- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- Re: Entering payments received in bank to outstanding invoices, is it just a case of going to inv...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Solved! Go to Solution.

Labels:

0 Cheers

Best answer July 06, 2019

Solved

Accepted Solutions

Anonymous

Not applicable

July 06, 2019

04:10 PM

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

I can summarize the most important discussions on this thread for you, Jonboy1210.

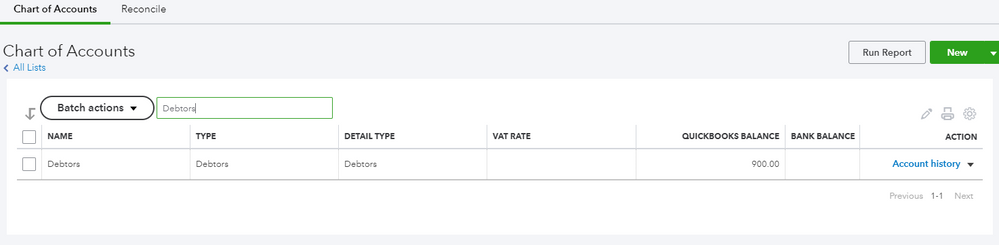

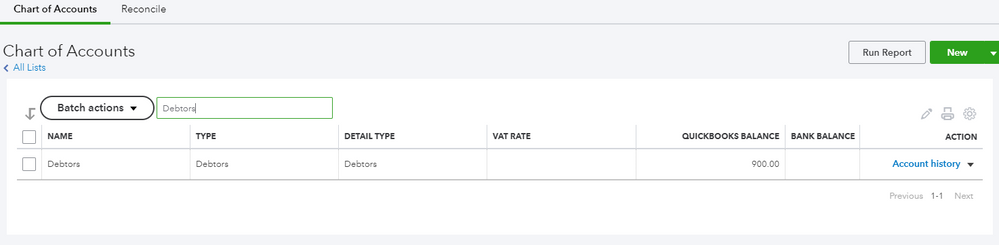

Accounts Receivable (A/R) is an asset account used for most regions. In the UK region, Debtors is the corresponding account for it. That is the reason you can't see it from your Chart of Account list. Therefore, there's no need for your to pull up a report to show when the account has been named.

Here's what will happen when you add deposits from the Banking page to an open invoice.

QuickBooks Online will allows you to use the Find match function for bank deposits to be able to add them to an open invoice. Once they are added, the invoice's balance reduces.

Let say for example, I have an invoice for 1,000 pound.

When partial bank deposits are downloaded, use the Find match function to add these deposits one by one.

In the Match transactions page, expand the date range and choose All from the Show drop-down to see the open invoice. Select the invoice and click on Save.

To view if the payment was posted, please open the invoice. The deposit added from the Banking page is already posted to the bank account, and the invoice balance reduces. You don't need to make any receive payment transactions or link the deposits.

I'm pretty sure after following the screenshots above you're all caught up.

We are happy in helping you with your other concerns. Just go ahead and post them here.

0 Cheers

16 REPLIES 16

Anonymous

Not applicable

June 23, 2019

11:03 AM

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hello, Jonboy1210.

Entering invoice payments directly from the bank is one way of recording these transactions. These payment transactions from your bank will be downloaded automatically in QuickBooks (If online banking feature was activated). In your the For Review page, the system will suggest the closet open invoice that will match the downloaded payment transaction.

For additional information, please refer to this article: https://quickbooks.intuit.com/community/Banking/Match-and-categorise-your-downloaded-bank-transactio...

Please let us know if you have additional questions about processing invoice payments. We’re always here to help you with your QuickBooks concern.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hi the problem I have is the payments are part payments against open invoices so they don't ever match up.

Am I too do I receive payment against an invoice then that will match up with the card payments?

Or will doing a receive payment do a double deposit in the bank as you have to say where the money is deposited on a receive payment.

hope that makes sense?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hello,

You can manually find match for partial payments by selecting the transaction in Banking and click 'find match' - this should bring up open invoices, which you can then filter, and apply the partial payments against. You can also manually make payment against the invoice (selecting receive payment next to the invoice), making sure to select the correct bank account, which should then show as an automatic match in the banking feed.

Please let us know if you would like us to clarify this further.

Thanks,

Talia

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

So if I have already reviewed these deposits from my card collection machine. Can I still add these deposits to open invoices?

Or should I go back and un review these deposits that was pulled through from my bank link up

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hello there, Jonboy1210.

It's my goal to help you handle deposits from your bank to outstanding invoices in QuickBooks Online (QBO).

Yes, you can still add those deposits to your open invoices by linking them. This way, we'll be able to match them and avoid duplicates. I'd be happy to walk you through the steps below:

- From the left menu, select Accounting.

- Select Chart of Accounts under the Toolbar.

- Find the account you deposited the payment to, then select View Register (or Account History).

- Locate and choose the correct deposit.

- Select Edit.

- On Bank Deposit screen, scroll down to Add funds to this deposit, then find the fund you need to edit.

- In the Received From column, search and choose the appropriate Customer name.

- In the Account column, search and select Account's Receivable.

- Select Save and close.

I'd be glad to share this article to know more about linking deposits to an invoice: How to link a deposit to an invoice.

Should you have additional questions about entering payments received from your bank to outstanding invoices, feel free to let me know. I'm always here to help.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Will this reduce the amounts on open invoices

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

That’s correct, @Jonboy1210.

Linking your deposits to open invoices with reduce the amount. Let me discuss this further to help you.

When payments are linked or matched to open invoices, may they be full or partial, it’ll reduce the amount. In addition, you can still link future payments to the invoice until it’s zeroed out.

If you want to learn more “How do I” steps, you can always visit our Help Articles page.

I’ll only be a post away if you need help with anything else.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

I still can't get this to link to my open invoices how do I get that option as it doesn't come up following the procedure you have mentioned

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hello there, @Jonboy1210.

Thanks for sharing the results of following the steps from @Charies_M.

Let’s perform the same troubleshooting again, but this time select Accounts Receivable as the posting account. This way, you can link the invoice to the deposit.

- From the Bank Deposit page, go to the Add funds to this deposit section.

- Enter the amount, then fill in the remaining fields.

- Click on Save and close.

Now, open the invoice and receive the payment. Here's how:

- On the left panel, select the Sales menu and pick Customers.

- Click on the customer’s name to open the Transaction List page, then choose the invoice you’re working on.

- On the Invoice page, hit the Receive Payment tab to link the deposit.

- From the Receive Payment window, scroll to the Credits section and mark the Deposit box.

- Click on Save and close.

Here's a link with additional information on how to apply a credit from an overpayment. Just as heads, this is article is from a different region but it also applies to the UK version.

These steps will point you in the right direction linking payments to open invoices.

If you need further assistance with any of these steps, reach out to me by posting a comment below. I'm here to help.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hi All

Im still worried as to what the correct way to do this?

I have linked my bank account to quick books and accepted the deposits from my shop card machine daily takings I now need to link this deposits to the open invoices now I have tried all the above steps and they all seem to differ.

Is the correct way to open the invoices and do receive payments there? But I'm worried that this doesn't link the already deposits I have accepted?

Should I cancel the deposits then link them as I go?

Whats the correct way to do this with out messing up my account?

Regards

jon

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Hi there, @Jonboy1210.

The steps provided by my colleague Rasa-LilaM should be able to help you link the deposit as a payment of your outstanding invoices. First, ensure to select the Accounts Receivable account on the deposit. Once completed, you can now apply the deposit following the steps provided above.

However, if you need further assistance with the process, you can always get in touch with our QuickBooks Support Team.

You can also check our self-help articles for your future reference: Help articles for QBO.

Let me know if you have any other questions about linking deposits as a payment to the open invoices. I'm always here to help you!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Thank you for all your replies but one little question I don't have accounts receivable as an option on the account deposits drop down tab

Do I create this account? I do have an income account called product sold in the drop down?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Good day, @Jonboy1210.

I'd like to provide some clarifications about the Accounts Receivable account on your QuickBooks Online.

The Accounts Receivable is a built-in standard account in QuickBooks Online. To locate the account, all you have to do is double-check your COA and see if the A/R has been renamed. This can be the reason why you're unable to see the account.

To give you more insights about accounts receivable, you may read through these articles:

Once you've already found the account, you can now start linking the invoices to the deposits.

If you need additional assistance with the process, you can always reach to your Customer Care Team.

There you have it!

Please let me know how it goes. I'm just a post away if you have any other concerns. Take care!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Is there a report that shows when an account has been renamed? As I'm still not sure what account is accounts receivable

0 Cheers

Anonymous

Not applicable

July 06, 2019

04:10 PM

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

I can summarize the most important discussions on this thread for you, Jonboy1210.

Accounts Receivable (A/R) is an asset account used for most regions. In the UK region, Debtors is the corresponding account for it. That is the reason you can't see it from your Chart of Account list. Therefore, there's no need for your to pull up a report to show when the account has been named.

Here's what will happen when you add deposits from the Banking page to an open invoice.

QuickBooks Online will allows you to use the Find match function for bank deposits to be able to add them to an open invoice. Once they are added, the invoice's balance reduces.

Let say for example, I have an invoice for 1,000 pound.

When partial bank deposits are downloaded, use the Find match function to add these deposits one by one.

In the Match transactions page, expand the date range and choose All from the Show drop-down to see the open invoice. Select the invoice and click on Save.

To view if the payment was posted, please open the invoice. The deposit added from the Banking page is already posted to the bank account, and the invoice balance reduces. You don't need to make any receive payment transactions or link the deposits.

I'm pretty sure after following the screenshots above you're all caught up.

We are happy in helping you with your other concerns. Just go ahead and post them here.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Entering payments received in bank to outstanding invoices, is it just a case of going to invoice and making payment to bank account? will the match up?

Is there an easier way to accomplish this? Most systems this is ONE step, not 8. This is nuts. Quickbooks is taking me five times longer to do anything versus Excel. Yes, EXCEL is better than this nonsense.

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...