Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

I've got just the steps you'll need in recording the refund, @hotlocks.

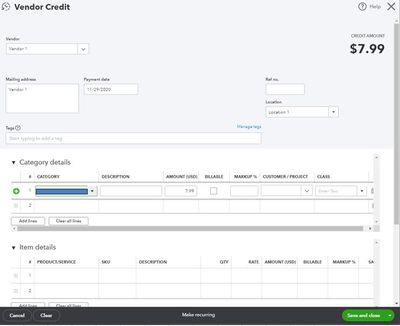

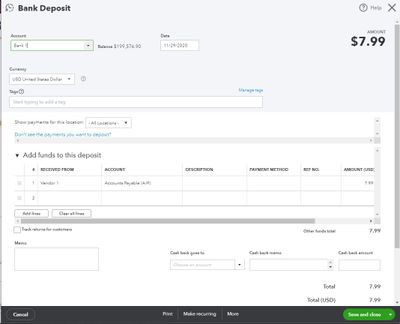

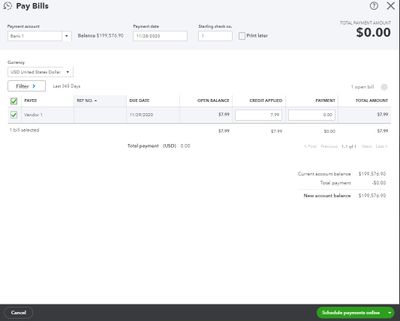

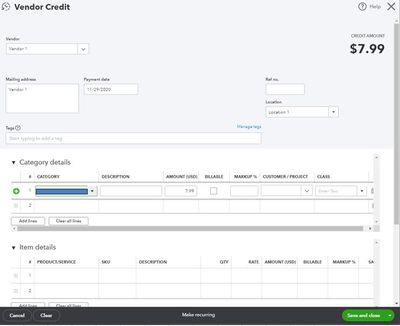

When you receive a refund from a vendor, you must first record a supplier credit for the expense that the refunded payment was applied. Then, you'll have to deposit the money received. After that, apply or link the deposit to the credit memo with a "zero GBP" payment. I'll show you how to do it.

Let's start recording the refund by entering the vendor credit.

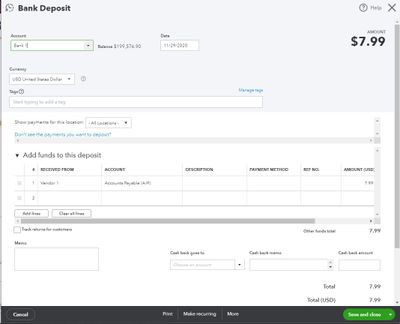

Then, let's deposit the money received.

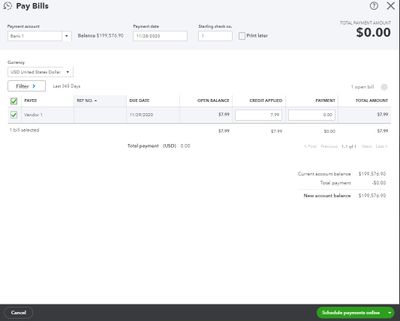

Lastly, let's link the deposit to the vendor's credit memo with a "zero dollar" payment.

These instructions are available from our guide on entering a refund from a supplier.

Once done, you can reconcile your account to make sure they match your bank statement.

Just to add this is available in our Essentials and Plus packages. If you are using the Simple Start package you can record the refund by creating a bank deposit (+ New > Bank deposit) - select the date and bank account the money was returned to and then scroll to 'add funds to this deposit'. On the first line, enter the same expense account used in the original expense and then enter the total amount and VAT code.

Please touch base with us here if there's anything else you need, I'm determined to ensure your success. Have a wonderful day.

I've got just the steps you'll need in recording the refund, @hotlocks.

When you receive a refund from a vendor, you must first record a supplier credit for the expense that the refunded payment was applied. Then, you'll have to deposit the money received. After that, apply or link the deposit to the credit memo with a "zero GBP" payment. I'll show you how to do it.

Let's start recording the refund by entering the vendor credit.

Then, let's deposit the money received.

Lastly, let's link the deposit to the vendor's credit memo with a "zero dollar" payment.

These instructions are available from our guide on entering a refund from a supplier.

Once done, you can reconcile your account to make sure they match your bank statement.

Just to add this is available in our Essentials and Plus packages. If you are using the Simple Start package you can record the refund by creating a bank deposit (+ New > Bank deposit) - select the date and bank account the money was returned to and then scroll to 'add funds to this deposit'. On the first line, enter the same expense account used in the original expense and then enter the total amount and VAT code.

Please touch base with us here if there's anything else you need, I'm determined to ensure your success. Have a wonderful day.

Hi I have quickbooks online and its telling me i need to upgrade, is there no other way of doing this

Let me help you record the vendor refund, @hotlocks.

Can you tell us more where you've seen the prompt to upgrade your subscription? Either which version of QuickBooks you're using, you can still enter a vendor credit, create a bank deposit, and link the deposit to the vendor's credit memo with a zero dollar payment through Pay bills feature to record a refund.

The steps that we're mentioned by LieraMarie_A is the process to record a vendor refund. The other way of handling it is by entering the supplier credits. Then, pay the bill using the supplier credits. This is the best option if you're planning to receive the credit from your supplier and apply it to future bills.

You can check the Scenario 2 in this article for more information: How do I handle supplier credits and refunds?.

In case you'd still like to upgrade your current subscription, you can check this link for more information about the monthly subscription and the features they have: https://quickbooks.intuit.com/uk/pricing/.

You can upgrade your subscription from the Billing & Subscription menu. Check the steps below:

See this article for more information: Upgrade or downgrade your QuickBooks Online subscription.

I'm always here if you need more help or if you have follow-up questions in recording this refund. Take care and have a wonderful day!

I followed this easy-to-understand process and it came out perfect.

Thanks for the light!

I have tried to follow this in my quickbooks on line and cannot make it work. I am lost. Have tried Quickbooks chat and the person could not show me how to make this work. When I try to do the first step I am told I have to upgrade

Hi ponkysue17 Is the refund in relation to a supplier or a customer?

It is a refund FROM a supplier - they had taken £8.36 against my Debit card in error.

Thanks ponkysue17, so that we can guide you on the steps to record this, can we check if you're using QB Simple Start, QB Essentials, or QB Plus?

I am using Simplestart -

Thanks ponkysue17, in this case, you can record the refund by creating a bank deposit (+ New > Bank deposit) - select the date and bank account the money was returned to and then scroll to 'add funds to this deposit'. On the first line, enter the same expense account used in the original expense and then enter the total amount and VAT code.

I am using QuickBooks Desktop Pro 2019. When I go to "Pay Bills" the deposit does not appear. Is there a way to finish this step short of creating a bill for the amount of the refund?

Hi palmerflooring!

Thanks for joining this post. You'll want to check how you created the deposit. Allow me to help you.

Let's make sure that you used an Accounts Payable account in the From Account drop-down. You'll want to open the deposit and edit it if needed.

On the Pay Bills window, click the Set Credits and apply the Bill Credit you created. Then, click Done, select Pay Selected Bills, then select Done again.

This article will guide you in recording refunds you received from a supplier: Record a supplier refund in QuickBooks Desktop.

If the same thing happens, you'll want to rebuild your company file. This scans the data and fixes any issues. You can find the detailed steps here: Verify and Rebuild Data in QuickBooks Desktop.

Lastly, I added this article if you need help in reconciling your accounts: Reconcile an account in QuickBooks Desktop.

Please feel free to reach out to us again if you have more questions. I'll help you!

Hi I tried to follow these instructions but got stuck on the recording a Bank Deposit. It says 'You cannot track tax on accounts of types Debtors and Creditors.' I am using QB Online.

Thanks for joining this thread, @Danielle20. Allow me to provide some info about the error message and how to fix it.

The system will only allow you to track taxes on the expense, checking, and income accounts. Currently, utilizing the Accounts Payable or Accounts Receivable type of accounts is unavailable.

To get your work done and get past the error message, you'll need to create an invoice or a bill so you can allocate a VAT code to the transaction. This way, it will be added to the appropriate bank account and will help show the tax amount you've paid.

Once done, you can continue recording a bank deposit. For your reference, feel free to review this article: Make bank deposits in QuickBooks Online.

Additionally, I'm also attaching these links you can utilize to help manage VAT codes in QuickBooks:

Don't hesitate to comment below by clicking the Reply button if you have further questions about recording bank deposits. I'm always right here to assist you. Take care!

Hi

Yes I am not sure which account to set the refund to as it is a form of income but not 'uncategorised' or 'non-profit'.

Thanks

Danielle

Hello there,

I followed these steps and first two steps were simple but when i click on pay bills i don not see the Transaction there

Hi jasgagan, did you select the accounts payable (or 'creditors') account in the account field of the bank deposit? I'd also recommend navigating to the suppliers page (expenses > suppliers > select supplier from list > new transaction > cheque) to match the supplier credit and bank deposit.

Hello there,

Thanks for reply,

I have selected the bank account

I appreciate you getting back to us, jasgagan.

To ensure your transactions are showing when paying bills, you might want to ensure you've selected the Accounts Payable (Creditors). See the sample screenshot below.

Once done, we can go back to the Pay Bills section and select the Bank Deposit from there.

To know more about this process, we can refer to this article: Record a customer refund or supplier refund in QuickBooks Online. In the same link, we can find other ways how to handle supplier refunds based on scenarios.

Should you have follow-up questions about recording refunds in QuickBooks Online, please let me know. I'm all hands on deck to keep helping. Have a good one, jasgagan.

Hi there ,

Can i call you to discuss this more , What i am understanding here is

Supplier credit > Bank Deposit with creditors account > Pay bills

Hello, @jasgagan.

Thanks for following up with us. Allow me to chime in and share additional information about recording a supplier refund. I want to make sure you can get everything straightened out.

Yes, you're right. The way to record a refund is to create a supplier credit for the expense that the refunded payment was applied. Then, you'll have to deposit the money received. Make sure to select Accounts Payable in the Account field. This way, you can apply or link it to the credit memo using the Pay Bills feature. You may also read through this article for your reference: Record a customer refund or supplier refund in QuickBooks Online.

Although I'd love to look further into this for you, I don't have the same types of tools needed to call as our Customer Care Support team do. If you wish to reach them, you may follow the steps below:

Keep in touch with us here if you need more help with the process and update us on how the call goes. I'm determined to ensure your success. Have a great day!

Hi ponkysue17,

Did you ever figure out how to record a refund in quickbooks online??? I’m having similar issues here and no one from the team can’t seems to help. Yesterday someone from the team ended our chat in the middle of trying to help me when he couldn’t figure it out.

I don’t need to upgrade and I still can’t record a refund. The instructions doesn’t make sense!

Hi Samename, are you looking to record a refund for items/services returned by a customer, or a refund returned to you by a supplier?

Hi there ,

I am looking to record a refund returned by online supplier that i have purchased some parts just like an amazon refund on a returned merchandise

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.