At the end of each financial year, we have set procedures to ensure that correct payments have been allocated throughout the year. Let’s look at end of financial year checks for ‘Payroll’ in QuickBooks Online.

There are three main accounts we need to check: Wages, PAYG and Superannuation. If transactions in these accounts have not been entered correctly, or if they have not had the correct payments entered, this could impact: compliance; PAYG Summaries to employees; PAYG paid to the Australian Taxation Office; Superannuation that was paid to employees; and fees may be incurred and possibly interest charged.

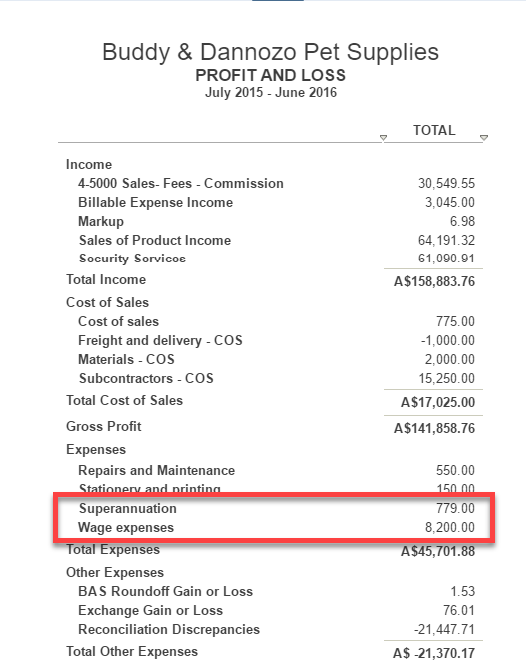

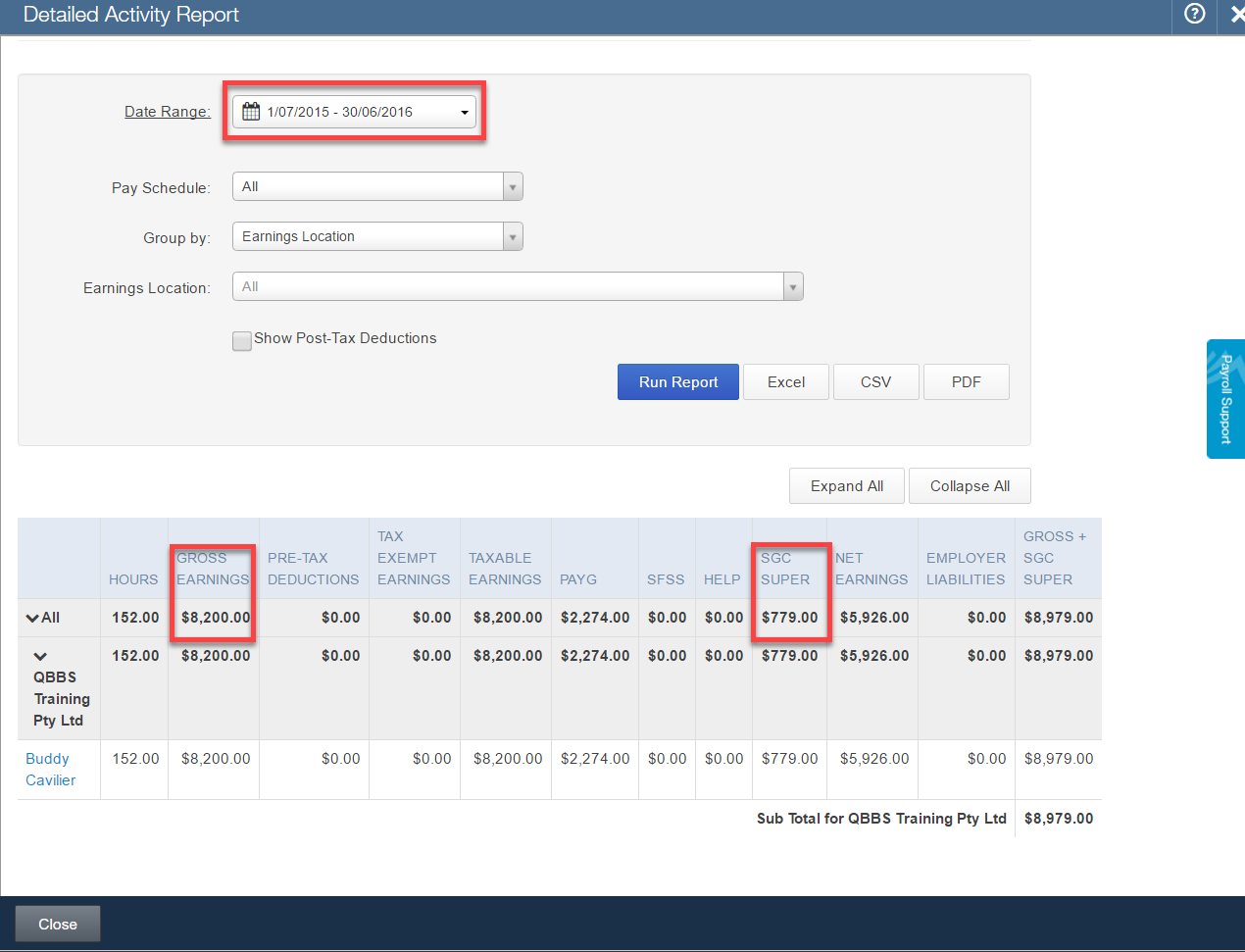

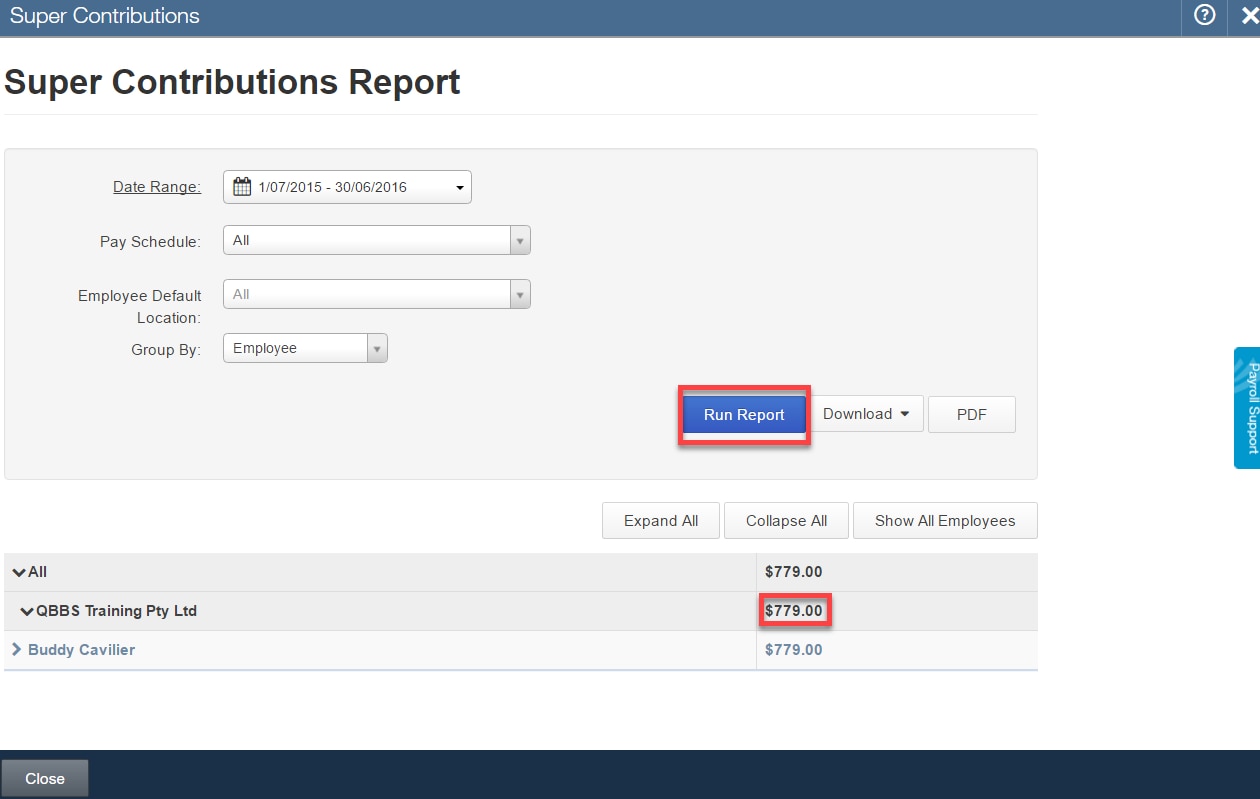

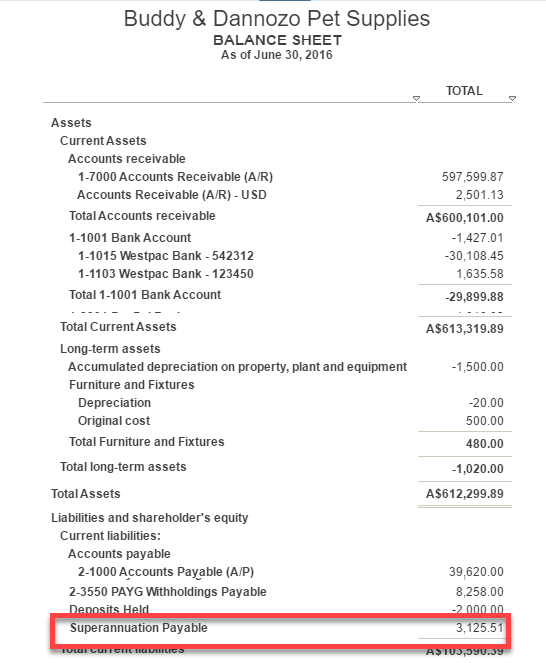

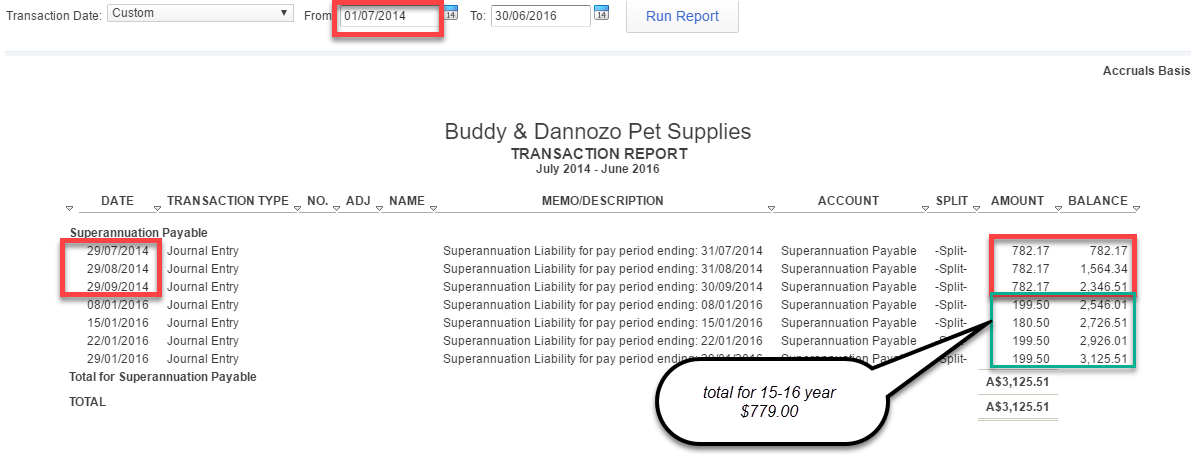

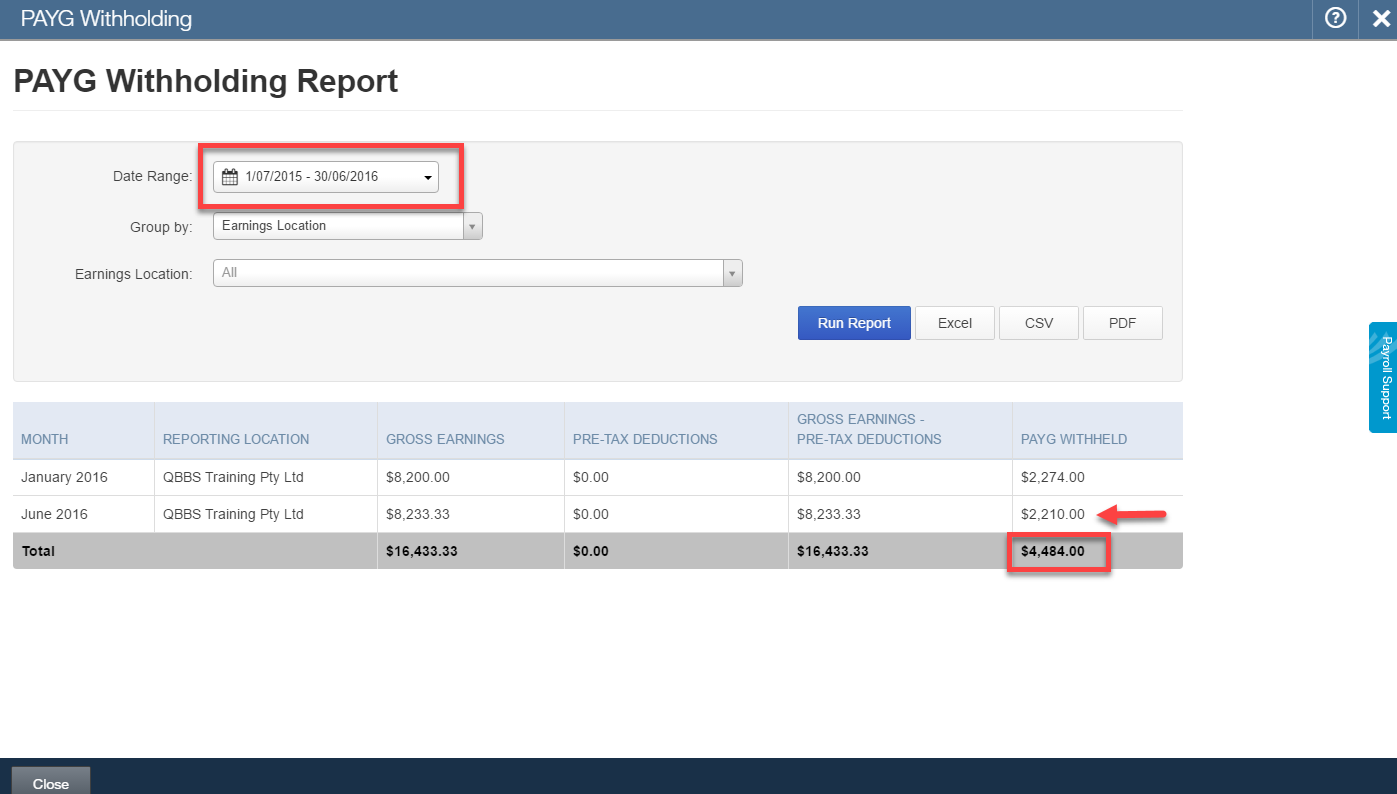

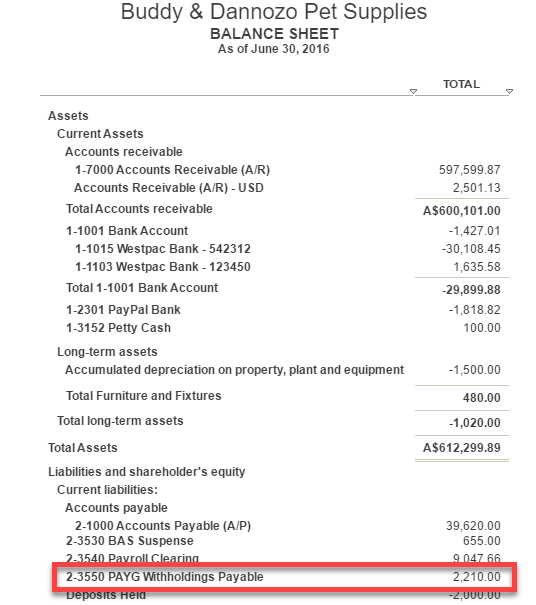

These errors will be seen when comparing the ‘Profit and Loss & Balance Sheet Reports’ to certain payroll ‘Reports’.

Let’s walk you through some of these procedures.

When running payroll each week, fortnight or month, there are transactions that happen behind the scenes. These transactions are posted to what we call control accounts:

- Wage expenses.

- PAYG Liability.

- Superannuation Liability.

Each of these accounts needs to reconcile back to amounts that have been paid through the ‘Payroll Centre’ during the process of pay runs. If these accounts do not reconcile, there could be several factors impacting these control accounts. Either the pay run may have been deleted by accident, an amount may have been changed, or incorrect amounts may have been allocated to control accounts – just to name a few.

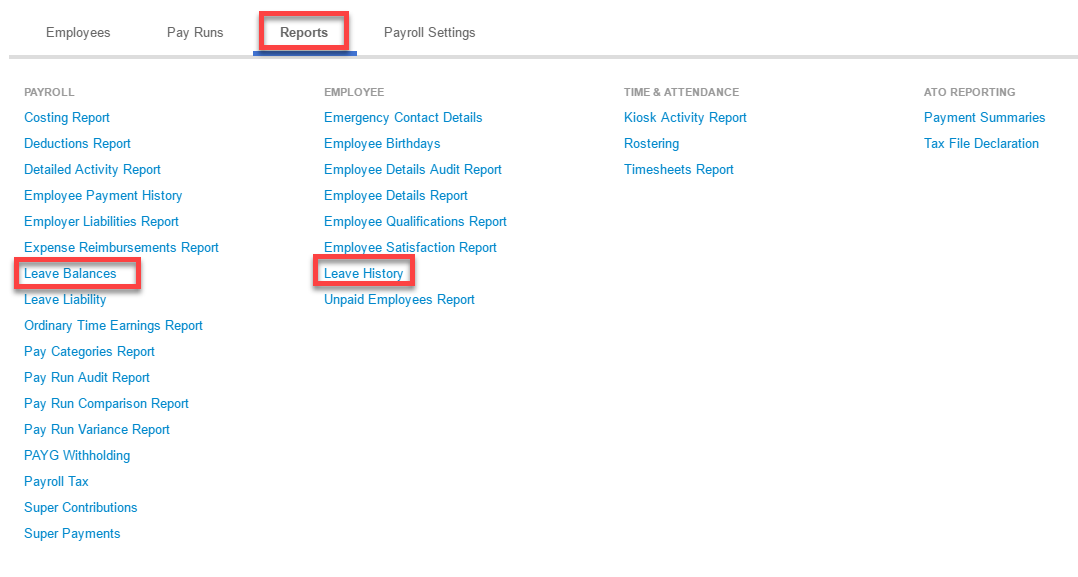

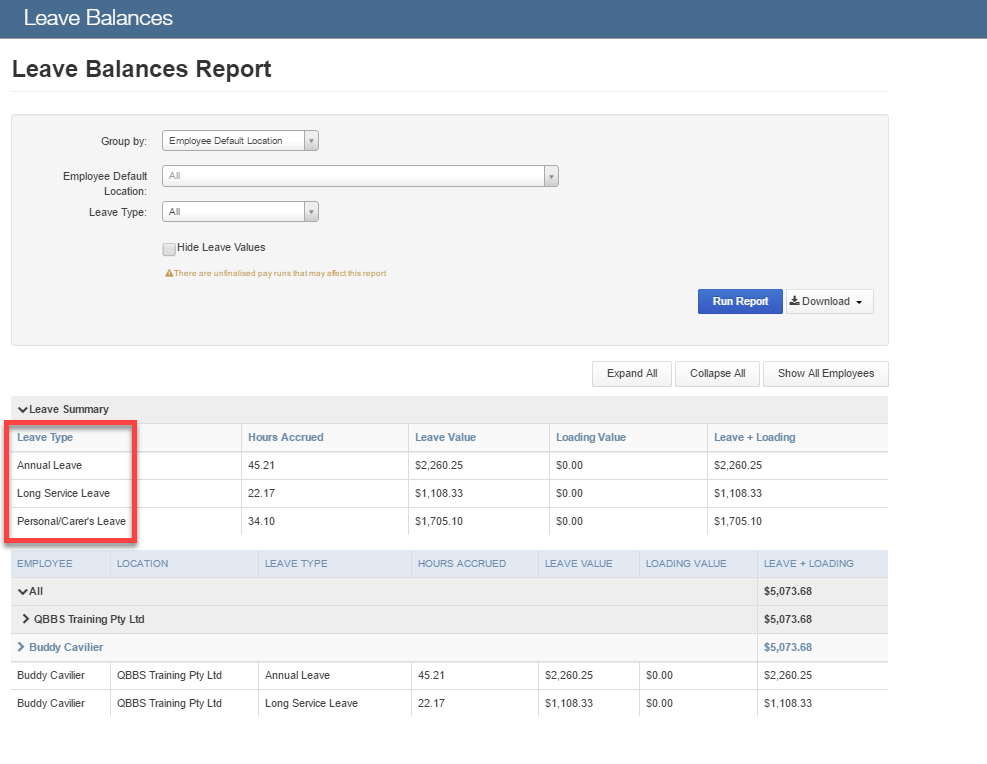

Some of the ‘Reports’ that need to be reviewed are:

- Balance Sheet & Profit and Loss.

- Detailed Activity Report, Super Contributions and PAYG Withholding Report. These are found in the ‘Reports’ section in the ‘Payroll Centre’.