, while improving your pricing strategy with data insights that indicate the complexity and required effort to clean up and maintain the books.

- Save time. Get a better sense of where to start your file analysis with a view of items that typically require attention and cleanup

- More transparency. Better evaluate the required ongoing workload with information on the client’s company setup and business activity insights that reflect the prospect’s proficiency with QBO.

- Simple and efficient. Get to where you want to go in fewer clicks with deep links that take you directly to relevant transaction reports, specific bank accounts and the reconciliation tab.

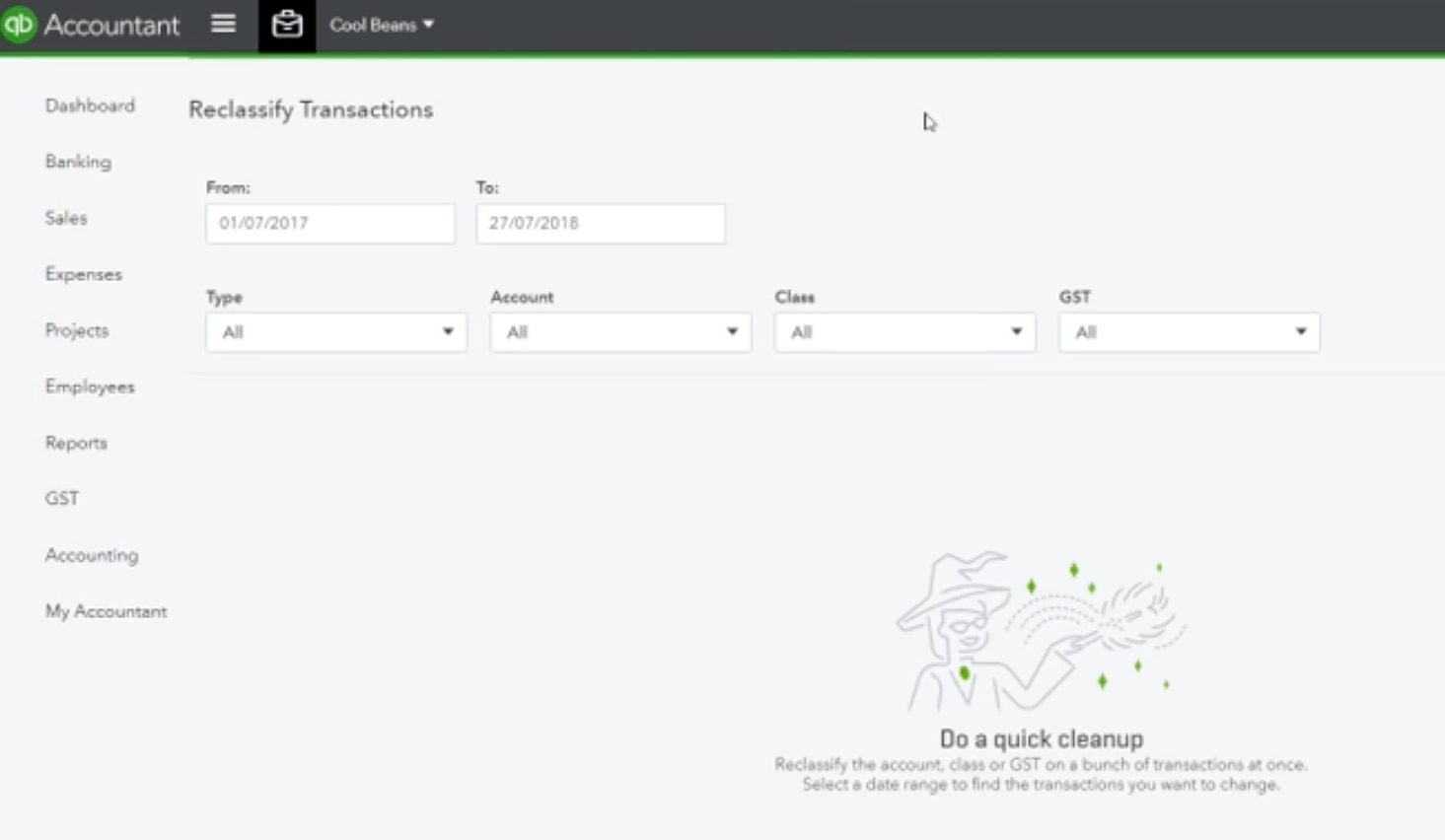

How client overview works

It’s very simple. When you access a prospect client’s QBO account through QuickBooks Online Accountant, you have a new Overview tab inside QBO (visible to accountants only), which provides relevant and actionable data to kick – start your initial file review.

Client Overview will help you identify signals that indicate how much effort would be required to clean up the books and then maintain them on an ongoing basis. Only with a decisive understanding of the ‘state of the books’ can you satisfactorily determine the projected outcome.

Try Client Overview for yourself

Access Client Overview through QBOA to save time and price your services more accurately. Chances are you’ll have an opportunity to try our Client Overview right away; the very next time you find a prospect, you can use this new feature to quote the work more accurately, while getting a better idea how organized the books are. And, you will gain the prospect’s trust because you’re already demonstrating your knowledge of accounting and QBO. That’s a win – win for everyone!

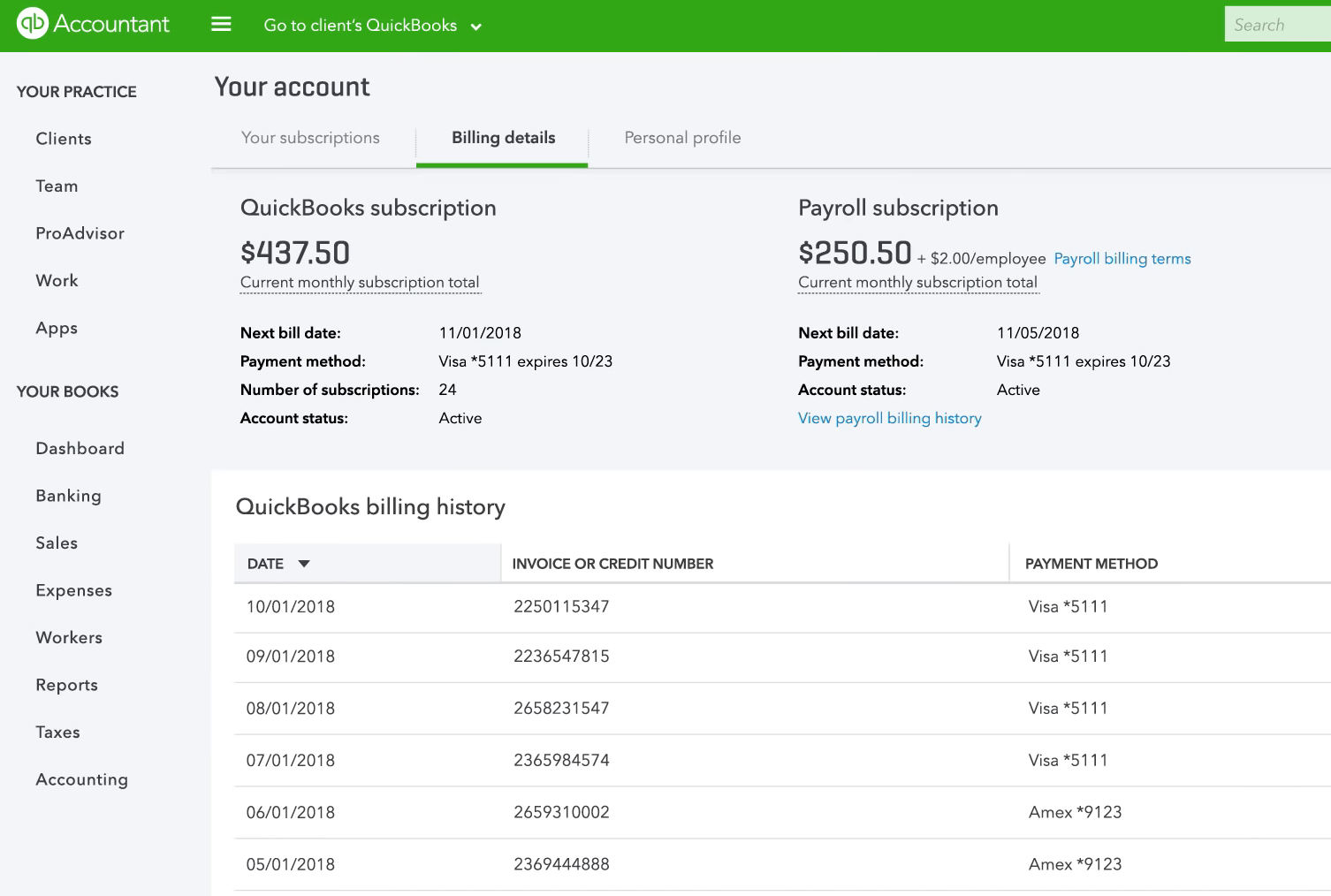

New, itemised QuickBooks Online wholesale billing

In a nutshell: New and improved QuickBooks Online invoices have a clean and simple layout. With the new itemised invoices, you will be able to easily understand your monthly subscription charges and how they flow into each client relationship.

How it works:

- The first section provides a snapshot of your total subscriptions for each QuickBooks Online product including those bought with a package.

- In the next section, you’ll see the unit price, taxation, and total billed for your Plus and Essentials subscriptions, as well as Plus subscriptions purchased on a package discount.

- In the Billing by Client section, charges are listed by client including taxation. No more calculating client bills by hand! This will save you valuable time when you bill your clients every month.

- Lastly, the invoice provides your total tax charges for the month to make tax preparation smoother.

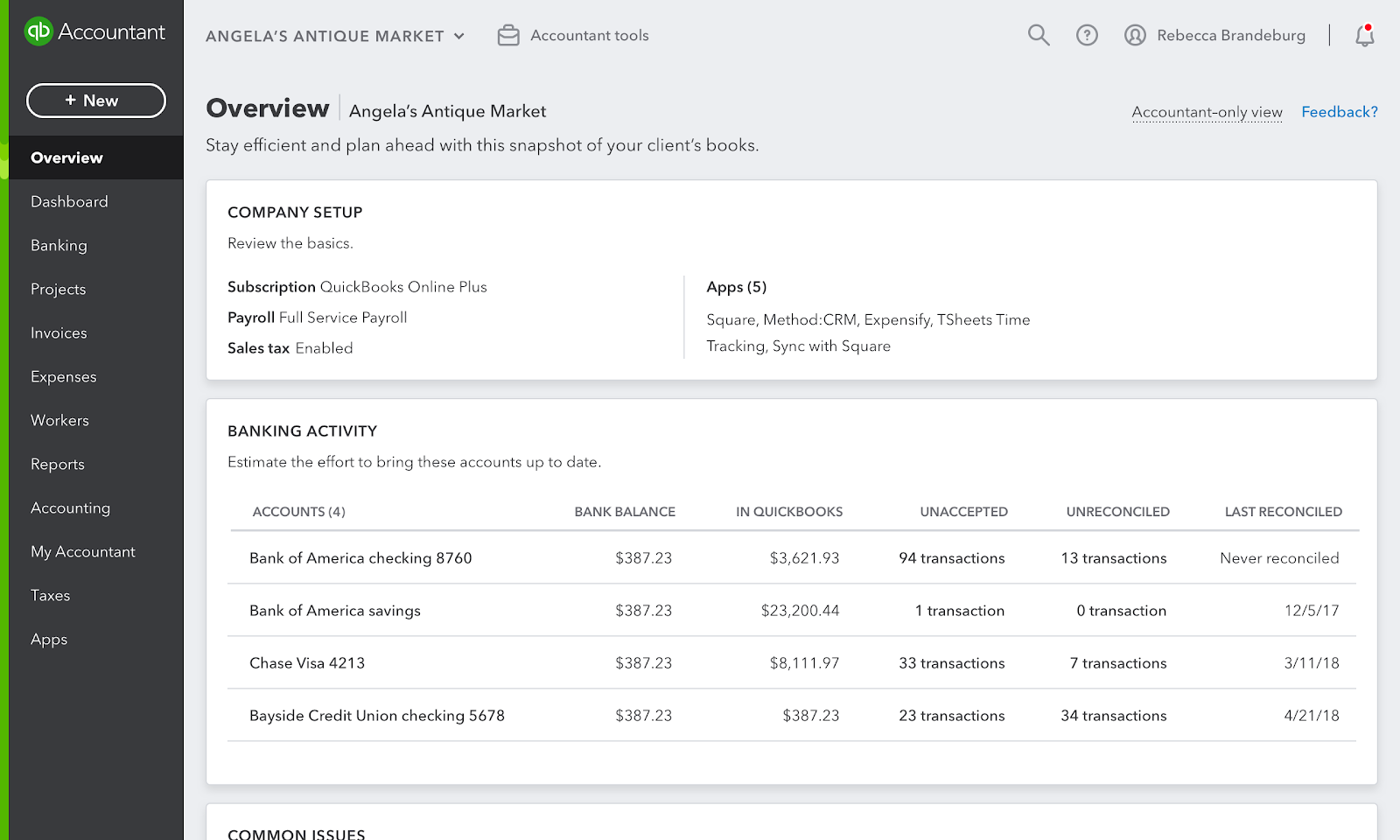

Enhanced bulk reclassify

Recently we enhanced the bulk reclassify functionality in QBOA so it now allows an advisor to reclassify GST transactions in bulk. The enhanced feature will reduce the need for transactions to be edited at a line item level saving time and reducing the chance of error.

Key advisor benefit

- Save time

- Ability to reclassify GST codes in bulk

- Completely redesigned and intuitive bulk reclassify experience

FAQs

- What properties can I reclassify in bulk?

- Users can reclassify accounts, classes and sales tax codes in bulk

- How does sales tax reclassification work?

- Sales tax reclassification works by changing the GST codes at a line item level. However, the total amount (Gross amount) will not change at the transaction level

- I have many transactions in my file and when I list all of them, they span multiple pages on the bulk reclassify screen. Can I select transactions spread across different pages and reclassify all of them at once?

- Bulk reclassification works at a page level. So you have to select transactions at a page level and reclassify them before proceeding to the next page

- How many line items can I reclassify in bulk?

- The maximum number of line items that can be displayed on a page is 300. So you can reclassify up to 300 lines in one go.

- I tried to reclassify 100 line items and I got an error that a few transactions cannot be reclassified. Can I still go ahead with the others?

- Yes. If there are errors, you will be given an option to either continue with reclassifying the ones that can be reclassified or abort the reclassification transaction altogether

- Can I undo a bulk reclassification transaction?

- No, bulk reclassification cannot be undone.

Save time with QuickBooks Self-Employed on the Web

Did you know you can now use QuickBooks Self-Employed on any device? Australian customers can get tax time ready with the same great features they use on mobile (mileage tracking, expense and receipt sort and capture, invoicing and GST tracking) plus a few feature enhancements on web including:

- Bulk categorise to sort multiple transactions in seconds

- Add GST to multiple transactions in seconds

- Share receipts with their accountant in one report to avoid shoeboxes of receipts at tax time

Related Articles

Looking for something else?

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.