Gross profit is a great tool to manage both sales of products or services, and the cost of goods sold (COGS).

In this article, you will learn:

Gross profit is a great tool to manage both sales of products or services, and the cost of goods sold (COGS).

In this article, you will learn:

The definition of gross profit is total sales minus the cost of goods sold (COGS).

Sales are defined as the dollar amount of goods and services you sell to customers. The COGS includes all costs that are directly related to creating and selling the product or service.

It’s important to note that gross profit is different from net income. To calculate net income, you must subtract operating expenses from gross profit.

In addition, sales do not equal revenue all the time. Total revenue includes total sales and other activities that generate cash flows and profit if there are any. If a manufacturer, for example, sells a piece of equipment for a gain, the transaction generates revenue. However, a gain on sale is different from selling a product to a customer.

A gain on sale of a non-inventory item is posted to the income statement as non-operating income and is not part of the gross profit formula.

Every manager should analyse financial data, including gross profit, in order to improve business results.

Gross profit = (revenue - cost of goods sold)

The gross profit formula is used to calculate the gross profit by subtracting the cost of goods sold from revenue. Revenue equals the total sales, and the cost of goods sold includes all of the costs needed to make the product you’re selling.

Revenue = number of sales x price of service

COGS = beginning inventory + purchases + other costs - ending inventory

Calculating gross profit is as simple as finding your total sales and the cost of goods sold. These usually come from your financial statements but can also be found by diving into your income statement that separates your earnings (like total sales), administrative expenses (like fixed costs and variable costs), and business credit card transactions.

Now it’s important to note that sales revenue differs from your company's profits. Profit is the income that is left over after you deduct your COGS. To find your sales revenue, either look at your financials, like income statements, or calculate all of your earnings for the term you’re looking at.

A simple way to look at it would be:

Revenue = number of sales x price of service

The cost of goods sold can be a bit more tricky. First, you need to break down all of your costs and determine which category they fall under.

These include:

The overall method of finding your cost of goods sold should look like this:

COGS = beginning inventory + purchases + other costs - ending inventory

Lastly, it’s plug and play — simply take your total sales revenue and subtract your cost of goods sold. To get a better understanding let’s present some visuals and examples below.

Gross profit = (revenue - cost of goods sold)

To understand the gross profit formula, meet Sally, the owner of a small business named Outdoor Manufacturing. Sally’s business manufactures hiking boots, and her firm just completed its first year of operations.

| Outdoor Manufacturing | |

| Income Statement for the period ending December 31, 2023 | |

| Sales | 520,000 |

| Cost of Sales | |

| Materials (leather, metal, plastic) | 170,000 |

| Labor | 250,000 |

| Total Cost of Sales | 420,000 |

| Gross Profit | 100,000 |

| Operating Expenses | |

| Office salaries | 40,000 |

| Depreciation | 20,000 |

| Insurance | 12,000 |

| Home office lease | 10,000 |

| Marketing, advertising | 4,000 |

| Repair and maintenance | 4,000 |

| Total Operating Expenses | 90,000 |

| Net income (revenue + gains) - (expenses + losses) | 10,000 |

The sales component of the formula is straightforward (selling price multiplied by the number of boots sold). Outdoor sold $520,000 in boots in 2020. The firm’s cost of sales component is more complex, however. What expenses are included in the cost of goods sold balance?

The cost of goods sold (COGS) balance includes both direct and indirect costs (or overheads). Managers need to analyse costs and determine whether they are direct or indirect. In addition, companies must label expenses as fixed or variable costs.

Taking the information provided in the income statement, we can determine the following:

Gross profit = revenue - cost of goods sold

$100,000 = $520,000 - $420,000

Direct costs are directly related to producing a product or delivering a service - also called production costs The most common direct costs are raw materials and labour costs. Indirect costs, on the other hand, cannot be traced to a specific product or service. These, for example, are usually other costs that are associated, such as fixed costs like rent or utilities.

Outdoor’s cost of goods sold (COGS) balance includes both direct and indirect costs.

Outdoor purchases leather material to manufacture hiking boots, and each boot requires two square yards of leather. Both the cost of leather and the amount of material required can be directly traced to each boot. Outdoor knows how much material is required to produce a production run of 1,000 boots.

Hiking boot production also requires labour costs. Outdoor pays workers to operate cutting and sewing machines and to stitch some portions of each boot by hand.

Based on industry experience, management knows how many hours of labour costs are required to produce a boot. The hours, multiplied by the hourly pay rate, equal the direct labour costs per boot. Outdoor knows the direct labour costs required to produce 1,000 boots.

The 2020 income statement reports that Outdoor incurred $170,000 in direct material costs and $250,000 in direct labour costs.

Indirect operating expenses cannot be directly traced to a product or service. Instead, indirect costs are allocated to production. Most managers use the term “overhead,” rather than “indirect costs.”

Managers need to know why a particular cost is being incurred. One way to understand costs is to determine if the expense is fixed or variable.

Direct costs, such as materials and labour, are typical costs that vary with production. However, if a customer contract requires you to hire an outside firm to assess quality control, that one-time cost may be considered a fixed direct cost.

The cost paid to an office security company is a fixed overhead cost. In other words, the security company’s rate does not change according to how much you produce or sell in a month - it remains the same. On the other hand, the hourly rate paid to repair company machinery is a variable overhead cost. This is because one month you might not need repairs, whereas another month you might have 3 photocopiers break down.

Inventoriable costs are not immediately assigned to the cost of goods sold.

Inventoriable costs are defined as all costs to prepare an inventory item for sale. This balance includes the amount paid for the inventory item and shipping costs. If a retailer must build shelving or incur other costs to display the inventory, the expenses are also inventoriable costs.

The cost to train people to use a product is also included in this category. The cost to train employees to use IT is a good example.

When the inventory item is sold, the inventoriable costs are reclassified to the cost of goods sold. A retailer may have thousands or even millions of dollars in inventoriable costs that are not yet expensed.

Gross profit margin is best used to compare companies side by side that may have different total sales revenue. Since the gross profit margin only encompasses profit as a percentage of sales revenue, it’s the perfect factor to use as the measurement of comparison.

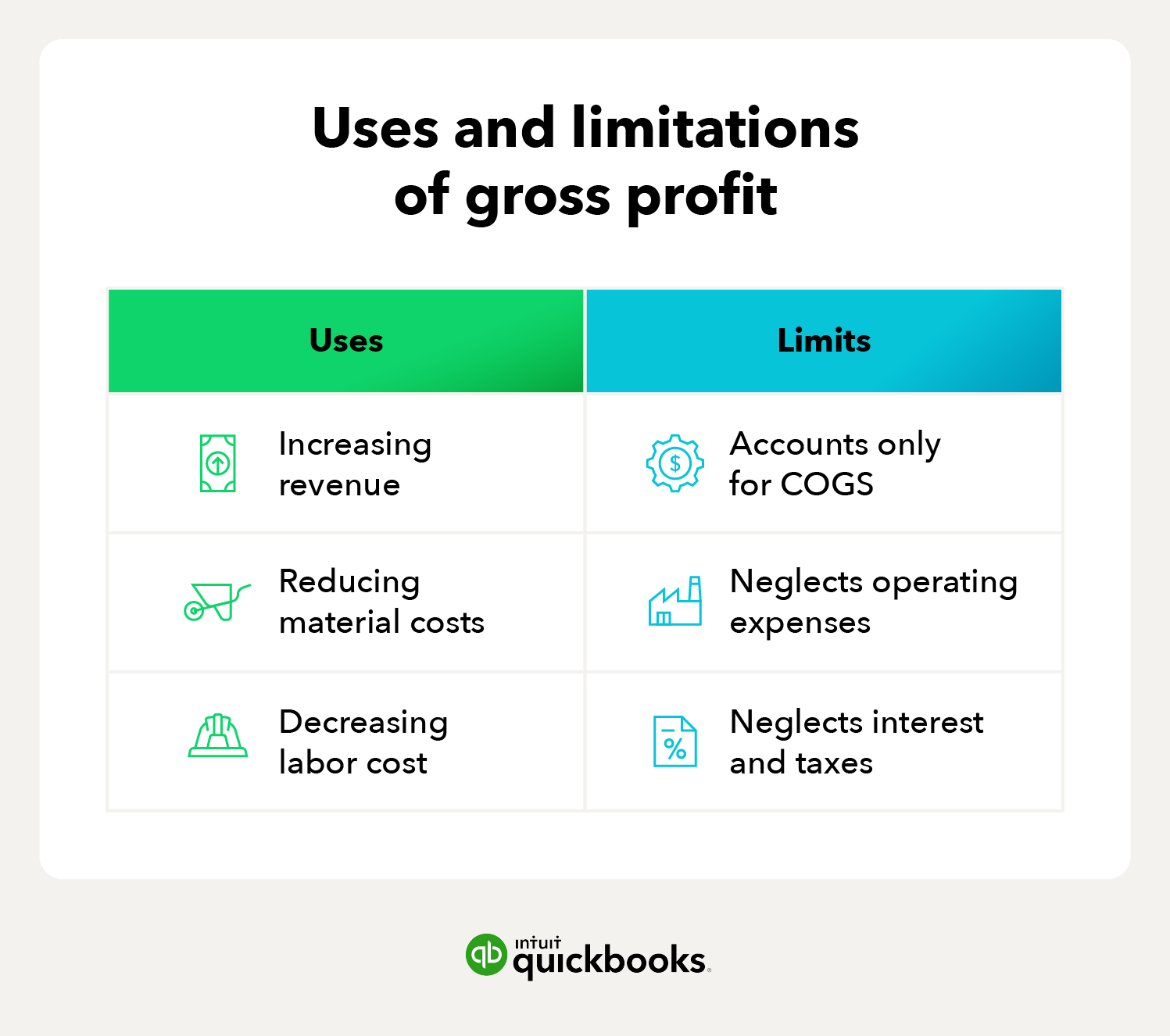

It can be limiting, however, since it only takes into account the profitability of the company and not additional relevant data, such as rising material costs or labour shortages. A better indicator of a company’s overall financial health may be that of net profit.

As we’ve previously discussed, gross profit is an indicator of a firm’s profitability but disregards some additional expenses the company incurs like operating costs. Net profit fills in these gaps by serving as the equaliser.

The formula below shows all that net profit accounts for:

Net profit = revenue - COGS - operating expenses - other expenses - interest - taxes

The bottom line is that net profit considers all other associated expenses whereas gross profit only accounts for COGS.

Gross margin is expressed as a percentage, while gross profit is stated as a dollar amount.

Gross margin is defined by this formula:

(Total revenue - the cost of goods sold) / (total revenue)

The 2023 gross margin for Outdoor is:

($520,000 revenue - $420,000 cost of goods sold) / ($520,000 revenue) = 19.2%

For every dollar of sales, Outdoor generates about 19 cents of gross margin. The gross profit formula helps you identify cost-saving opportunities on a per-product basis.

A company’s gross profit is not just for reflecting on the profitability of a company, it can also be used to increase profits. To improve gross profit, focus on the components of the formula.

Businesses can increase total sales revenue by raising prices, but price increases can be difficult in industries that face a high level of competition. The ability to purchase products and services online also puts downward pressure on prices.

The most effective way to bolster total sales revenue is to increase sales to your existing customer base. You can also increase revenue by improving your marketing outcomes. Use promotions, rewards, and testimonials to promote your products, and survey your customers to find out what products they want.

The other strategy to increase gross profit margin is to reduce cost of goods sold.

You can reduce material costs by negotiating a lower price with your suppliers. If you’re a large customer who buys materials every month, you may be able to negotiate a lower price based on your purchase volume.

The material costs you incur are driven by cost and by usage. Analyse your production and take steps to avoid wasting material.

Take a close look at your labour costs, and see if you can find ways to lower spending.

Just as with material costs, labour costs are the product of the hourly rate paid and the number of hours worked.

The hourly rate you pay is closely tied to current economic conditions and the rate of unemployment. If the economy is growing, you may need to pay a higher hourly rate of pay to hire qualified workers. The opposite is true in a slowing economy.

Invest in training so that employees can work efficiently. Well-trained workers can get more done in less time, and they make fewer mistakes.

When you create an annual budget, include gross profit calculations to forecast company profit.

When you build a budget using gross profit, you can reduce costs and increase revenue in the planning process.

Use an accounting software like QuickBooks, that can easily generate your firm’s gross profit and other important metrics. Compare your firm’s gross profit margin to other companies in your industry.

Finally, put in the time to make improvements that lower production costs and your operating expenses, while on the other hand increase your total sales revenue. Be proactive and make improvements sooner rather than later to take charge of your business’s financial health. Your business results will improve, and your firm will increase in value.