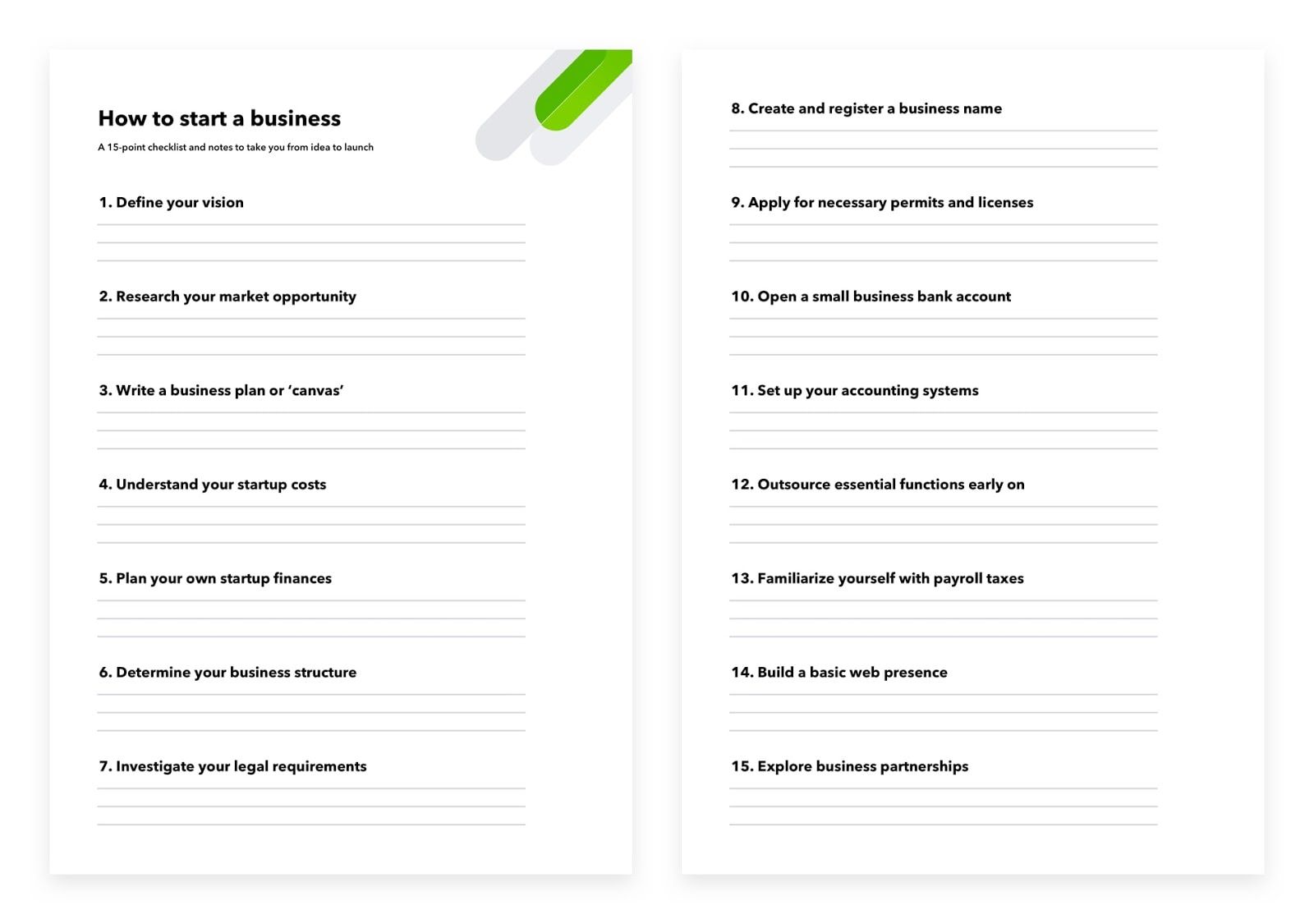

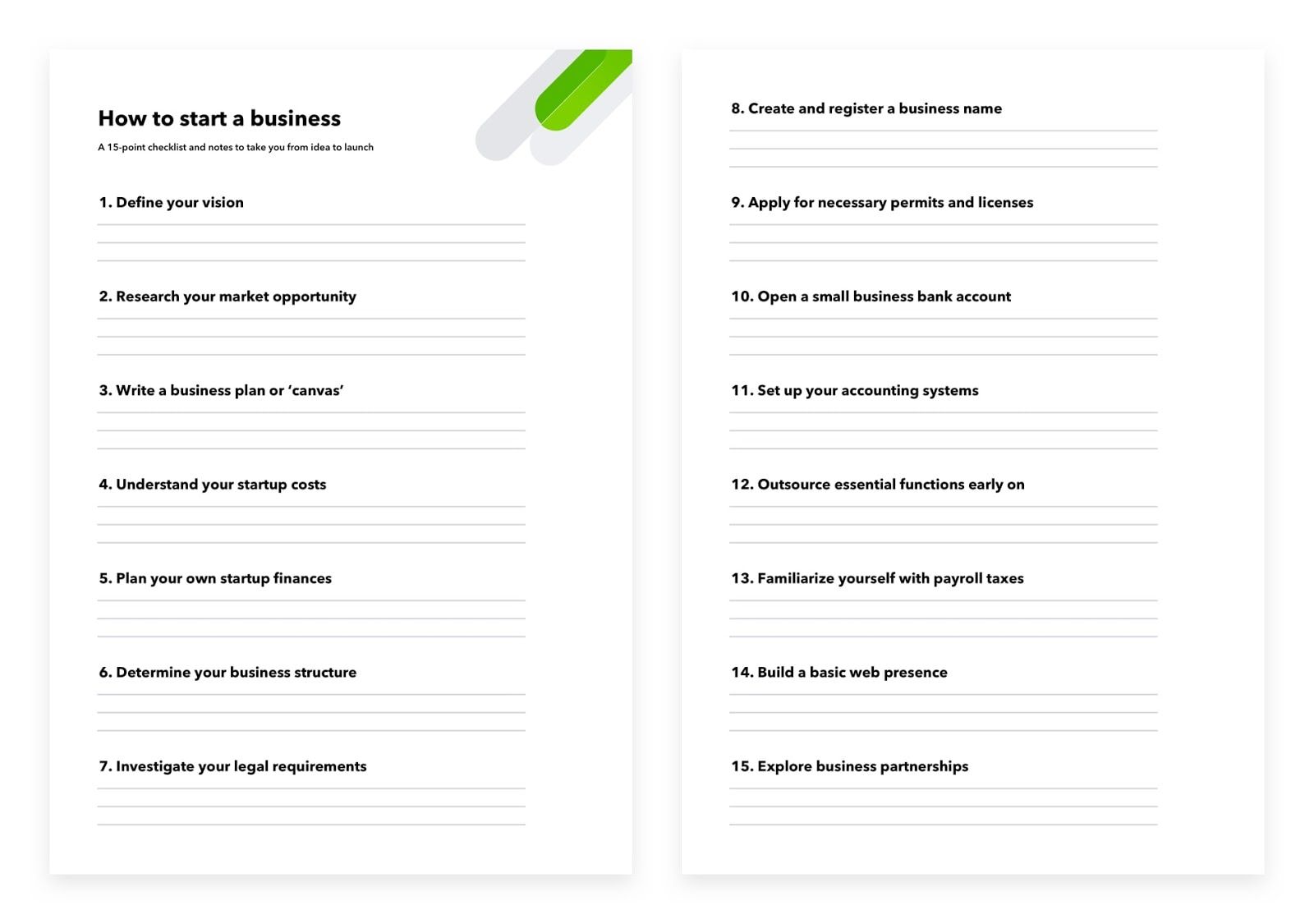

15. Explore business partnerships

While we talked about reasons to go into partnership with others to start a business, we should also address partnering with other businesses for collective growth.

There are many different ways to form a partnership, like:

(1) Referrals and Revenue Share

Some work with partners to help them sell services in exchange for a commission or revenue share deal (e.g., one business gives another one a percentage of the sale). It’s very common if you have a small sales team and want to expand your efforts without hiring more full-time employees.

With referrals, you might offer a commission to a partner who helps introduce and assist you with closing a new prospective customer.

Revenue share is usually better for businesses that help a customer to use your product or service better. For example, software vendors have expert partners who might help a mutual customer to use the software in a more effective manner and, therefore, spend more time with the software vendor. The expert partner would, therefore, get a percentage of sales based on terms both parties would agree on.

(2) Joint Ventures

If you plan to, say build an office tower or make a movie, you might consider forming a joint venture with another business or group of businesses.

Let’s say you have all the equipment and staff to film the story, but want to add computer graphics in afterward. That’s where a partnership with another production business with that staff and those capabilities makes sense.

(3) Cross-promotions

If two businesses have similar target customers, it often makes sense to partner on a cross-promotion.

Spend some time thinking about whether there are businesses in your community that you can work with on a partnership deal. When approaching them:

- Be honest and clear about what you want and what’s in it for them

- Be patient and willing to negotiate to ensure both parties are happy with the deal

- Be willing to walk away if you can’t negotiate a fair and mutually profitable opportunity

Just like when you’re hiring employees, place trust at a premium. You can always ask their existing or past partners whether they were happy with a recent joint venture or cross-promotional experience.