How to use invoice numbers: a step-by-step example

Say you own a business that does contract work for other companies. A client hires you for a new project that will span the course of three months.

Because this project takes three months, you end up sending your client three separate invoices for payment. To keep your personal records clear and understandable, you create a numbering system for your invoices that lets you quickly search through your invoices if questions come up later.

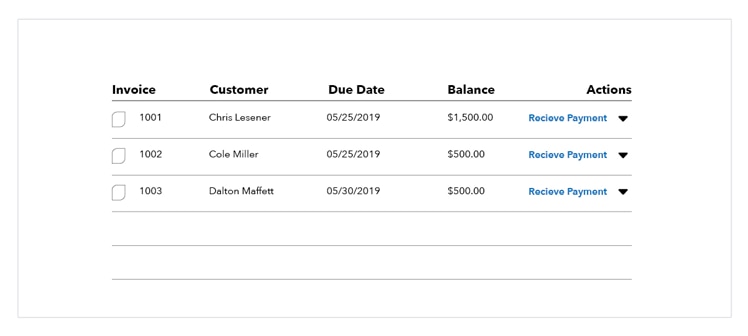

Here’s an invoice number example of how you might label each invoice for each month of billing:

- First invoice: SA0001

- Second invoice: SA0002

- Third invoice: SA0003

Now let’s imagine that about six months after you’ve completed these projects, the client reaches out to request some additional work. Last time, you charged them $2,000 for the project. However, this time, your client insists that they paid only $1,500.

Because of your well-organised invoicing system, you can quickly Checks your records for the particular invoices previously billed to your client. Quickly finding the last invoice, SA0003, you are able to provide concrete proof of payment you received for the previous project.