If you’re registered for GST you are required to lodge your Business activity Statement (BAS) either monthly, quarterly or annually. The most common lodgement period is quarterly. Leanne Davis, owner operator of Sort It Out – Office Assist, and member of Intuit’s Trainer Writer Network, has put together some simple steps on how to lodge a BAS using QuickBooks Online.

How to lodge BAS using Quickbooks Online

How to lodge BAS in QuickBooks Online

You can download this guide here. Sign up for our BAS Webinar here.

1. Set up GST

If the business is registered for GST you will first need to set this up:

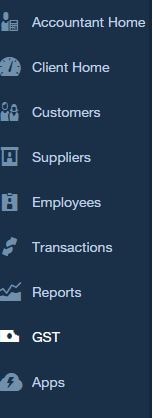

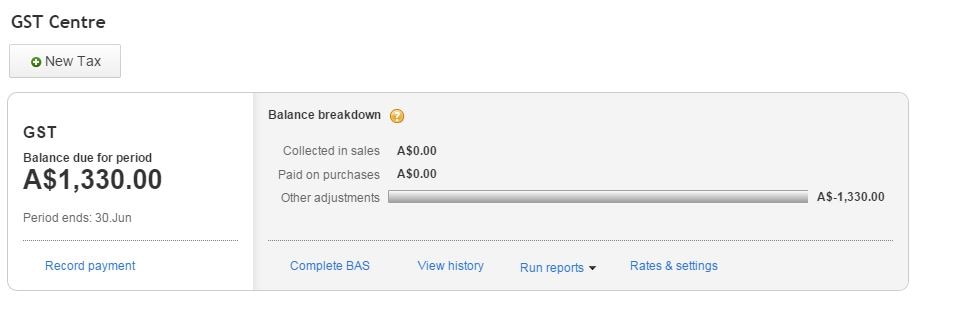

On the Left Hand Navigation menu select the GST tab

Select “Set Up GST”

Enter the information in the box that pops up with your business details

2. New Accounts in your COA

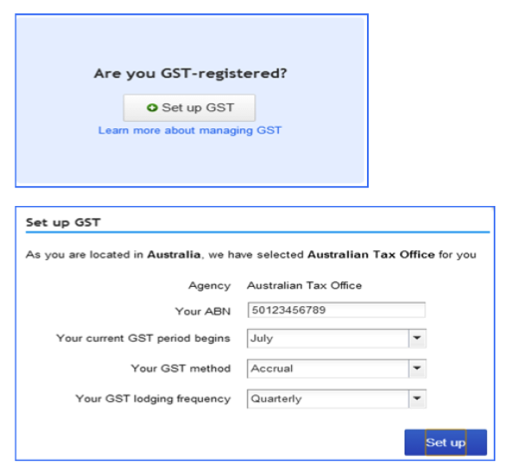

Once you have set up your GST, two new accounts will automatically be created in your Chart of Accounts:

– BAS Liabilities

– BAS Suspense.

The BAS Liabilities account is the account that has all of the GST Collect and Paid posted to it. The BAS Suspense account is like a clearing account, once you lodge your BAS in QBO the amount payable or refund due will be posted to this account.

These two accounts can be renamed if you prefer to call them something you are more familiar with.

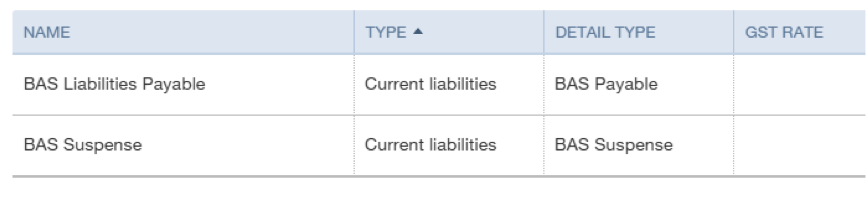

3. Completing a BAS (or “marking as Lodged”) creates a 2 line journal entry that moves what you owe (or what you are owed) from the BAS Liability account to the BAS Suspense account.

DR to BAS Liabilities

CR to BAS Suspense (Assuming GST is due to paid to ATO)

4. To Process your BAS

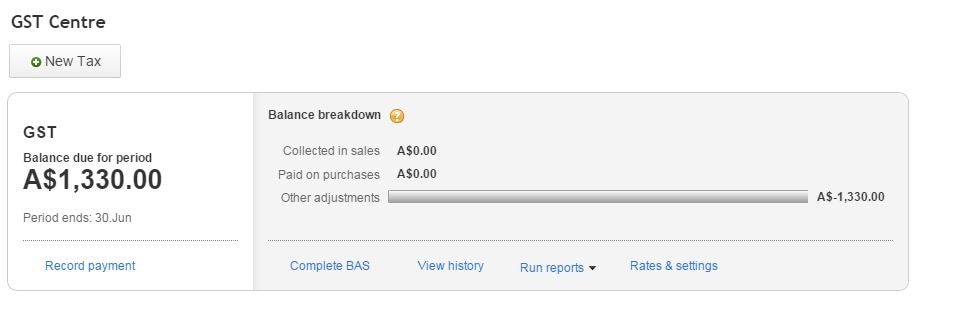

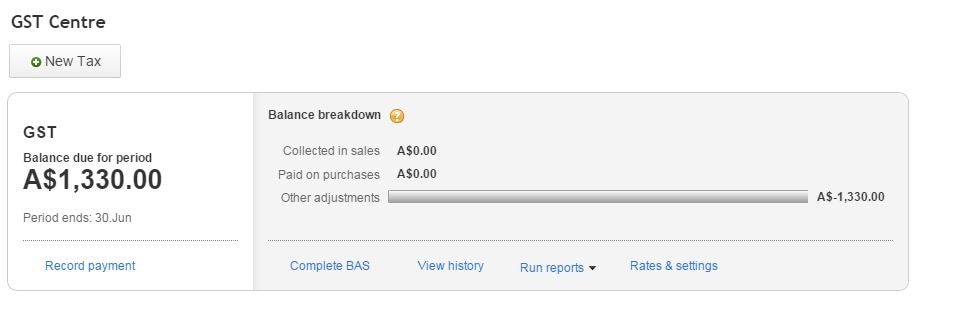

Select the GST tab from the Left Hand Navigation Bar

(this is assuming you have done YOUR normal bookkeeping tasks, GST reconciliation or completed your BAS Checklist)

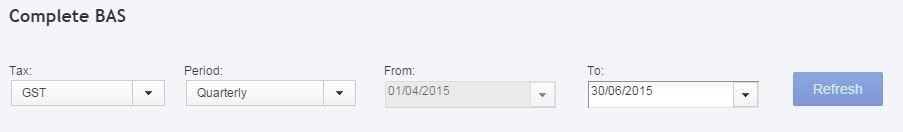

Select “Complete BAS”

Ensure the dates are correct for the reporting period.

Check your numbers with your reconciliation

Have your PAYG and Wages amounts come across to W1 and W2 correctly? See step 9 – Reporting your PAYG and IAS.

Lodge your BAS as you normally would, via a paper statement, your Portal or if you are using Gov reports – QBO integrates with Gov reports.

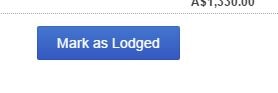

It depends entirely on your process whether you hit mark as lodged before you physically lodge it with the ATO or after, either way you need to hit the “Mark as Lodged” button, this will then let QBO know you have lodged your BAS and it will save a snapshot of your return.

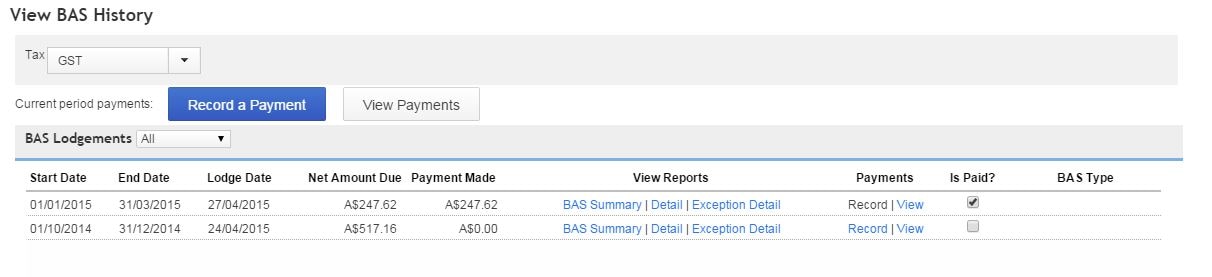

Check the “View history” Tab to view your BAS Lodgement

This will give you history of any previous BAS’ lodged and any payments made. It will also have the 3 reports generated for that period when you Mark as Lodged. The BAS Summary, Detail and Exception Detail.

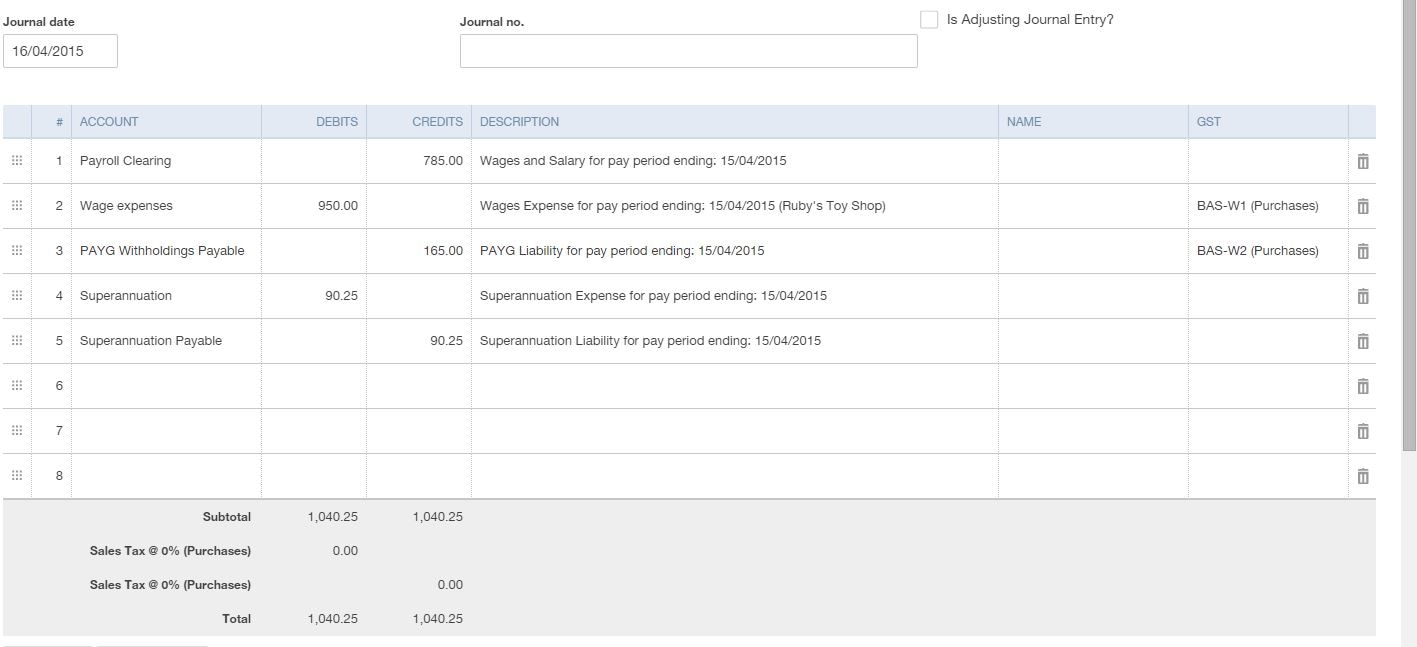

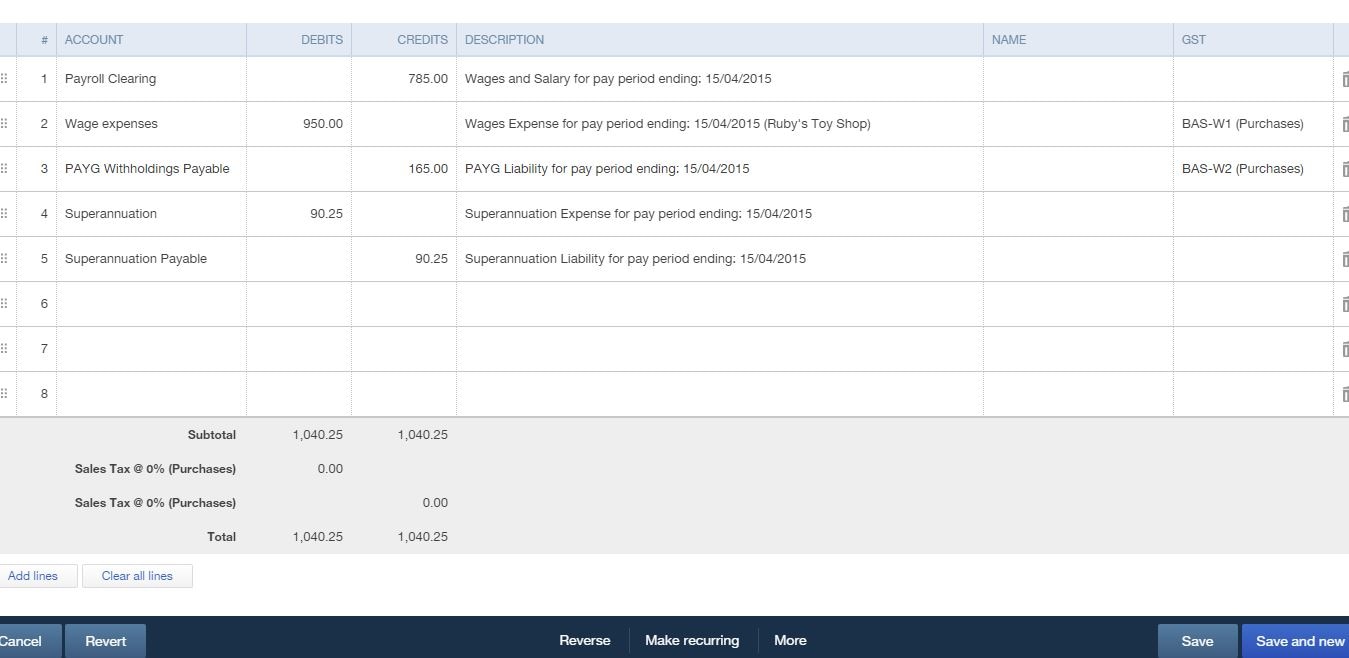

5. Journal Entries

QBO will then create the journal entry debiting (or crediting if you have a refund) the BAS Liability account and posting to the BAS suspense account. It will also debit any PAYG and transfer that to the BAS Suspense Account.

6. Adjusting the date the Journal was created.

The journal entry will be created as at the date you “Mark your BAS as Lodged”

This journal cannot be edited or modified once it is created. If you wanted to have the journal entry as at the last day of the quarter so that your GL accounts are as you prefer to see them for reconciliation purposes, you could reverse the journal that is created and redo it at the date you want.

To reverse the journal,

– open the journal from the recent transactions

– select the “reverse” tab in the bottom middle of the journal entry screen

– Save and Close

– Redo the journal entry with the date you want it to be.

7. Making payments

When you make a payment or receive a refund for a BAS that you have lodged, you must make sure you record the payment by clicking “View History” and then select “Record” under the payments column. DO NOT USE THE BIG BLUE BOTTON ON THE GST HOME SCREEN. This is meant for upcoming filings and will create a discrepancy on your next return if used incorrectly. You’ll know you’re in the wrong payment window if the tax period says Upcoming Filing. Make sure you enter the correct date. I recommend entering a memo as well, for example, “Qtr 1 BAS 2015.”

8. Posting to BAS Liability Account

Don’t post journals directly to the BAS Liability account. You are allowed to, but I would recommend not to. Although it will post to the balance sheet account it won’t show up when you go to complete your BAS. You can however assign the GST code on the line item of the journal entry and this will work properly for your BAS lodgement.

9. PAYG & IAS

There are 2 options when it comes to reporting monthly IAS and Quarter BAS in QBO.

Option 1: Using Employment Hero

If using Employment Hero in QBO you will need to edit the journal entry that QBO creates by deleting the tax codes. These tax codes are automatically created when payroll is turned on and it is these tax codes that populate the amounts on the BAS Worksheet in the GST Centre (Complete BAS tab).

You will need to do this for the first two months of the quarter and then leave the 3rd month, as you want this to appear on the Quarterly BAS Worksheet.

For the payments for the first two quarters you can either create the expense for payment and take it directly out of the account it is in (ie PAYG payable) or journal it to your BAS Suspense account so you have a running balance of the GST & PAYG that will match your integrated client account.

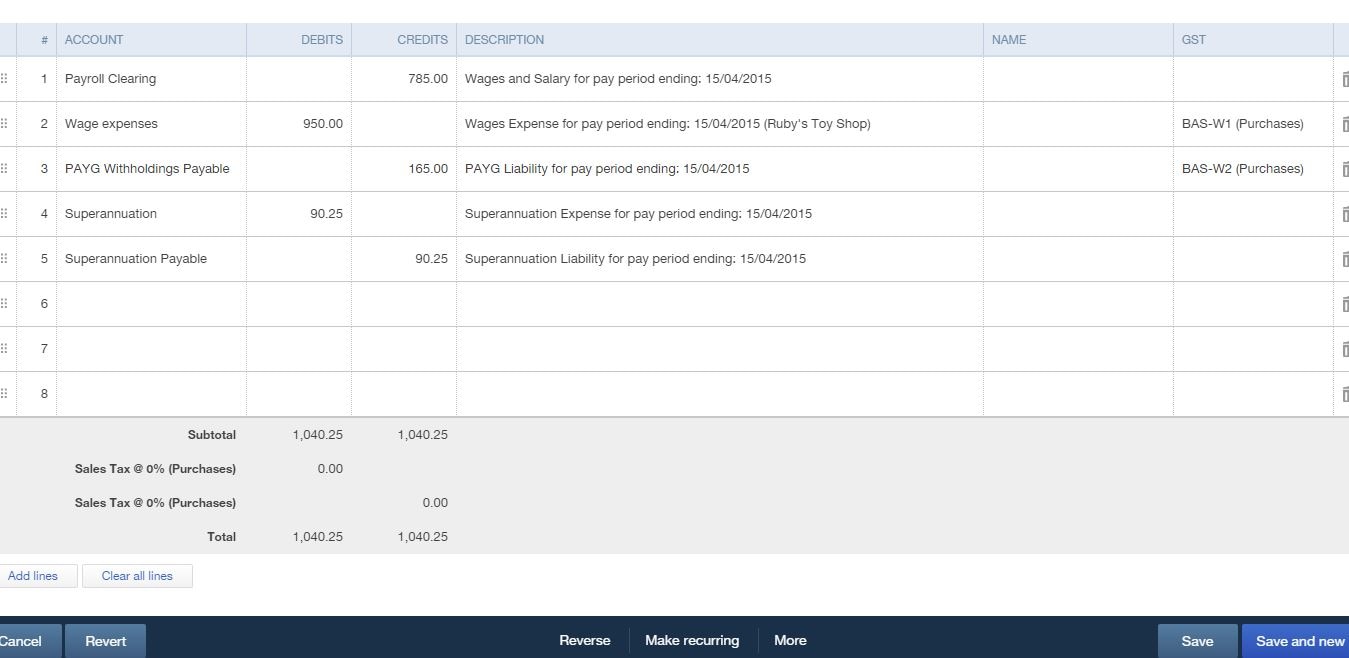

Option 2: Process PAYG using journal entries

If you aren’t using QBO payroll then you would just process your PAYG as normal, through journal entries and then on the last month you can manually add your Wages and PAYG to W1 and W2 on your BAS Worksheet and this will add it to your BAS for the quarter. You will need to select the liability account to debit (PAYG payable) when you complete the worksheet and this will transfer it to the BAS liability and then to the BAS Suspense when you “mark as lodged”.

Lodgement of your BAS for your business can be complex. We highly recommend if you don’t understand any of the components that you engage the services of a BAS or tax agent to assist you.

Related Articles

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.