Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi All

I started my pension for employees several weeks after starting my business.

My contributions for my employees hasn't been paid as the payroll pensionsync has issues each payroll.

I must of entered the wrong dates somewhere and now it won't accept my payroll dates.

How on earth do I submit these submissions and pay their pensions???

I've asked pensionsync and Nest but im none the wiser

Thanks

Solved! Go to Solution.

Thank you for reaching back to us, The Pointer Inn.

Yes, you can submit and use other pension schemes in QuickBooks. Once, complete setting up a pension scheme for your business to process workplace pension files within QuickBooks Online Payroll. That said, the use of inbuilt pensionsync will automate the integration of your pension report.

You can check this article for the detailed steps on how to set it up: Manually Set Up A WorkPlace Pension Scheme In QuickBooks Online Advanced Payroll.

You'll also want to visit this article: Pension Scheme SetUp. It contains the available pension providers in QuickBooks and how to complete the pensionsync setup.

Please let me know if there's anything else that we can do to help. I'm always right here to assist. Have a great day. Stay safe!

I've got a couple of steps and info to ensure you can process your pensions payments seamlessly in QuickBooks Online (QBO), @The Pointer Inn.

There are a few things we need to check to make sure everything is set up fine. First, let's ensure that the employee's pay period in QuickBooks is the same as the details entered for your pension provider (NEST). This way, you can prevent errors when submitting your contributions.

You can start by checking all your Pension Sync interactions with NEST if the date match with that in QuickBooks. Here's how:

Once done, let's also check the NEST details entered in QuickBooks. Let me guide you how:

If everything's fine, you can attempt to submit your contributions again.

In case you encounter any Pension sync errors in QuickBooks, you can refer to this article on how to resolve them: Fix Pension Sync Errors in QuickBooks Online. It also contains info on what each error message means.

You can count on me if you have more questions about managing your payroll in QBO. I'd love to hear more from you in the comment section.

Hi ReyJohn

Thank you for your help but it doesn't work.

For starters I don't have a SMT and secondly I don't have the screen you did a shot of. My screen ends at Advanced. In the payroll section I don't have all them options either.

Thanks for trying though!

Hi there, The Pointer Inn.

Can you tell us what payroll subscription you're using? The screenshot shared above is using an Advanced Payroll subscription.

If you're using Standard Payroll, you can submit your NEST reports directly to NEST from their website. You can use the reports in your account in submitting the data to NEST. Here's how:

You can also check out this article for more details: Submit Pension Reports In QuickBooks Online Standard Payroll.

Let me also share this link so you can access the Help articles for Standard Payroll: QuickBooks Online Standard Payroll Hub.

I'll be around if you need anything else.

Hi

I'm using advanced payroll.

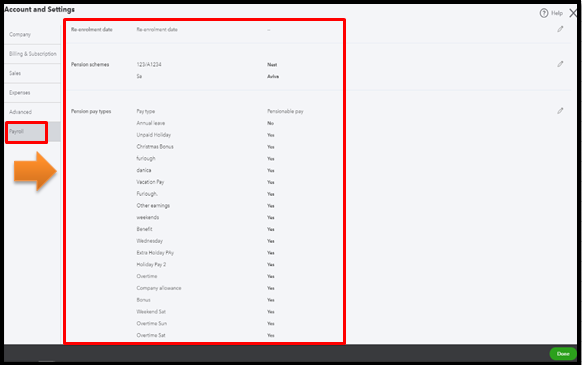

This is my screen shot

Thanks

I appreciate the screenshot you've provided, The Pointer Inn.

The screenshot above provided by my colleague is for an Advance Payroll subscription. Since you don't have those options on your end, I recommend reaching out to our Payroll Support team. This way, we'll be able to pull up your account in a secure session then run a set of examinations to amend the underlying issue.

Here's how to contact our support team:

I'll be adding this resource for the support hours. It contains the time on when the support is available, depending on your type of subscription. Just go to the QuickBooks section of this article for more info: Contact QBO support.

You can refer to this article if you encounter an errors about your Contributions in QuickBooks: Pension Sync Errors in QuickBooks Online Advanced Payroll.

Take a quick look at this article to learn how to manage your QBO account: QuickBooks Online Advanced Payroll Hub. This includes detailed information and how to customize payroll settings.

Let me know if you have any other questions by dropping a comment below. I'll be sure to get back to you. Have a great day!

Hi

Thank you for your help.

Just out of curiosity, if I was to remove Nest and go with People's pension or one of the other pension suppliers can I submit the pension info to them instead?

Nothing has made it to Nest in the last 3 or 3 payruns. I've obviously done something wrong.

Thanks

Thank you for reaching back to us, The Pointer Inn.

Yes, you can submit and use other pension schemes in QuickBooks. Once, complete setting up a pension scheme for your business to process workplace pension files within QuickBooks Online Payroll. That said, the use of inbuilt pensionsync will automate the integration of your pension report.

You can check this article for the detailed steps on how to set it up: Manually Set Up A WorkPlace Pension Scheme In QuickBooks Online Advanced Payroll.

You'll also want to visit this article: Pension Scheme SetUp. It contains the available pension providers in QuickBooks and how to complete the pensionsync setup.

Please let me know if there's anything else that we can do to help. I'm always right here to assist. Have a great day. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.