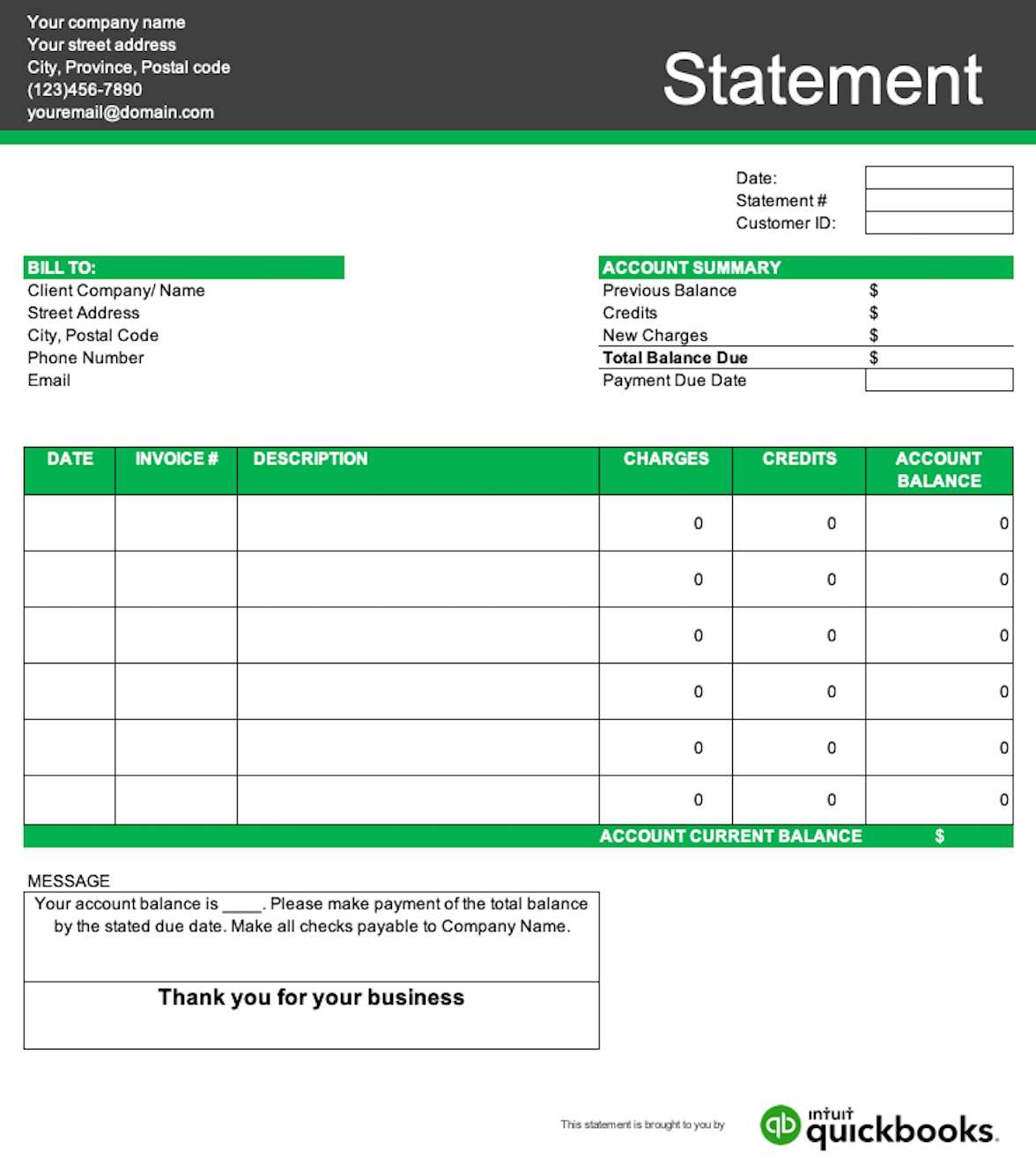

Sending out customer statements

A statement of account might look like a monthly statement issued to a client. Typically, companies issue monthly statements to their clients with up-to-date transactions, often as a PDF file sent via email.

Sending off a statement of account to a client at the end of the month is a good way to point out if they have any overdue accounts. Accounts receivable is the money owed to a business by the client, which can be found in these statements.

If a customer’s statement displays a zero balance then they are up to date on all payments. Typically, customers who have zero balances do not need to be sent this document unless they specifically request it. However, customer statements are still used internally within a business to keep track of financial reports and transactional history when managing customer relations and in case of disputes.

If your small business offers customers the ability to make purchases on credit, these statements should always be sent out to the clients at the end of the month to bring awareness to any overdue credit and outstanding payments.