As a small business owner, maintaining cash flow is crucial to keeping your business running effectively. However, a recent study conducted by QuickBooks Australia* has found that Aussie small businesses are struggling to manage unpaid invoices and cash flow issues, with significant consequences on their business and personal lives.

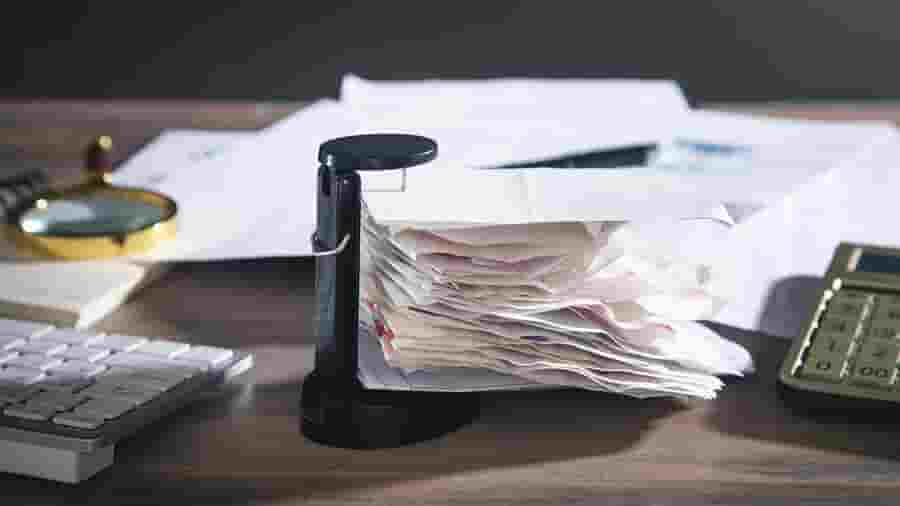

The research found that small businesses spend over an hour and a half every week chasing late or unpaid invoices, with almost two in five businesses dedicating between one to three hours per week to the task. This staggering amount adds up to a total of $2.17 billion owed across Australia, with small business owners expecting to close 2023 with an average of $8,684 owed in unpaid invoices.

Unpaid invoices appear to have a ripple effect across other small businesses with a little over a quarter of small business owners reporting that they have missed a supplier payment or deadline due to a lack of cash flow from unpaid invoices.

Unfortunately, this problem is not solely a financial issue, with 67% of small business owners taking business admin - such as chasing invoices - home with them and spending approximately 104 hours annually managing their business’s admin, when they could be spending time with their family or on hobbies.

More than half of small business owners (53%) reported they found it difficult to manage business admin tasks without the aid of a mobile app such as the companion app to QuickBooks Online. Doing business admin on the go with a mobile app seems to ease the burden of tasks such as invoicing with more than one in ten small business owners reporting that using a mobile app to manage their business admin tasks has improved their work-life balance.

Here are out top tips for small business owners to overcome the stress of unpaid invoices and negative cash flow:

- Send invoices straight away: QuickBooks Online users can download the mobile app for free and send invoices straight from their job site. This stops admin piling up and is the first step to getting paid fast.

- Follow up early and often: Don't wait until your invoices are past due to follow up with your customers. Schedule reminders a few days before the due date and follow up immediately after the due date has passed.

- Offer incentives for early payment: Consider offering discounts for customers who pay their invoices early or on time. This is an effective way to encourage prompt payment while maintaining a positive relationship with your customers.

- Include payment options: Make it easier for your customers to pay by including payment options on your invoice. QuickBooks Online users can accept online payments with PayPal so customers can make instant payments using their credit card, debit card or PayPal account.

- Seek financial advice and support: Reach out to your accountant or bookkeeper for advice on how to manage your cash flow effectively. They can help you create a budget, forecast your cash flow, and identify potential cash flow issues.

- Consider alternative funding options: If you're struggling with negative cash flow, consider alternative funding options such as small business loans, invoice financing, or factoring. These options can help you access funds quickly to cover short-term cash flow issues.

By following these tips and seeking support when needed, you can reduce the stress of unpaid invoices and negative cash flow, improving your business's financial health and your own personal well-being.

*Intuit QuickBooks, October 2023