- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- How do I set up Childcare vouchers for salary sacrifice??

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

0 Cheers

Best answer February 13, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Welcome to the Community forum, @jan-dorling.

Currently, QuickBooks doesn't support childcare voucher. For the meantime, you can create a Pre-Tax deduction for you to show the item on the employee's payroll.

To set up a deduction category, here's what you'll need to do;

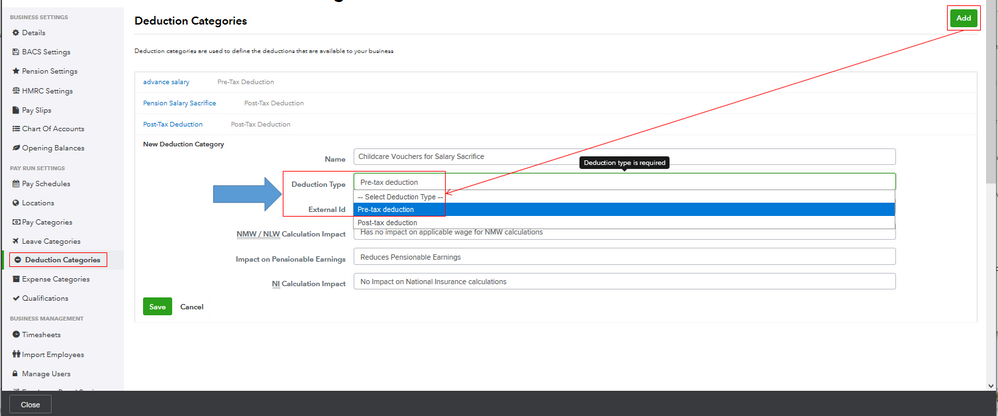

- Choose Payroll Settings, then Deduction Categories.

- To add a new deduction category, select Add. There will already be two deduction categories for you (Pre-Tax Deduction and Post-Tax Deduction). You can edit any of these by selecting the name of the deduction category.

- Enter a name for the deduction category.

- Select whether it will be a pre tax or post tax deduction.

- Add an external ID and select the NMW/NLW Calculation Impact as required.

- Hit Save.

Once done, you can now assign the deduction to your employees.

Keep me posted if you have any additional questions, as I'm always here to help. Take care.

0 Cheers

9 REPLIES 9

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Welcome to the Community forum, @jan-dorling.

Currently, QuickBooks doesn't support childcare voucher. For the meantime, you can create a Pre-Tax deduction for you to show the item on the employee's payroll.

To set up a deduction category, here's what you'll need to do;

- Choose Payroll Settings, then Deduction Categories.

- To add a new deduction category, select Add. There will already be two deduction categories for you (Pre-Tax Deduction and Post-Tax Deduction). You can edit any of these by selecting the name of the deduction category.

- Enter a name for the deduction category.

- Select whether it will be a pre tax or post tax deduction.

- Add an external ID and select the NMW/NLW Calculation Impact as required.

- Hit Save.

Once done, you can now assign the deduction to your employees.

Keep me posted if you have any additional questions, as I'm always here to help. Take care.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Hi - thank you for your reply - how do I access payroll settings ?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Hi there, AF0113.

Do you mean the Payroll settings mentioned by my colleague MirriamM? I can show you where you can check it.

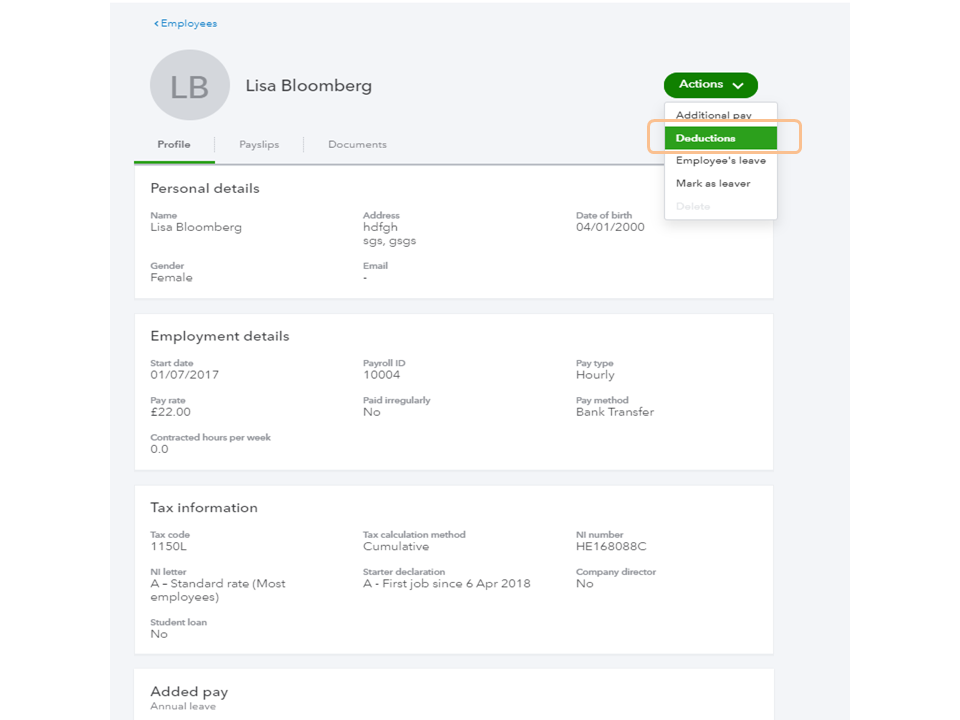

- In your QuickBooks company, go to the Employees menu.

- Locate the employees's name and click on the Actions button.

- Click on Deductions.

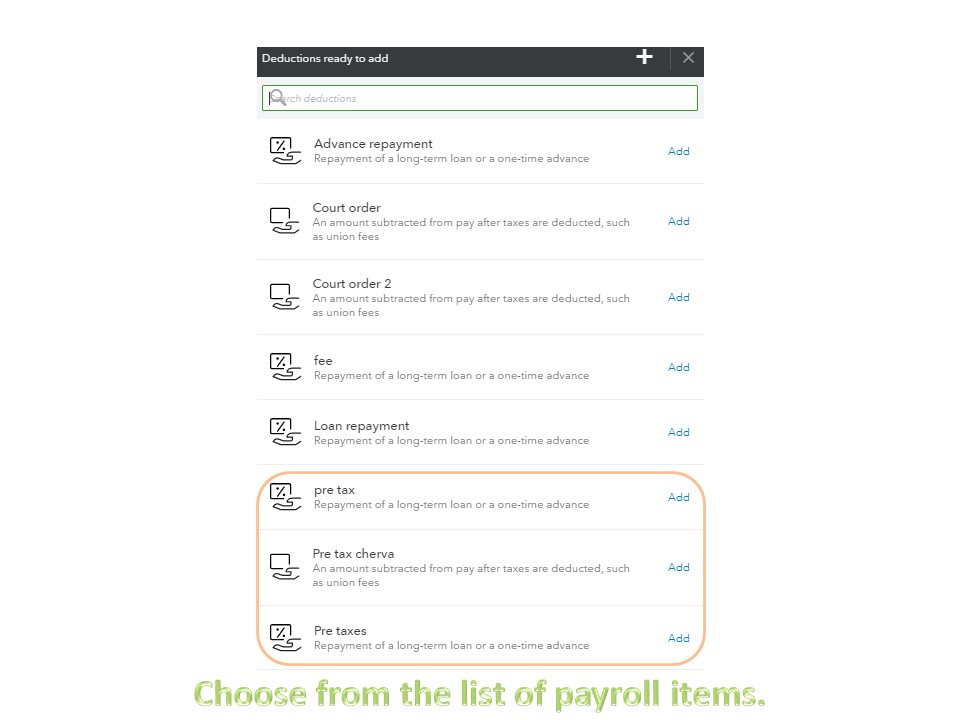

- Choose the deduction you wanted then click Add.

Here's how it looks like.

That should do it. Let me know if you need anything else. I'll be here to help. Take care.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

I can get to the settings but there is no option to create a pre tax one?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

I have the steps you can perform to create a pre-tax deduction category in the program, @Skylane.

Based on your scenario, it looks like you've followed the steps provided by MirriamM above. Thus, you're using QuickBooks Online Advanced Payroll (QBOAP).

The stored cache on the browser may be full, which causes unusual behavior in QBOAP. That's why you have no option to create a pre-tax deduction category.

To help fix this, I'd first suggest logging into your QBOAP account through a private browser. It doesn't store data in the cache. Because of this, it's a great way to isolate browser-related issues. Here are the keyboard shortcuts depending on the browser you're using:

- Google Chrome: CTRL + Shift + N

- Safari: Command + Shift + N

- Mozilla Firefox or Microsoft Edge: CTRL + Shift + P

Once logged in, go back to Deduction Categories from the Payroll Settings menu. Just click Add to create a pre-tax deduction category and enter the details (see the screenshot below). If you're able to do so, let's clear the cache of your main browser. It removes the junk files on the browser so it'll function efficiently. If not, you can use another supported browser.

After that, assign the deduction to your employee. This way, the system will use it when you create a new pay run for them.

I'll be right here to help if you need further assistance. Have a great rest of your day, @Skylane.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Is it possible to add a pre-tax Deduction in the the standard payroll version?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Thanks for following on this thared, @Chris Hunt.

Yes, you can add a pre-tax deduction in the Standard Payroll. Adding the payroll item can be done in just a couple of minutes.

Here's how:

- Go to the Employees menu to choose the Employees option.

- Click on the worker's name to see the complete information.

- Hit the Actions drop-down to select Deductions.

- Tap the Add link for pre tax to key in the item's name in the field box.

- Press the Rate type drop-down to choose Value or Percent.

- Click Save to keep the changes.

For more information, check out the Add or customise deductions in QuickBooks Online Standard Online Payroll guide. It outlines the instructions on how to add an after-tax deduction and a repayment.

Additionally, the QuickBooks Online Standard Payroll Hub link provides a breakdown of articles of the processes you can do in the current payroll service.

Stay in touch if you have any clarifications or questions. I'll be right here to answer them for you. Enjoy the rest of the week.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Thanks, , but when I do that I only get two options - for an after-tax deduction or repayments, not the comprehensive list of deductions you've displayed. Are you sure you can add a pre-tax deduction as stated in standard payroll?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I set up Childcare vouchers for salary sacrifice??

Hi Chris

It is not possible to account for salary sacrifice/child care vouchers on the UK standard payroll product, however you are able to on the advanced product. We are not sure how the agent has these displayed, they may have been added manually or they are not using a UK product.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...