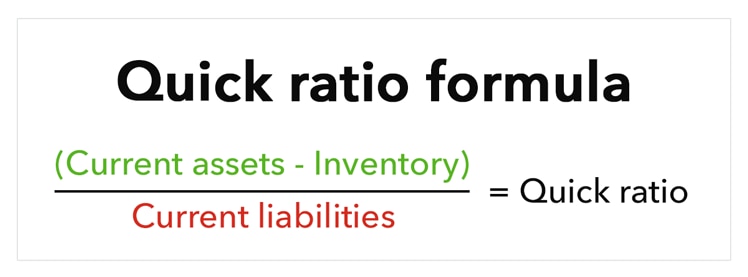

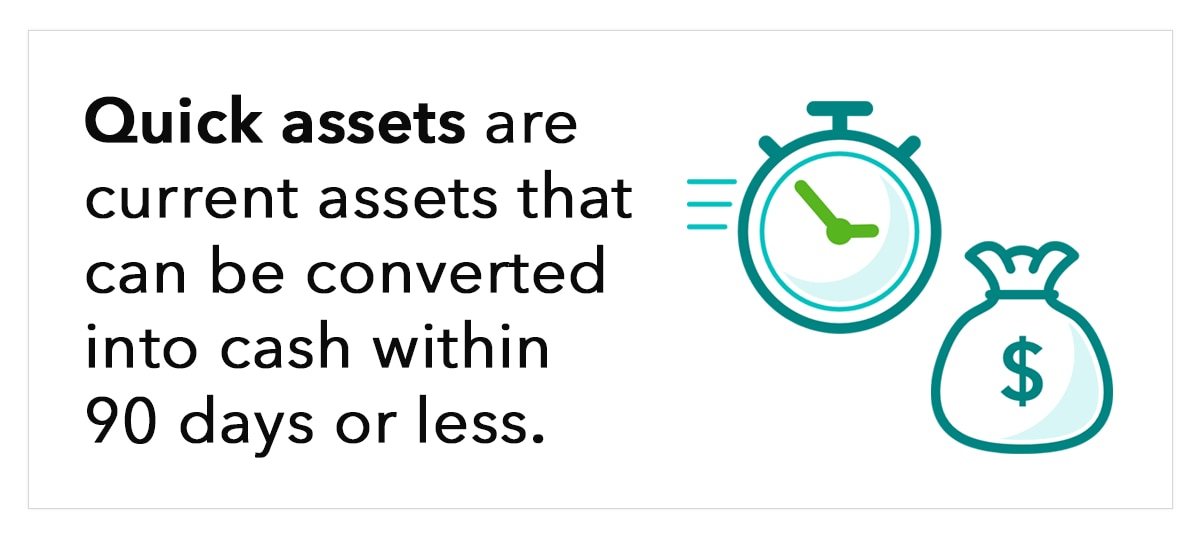

The quick ratio measures a company’s ability to cover its current liabilities with cash or near-cash assets.

Many entrepreneurs launch a startup based on an innovative business idea, but they quickly encounter a mess of complex accounting terms that are tough to understand, let alone calculate. Small business owners have a lot of responsibilities on their plates, with little spare time to crunch numbers and run tests. If you’re feeling overwhelmed, you might be wondering: Which accounting ratios matter and why?

The quick ratio (acid test) formula is worth learning, no matter your industry. You should always know how fast your business can pay back its debts, especially during uncertain economic conditions. Keep the quick ratio formula in your back pocket. You can use it to monitor your liquidity so that you’re always prepared if problems arise and lenders come knocking.

We’ll explain how to calculate the quick ratio and provide context as to how this liquidity test can shed light on your company’s financial wellbeing.