Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Many thanks for your help on student loan. Seems to e working OK.

Lindag

Hi Lindag,

Thanks for reaching out on the community

We can certainly help you with this, just need to find out a few things first.

Which Payroll are you using? Is it Advanced or Standard or Paysuite?

Thanks

I am on the standard payroll. Sorry for the delay in replying due to Christmas but your help would be much appreciated as payroll is now due and I need to make the student deduction. Many thanks. Lindag

That's okay, Lindag. I hope you enjoyed your Christmas celebration.

Let's go over to your concern. Repayments are not taxed. Let me help you set it up.

Here's how:

When you create a paycheck, the deduction will show.

Here's how it looks like:

I'll include the article on how to add or customise deductions in QuickBooks Standard Online Payroll.

I'm just around if you need my help. Just tag me and I'll get back to you as soon as I can.

Many thanks for your help on student loan. Seems to e working OK.

Lindag

Hello Lindag74

Thanks for letting us know:) Any questions in the future feel free to reach out to us here on the Community

Emma

Hi - I tried using the Deductions solution here, but it did not get reported to HMRC at all, even though it showed up on the employee's payslip. However, another employee had student loan repayments set up in his profile under Tax Deductions, and that one did get reported to HMRC properly. What is the difference and why would the student loan information set up in Deductions not be reported correctly in the FPS?

I can provide additional information about student loan repayment, @tiffanycarol.

Can you try to check if those deductions that were not reported to HMRC if it's still inside the FPS period? That is also one of the reasons why the deduction is not reported in the FPS.

If you'd like to view all your submitted FPS and EPS, view this article: View submitted FPS and EPS filings in QuickBooks Online Standard Payroll. You can find a list of FAQs right at the bottom of the page.

If you have other questions in mind or need further help with the employee's deduction, let me know in the comment section. I'll be glad to share and provide additional guidance at any time. Have a good one!

This was for December 2020 pay run. I checked the FPS for December, and it shows the student loan deductions in 2 different ways:

1. For the student loan set up under Tax Information, the FPS shows it as "StudentLoanRecovered PlanType=01..." This one was reported to HMRC correctly to connect the withholding to the employee's student loan.

2. For the student loans set up under Deductions / Loan Repayment, the FPS shows it as "<DednsFromNetPay>" and did not connect it to the employee's student loans with HMRC. So even though I withheld the amount from the employee, HMRC did not connect that to the employee's records on their end, it did not show up on my PAYE statement to remit to HMRC, and I received a notice that I did not withhold student loan payments for this employee.

If this article tells me to use Deductions / Loan Repayments, why did it not report correctly to HMRC like using Tax Information did?

I have since made sure both employees now have student loan repayments set up under Tax Information instead of Deductions.

Can I override January's payslip for this employee to correct the December information, or do I need to delete December's pay run, set it correctly, and resubmit the correct FPS t0 HMRC?

Thank you for elaborating your concern in such a great detail, @tiffanycarol.

I'd suggest contacting HMRC and ask them if it will be okay to modify the December paycheck and submit EFS. If yes, please reach out to our Payroll Support team to help you correct the paycheck.

For more details about our support availability, refer to this article: Contact Support.

Please let us know should you need further assistance. We're always here to help.

Hello. I’m going through a similar issue. I’ve been told to change my student loan plan for an employee to plan 4 which actually means she won’t be repaying cause the threshold is higher. However I cant select which plan she is on on QuickBooks. All it asks for is a percentage. I think they are all 9% but if I put that it tries to deduct that and she shouldn’t have to pay anything as the threshold has been raised. Very confused!

Hello, David Taylor.

I'd like to point you to the right direction and ensure you're able to track the employee's student loan properly.

We can only switch plans in the Advanced payroll subscription (Plans 1, 2 and 4 are available). For Standard subscriptions, you'll want to contact us so we can change the calculations of your student loan deductions.

Our agents will also ensure that your payroll year-to-date amounts are correct. I'd like to do it here. However, it requires me to access sensitive information.

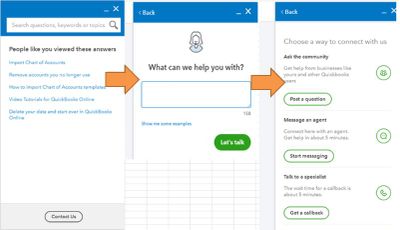

Here's how to reach them:

If you need help with the pay inclusions for your employee, you can check this article: Setting up pay run inclusions in QuickBooks Online Advanced Payroll.

You can always check out our articles in case you need help with your payroll subscription or processes in QuickBooks Online. Click the following links to get started:

You can always post any concerns you might have for payroll or anything else in QuickBooks. I'm here to help you achieve your tasks.

Hi james

we have the same problem as David. We do have advanced payroll but it isn’t giving me the option to put what plan the employee is on. They will be under the threshold so won’t be paying anything.

Hello anamaddy. Plan 4 should have been available from the 6th of April for the new tax year. Is this an existing employee or a new employee and have you moved the payroll into the new tax year?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.