Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

I appreciate the complete details you've shared, @martin41.

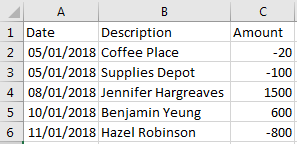

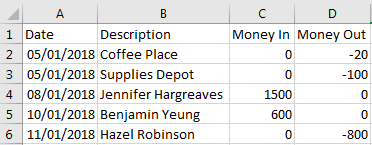

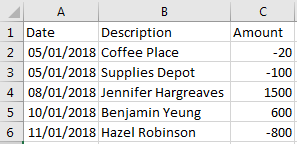

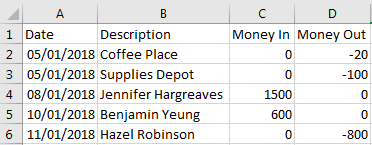

Yes, you can request for a CSV file from your property manager. I've added a screenshot of the sample file so you can easily track your income and expenses in QuickBooks.

3 columns

4 columns

Once your transactions are imported to the correct bank account, it will be listed in the For Review tab in the Banking page. Now, you can review each transaction and assigned it to the correct category.

On the other hand, you can use the Class Tracking feature. This allows you to keep track of your expenses by department, location, property, project or event. Here's how to turn on class tracking in your account:

Now, you can assign a specific class for each imported transaction. Also, you can generate and customize your reports to group info by class. You can run You can read through this article for more detailed instructions: Run reports by class.

Keep us posted here if you have other questions about managing your property-related income and expenses. I'm always here to help.

I appreciate the detailed information you've shared, martin41.

We can record and make deposit and use expense and rental income account. Let me guide you on how to do it:

You can also refer to these articles to see detailed steps and common questions about payments deposit in QuickBooks Online:

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success. Have a great day!

Hi Ailene,

Thanks for the prompt and detailed reply which was helpful. I have a few follow-up questions if possible to assist further:

We are effectively wanting to try and set up Quickbooks to account for the Company as a whole, but have the ability to view each Property in singular, e.g. to see each property's own income and direct expenses relating to that property only.

Any pointers on how best to set up would be helpful. Thanks again for all your help.

I appreciate the complete details you've shared, @martin41.

Yes, you can request for a CSV file from your property manager. I've added a screenshot of the sample file so you can easily track your income and expenses in QuickBooks.

3 columns

4 columns

Once your transactions are imported to the correct bank account, it will be listed in the For Review tab in the Banking page. Now, you can review each transaction and assigned it to the correct category.

On the other hand, you can use the Class Tracking feature. This allows you to keep track of your expenses by department, location, property, project or event. Here's how to turn on class tracking in your account:

Now, you can assign a specific class for each imported transaction. Also, you can generate and customize your reports to group info by class. You can run You can read through this article for more detailed instructions: Run reports by class.

Keep us posted here if you have other questions about managing your property-related income and expenses. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.