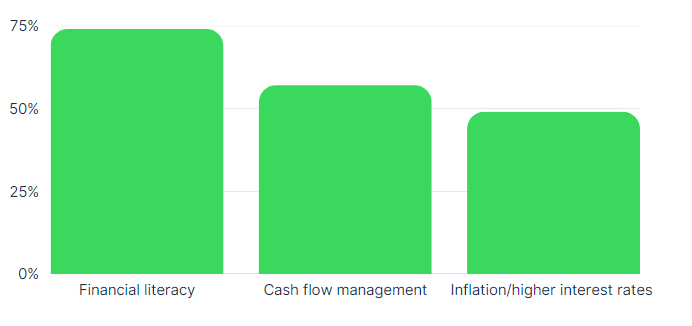

New research from QuickBooks has revealed that 74% of female entrepreneurs believe financial literacy is the biggest financial barrier when running a business. A further 90% of female small business owners believe their understanding of financial terms and skills impacts their ability to scale their business.

Given the significance of finance in this world, a woman's long-term financial success may suffer greatly if they are not financially literate. It can also create barriers to business growth and success.

But what is financial literacy? Financial literacy refers to the knowledge and skills required to make informed and effective decisions on financial matters. This can include understanding financial concepts, budgeting, and investing. Financial literacy gives you the tools you need to run your business successfully.

In contrast, a lack of financial literacy can lead to several issues, including a higher chance of overspending, taking on too much debt, and failing to invest in growth opportunities. It could also make it harder to secure funding from investors or lenders because small business owners may struggle to prepare the financial statements and projections required. This shows why female small business owners feel that financial literacy is a big hurdle to growing their business.