Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi everyone,

I am working on QBO and I am unsure how to register capital allowance.

We bought a small cabinet, which I assumed would go under the capital allowance category. However, from what I have read so far QBO does not allow you to register these kind of investments/expenses?

How do you deal with these kind of expenses though?

Many thanks,

Ana

Solved! Go to Solution.

Joining the thread to help with your question about creating equity accounts in QBO, anamenino.

Are you referring to this link: https://quickbooks.intuit.com/ca/resources/starting-business/how-to-customize-quickbooks-for-your-pa....

If so, it looks like the information shared in that link is intended for QuickBooks Desktop Canada. For QBO UK, there's no option to enter the percentage of share when creating an equity account. You'll need to enter the amount of the investment or capital in the Balance field.

Feel free to visit these articles for extra reference and guidance when managing your Chart of Accounts:

As always, you can visit us again or post questions again in the Community if you need more help. We're just around the corner to offer our assistance again.

Hello, Ana.

To know how to handle investments/expenses or any other type of transaction, it’s best to consult with your accountant or bookkeeper for advice.

If you're not affiliated with an accountant, you can visit our Intuit Find-A-ProAdvisor site to find certified professionals near you.

In case you need help with other task in QuickBooks Online, you can visit our general help topics page.

Should you have other questions or concerns, please leave a reply below and I'll get back to you as soon as I can. Have a good day!

Hi,

thank you for your reply.

Maybe I should have been more explicit: where do you find the capital allowance category on QBO? My question wasn't technical, was about your program.

And thank you for the suggestion to contact an accountant, I have seen that reply a lot around here. Makes me wonder what's the purpose of QB if any question about the program, QB replies with "Please find an accountant to help you with the program we have developed".

Thanks.

Hello there, @anamenino. I appreciate you for getting back to us and for the clarification.

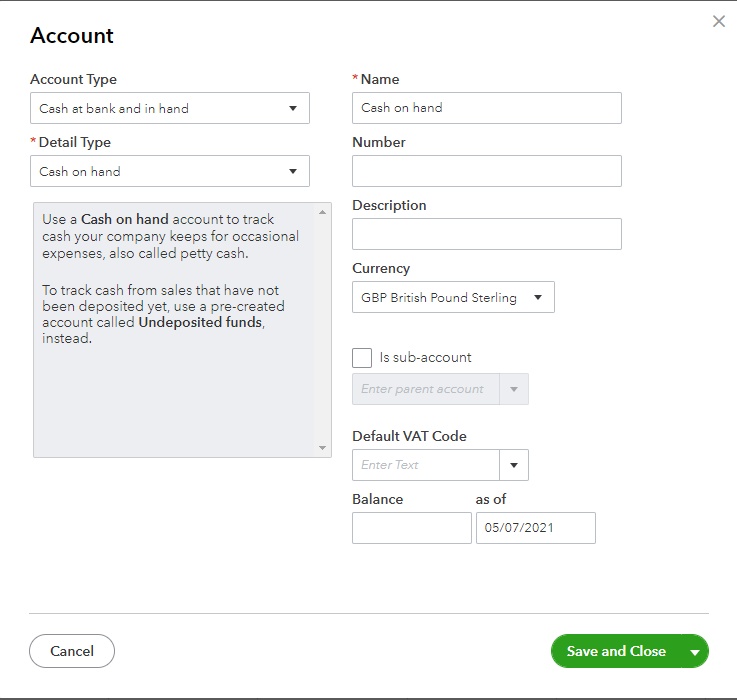

For the capital allowance category in QuickBooks Online, you'll need to create a new account from the Chart of Accounts (COA). However, this thing is something that your accountant can help with. It's important when doing this process you select the correct information of the account.

After speaking to your accountant, you can follow these steps:

I've gathered two resources where you can get additional details when handling your accounts from the COA:

You can always go back here if you have additional questions. Stay safe always.

Ana,

Did you managed to do this in the end. Looking to do the same and don't really understand the useless response from QB help.

Thanks

Thanks for joining the thread, @dwd1. I can share with you information about this.

To register the Capital allowance category in QuickBooks Online, you can follow the recommendation @SarahannC posted. You can create a new account from your Chart of Accounts. I'd also suggest consulting a tax advisor to make sure the item is accounted for well because this account may be for an expense, but it will become complicated once you claimed it.

Here's how to add this category:

In addition to the articles shared by my peers, here are some additional resources about capital allowance:

I'm including also our Community Help page to find more articles about expenses and suppliers, banking, and other QuickBooks Online self-help topics.

You can always ask me here if there's anything that I can help you with recording a transaction in QuickBooks Online. I'm always here to help. Have a great rest of the day!

@dwd1 I am still trying to understand it!

Thanks for your reply @Jovychris_A .

I understand the process and have found another QB thread where it states:

"Reporting Partnership Income

When you create an equity account for each partner, you are prompted to note each partner’s share in the company. For example, if you run the company with your spouse, and you each own half of it, you enter 50% for each person."

However, nowhere in our QBO or even on your snapshot, can I see where can I write down the partner's share.

Joining the thread to help with your question about creating equity accounts in QBO, anamenino.

Are you referring to this link: https://quickbooks.intuit.com/ca/resources/starting-business/how-to-customize-quickbooks-for-your-pa....

If so, it looks like the information shared in that link is intended for QuickBooks Desktop Canada. For QBO UK, there's no option to enter the percentage of share when creating an equity account. You'll need to enter the amount of the investment or capital in the Balance field.

Feel free to visit these articles for extra reference and guidance when managing your Chart of Accounts:

As always, you can visit us again or post questions again in the Community if you need more help. We're just around the corner to offer our assistance again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.