Income Statement Structure

As stated earlier, an income statement helps in knowing how your business can transform revenues into profits for a given accounting period. Accordingly, the net income of your business is calculated as follows:

Net Income = (Revenues + Gains) – (Expenses and Losses)

In order to have a better understanding of the structure of an income statement, let’s consider the example given under the single-step income statement format.

Company A earns a revenue of $200,000 from sales during the year 2019. It incurred various expenses such as the cost of goods sold, office supplies, etc. that amounted to $77,000. It earned gains from the sale of assets amounting to $5,000 and incurred a loss from a lawsuit of $500 during the year 2019.

The net income thus earned by Company A was $138,000 for the year ending on December 31, 2019. This example illustrates the simplest manner of generating income statements for any business entity.

As the name suggests, it is a single-step income statement that includes one subtraction, that is, subtracting the sum of expenses and losses from the sum of revenues and gains.

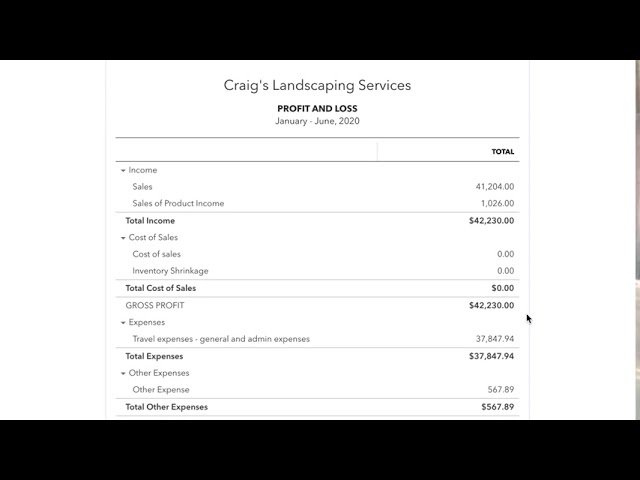

However, bigger companies have diverse business segments and divide an income statement into various sections such as operating and non-operating revenues and expenses, gains and losses, and provide more information through such statements to the various stakeholders.

Furthermore, in the multi-step income statement, different indicators of the profitability of the business entity are captured at different levels such as gross profit, operating income, pre-tax income, and after-tax income.

This helps stakeholders understand how much income your business is generating at various levels. For example, a higher gross profit figure and a lower operating income figure reveal that your business is incurring an increased amount of operating expenses.

Similarly, a higher pre-tax income and a lower after-tax income showcases that one-time costs are taking a toll on your business earnings.