Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have confirmed my employment allowance (£5k national insurance) eligibility in QB but it is not showing in my HMRC portal, does anyone else have the same problem

Let me help you record your employment allowance to show in the HMRC portal, Steve.

The Employment Allowance allows certain businesses that employ people to reduce their Employer Class 1 National Insurance liability by up to £5,000 per tax year. You can look at the HMRC website if you are qualified. If you're not sure of your eligibility, read the employer guidance.

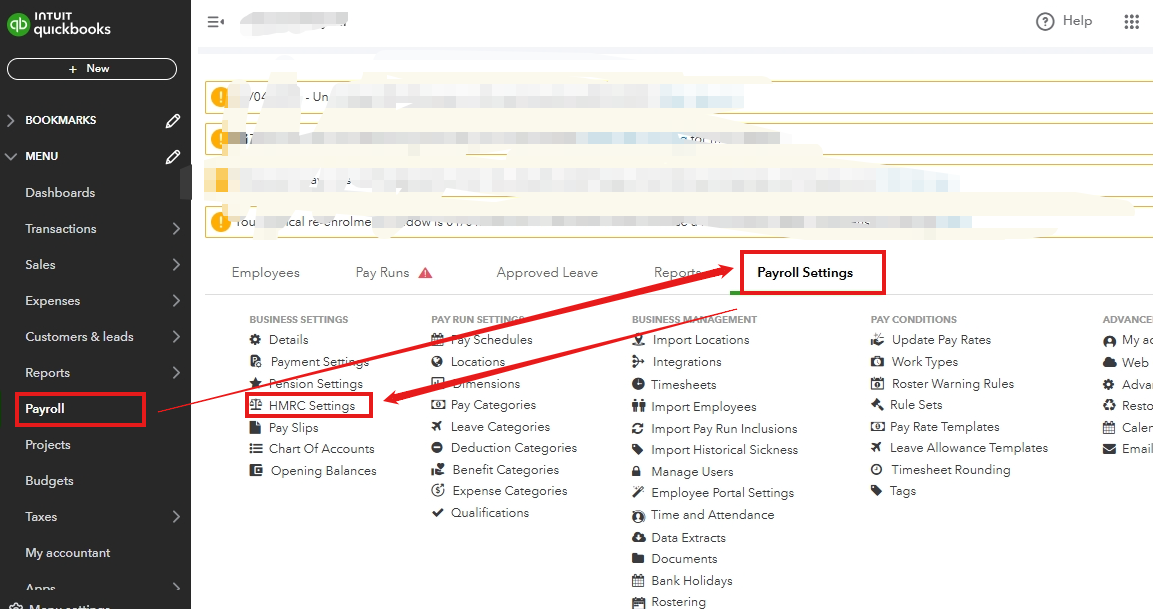

If you qualify, you must notify HMRC directly. Then, here's how to make it appear in the HMRC portal:

Additionally, I recommend checking our Reports and Accounting page for reference to learn some tips and tricks for managing your reports.

Don't hesitate to reach the Community for any other concerns about employment allowance. We got your back. Have a great day!

I have this same issue. I have followed your instructions. In HMRC settings it is already set to Yes for small business relief. This still does not reflect on the EPS when i run it. I have had a letter saying i owe money which is the Employment allowance that was shown as a deduction on the P32. I cannot seem to force it to create an EPS showing the employment allowance deductions. Please help

Hi I have same issue.. (Payroll Advanced) I've been in touch with QBO help.

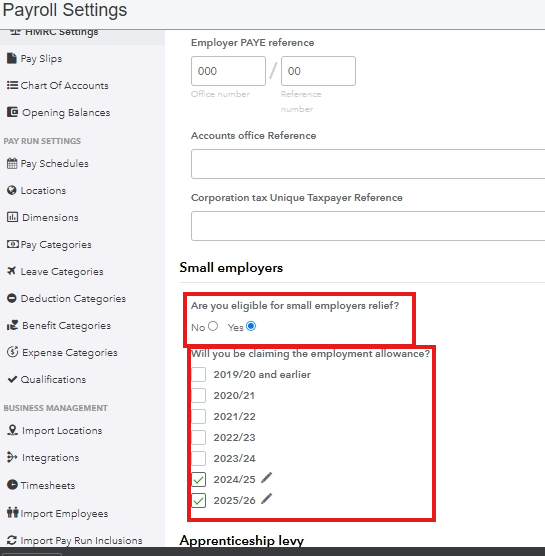

I already had ticked check box in Payroll Settings > HMRC settings > Small employers > Will you be claiming employment allowance > checkbox 2023/24.

Then come out of here go to reports > Payroll HMRC Reports > Ensure in correct year 2023/24 > Run reports.. I then went ahead and submitted previous report (don't tick the check boxes unless any of them apply eg no employees paid in period etc, its OK to submit without apparently. After the next payment run in the correct period I should be able to do this again and it will send the submission with the information HMRC need in respect of the employment allowance. I've set mine to auto submit EPS back in Payroll Settings again.

Hopefully this will now work!

Hi, I have the exact same problem.

I've ticked the Employment Allowance box in QB and it's been accepted.

The Employment Allowance is showing in the QB journal.

HMRC are taking the full contributions and making no adjustment for employment allowance (this has never happened before) and in our HMRC account page it is showing as we have not made an application.

If I go into Employment Allowance in QB, re check the box and save screen just goes into a continuous circle (not knowing what to do)

Any ideas?

Hi, I've had the same issue since November 2022, have you now managed to resolve this? thanks

Hi

I spoke to the helpline. For some reason there is a tick box that says to send the EPS automatically which had been unchecked. I don't know how this had happened as there is just me with access. I think that it's a glitch maybe after an update? You can force an EPS through by going into Payroll-Reports-HMRC reporting-employer payment summary. This sorted mine out and i have now had confirmation from HMRC. Hope this helps.

Brilliant thank you.

Hi did you resolve this? I have exactly same problem and nothing seems to be working. I have ticked the boxes and its showing the employment allowance on the p32 report but at HMRC end it is saying we are not claiming employment allowance

Hi Helen81, thanks for joining this thread. Have you sent an EPS (Employer Payment Summary) from QuickBooks to HMRC since turning on EA?

Hi yes i have done this and still have the same problem

I have this issue each month, i submit an additional EPS around the end of the month to correct the issue.

Thanks Helen8, are you using the Standard or the Advanced version of QuickBooks Online Payroll?

What is your most recent tax week/month, and did you run the payroll for this period after turning on EA in QuickBooks (not before)?

Hi i am using payroll advanced. I turned the employment allowance on in April and its showing on QuickBooks but not on the HMRC. They system has sent the EPS automatically every month. I don't know what else to do.

I also have another company on my subscription where the Employment allowance is turned off but its showing as claiming it on the HMRC.

Hi Helen81, thanks for getting back to us here. Please check that the correct employer PAYE reference is entered in the Tax office details (Payroll > Payroll Settings > HMRC Settings). After this, please then check the RTI submission report to see if this shows EmpAllInd:yes - this message means that the employment allowance has been submitted to HMRC successfully.

If you need any help completing this, you can contact our Live Support team- the agents here will have access to our Smart Look screen share tool to view this with you.

Hello, I am also having issues with Employers Allowance. Everything has worked fine for the previous 4 years but this new tax year I am having trouble. I am using QBO Advanced payroll. The p32 report is showing the EMP as claimed but when I log into the HMRC portal it says I am not claiming it and is not showing any credit. I have gone to the Gear Icon > Payroll Settings > HMRC Settings > The check box for 2024/25 is ticked. I have also checked my submission report and I have EmpAllInd:yes

Maybe it has a lag to pull through onto the HMRC portal?

Please advise if anyone can help

Allow me to guide you in claiming your Employment Allowance in QuickBooks Online Advanced Payroll.

To begin with, please make sure that you've enabled the Employment Allowance:

Once the Employment Allowance is enabled, it will be calculated and generated automatically on the Employer Payment Summary (EPS). The EPS typically auto-generates each month, but you may need to submit it manually, depending on your settings.

After this, make sure you’ve entered the necessary details in your HMRC settings, including:

Also, when claiming the Employment Allowance, select Yes. If you’re unsure about eligibility, verify with HMRC directly.

Additionally, there might be a delay in information syncing between QuickBooks and the HMRC portal. If you’ve followed the steps correctly, give it some time to update the portal.

Moreover, you can check out these helpful resources for the payroll year-end guide:

Let me know if you need further assistance claiming your employment allowance or have any QuickBooks-related concerns. Keep safe.

I'm having exactly the same issue with advanced payroll. I actually submitted my EPS online - with the QB support team sharing screen - so I know it was done as they recommend but HMRC say it's not ticked an indicator in their system.

QB are telling me I've submitted correctly but it's not being claimed at HMRC - so is there an issue with submission?

What do I do to claim it properly - it's now too late for this month (which is a cashflow issue in itself)?

I've never had an issue before with the standard payroll - just wish I hadn't upgraded to advanced this year - nothing but trouble!

Hey LT11, got a feeling this is a bit of system wide issue right now. My HMRC portal was saying that I wasn't claiming Employers Allowance for this year but after resubmitting the EPS it has updated and is now saying I am - however, is still not showing as a credit for the month.

(You can check your Employment Allowance Status in your portal - click on See all upcoming PAYE payments then right hand side Employment Allowance Status )

Just to confirm everything in QB on the p32 is correct, it is just the HMRC portal that is not displaying correctly.

Also the answer to my original post from RogelioL - this is out of date advice if anyone is following this thread. Payroll section is no longer listed under the Accounts and Settings tab. EMP is now £5,000 instead of £3,000 and there is no check box to say you are claiming Employers Allowance.

Waiting until tomorrow to see if the HMRC portal updates and if it doesn't, I intend to pay the full amount. Assuming HMRC will update correctly for next month and give me extra credit for the over payment made this month. But yeah you are totally right - a cash flow kick in-between my legs :smiling_face_with_smiling_eyes:

Hi henryb1

Thanks for your reply - good to know I'm not the only one.

FYI - my HMRC portal employment allowance status shows that I am claiming it BUT it's not reduced my payments so I rang the HMRC helpdesk and they confirmed that I'm NOT claiming it as a tickbox hasn't been ticked in the EPS submission!

I very much doubt that HMRC will change yours tomorrow either and sounds like you're in the same position as me - it looks like some issue between the two systems - but us left to bear the pain of sorting it out/paying.

I also don't know how submitting next month is going to be any different unless they make a change to how it's submitted? Hope QB get this sorted soon

Hey @LT11

Thank you for replying and sharing your experience. I have just checked my online portal on HMRC and it is showing the discount for the Employers Allowance. So everything appears in order. Cash flow disaster adverted haha. Has your discount updated as well? If not I can advise what I did do in case that helps for your next submission next month (Not sure if what I did last week helped or not - but I did untick the settings and submit an EPS and then ticked the settings and re-submitted the EPS). If you need help let me know.

Hi Henryb1

Thanks for your reply and I can confirm that this is already an investigation within QB as the EPS being submitted from advanced payroll (even after ticking and unticking settings and resubmitting) does not tick the box to claim Employers Allowance. The higher tier help desk have looked into it with me and don't know why this is happening, and confirmed it's currently under investigation. Guessing that many companies may be affected in the same way?

So although the HMRC portal tells you that you are claiming it (if you log in and check), the box is not ticked in the submission so it will not reduce the amount due to HMRC - if you know what I mean?

If it has worked for you that's great & hopefully this will be sorted out before next month for me otherwise they're suggesting HMRC Basic Tools to upload a correct EPS. If that's the case I'll try your submitting trick again and keep fingers crossed. I thought advanced payroll would be an improvement but it's been anything but so far! Thanks again for your support.

Since the system updates, this is no longer a valid post - where do we find this now?

Thank you for reaching out regarding your query, Pool. To ensure we fully understand your needs and provide the most accurate assistance, could you please share more details about exactly what you are looking to find? This will help us offer you a more targeted and effective solution.

On the other hand, if you're referring to how to make your Employment Allowance reflected in the HMRC portal. Please follow these steps:

Refer to this article for more details about Employment Allowance in QuickBooks Online Payroll: Set up Employment Allowance in QuickBooks Online Standard Payroll.

Additionally, you can check out this resource for guidance in helping you confidently manage your payroll year-end process, ensure your Employment Allowance is claimed correctly, and maintain compliance with HMRC requirements: Year-end guide for QuickBooks Online Standard Payroll.

If you're referring to something else, please let us know by leaving a reply below, Pool. We're here to help and will do our best to provide the information or guidance you need.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.