Always know where your business stands

Manage accounts receivable

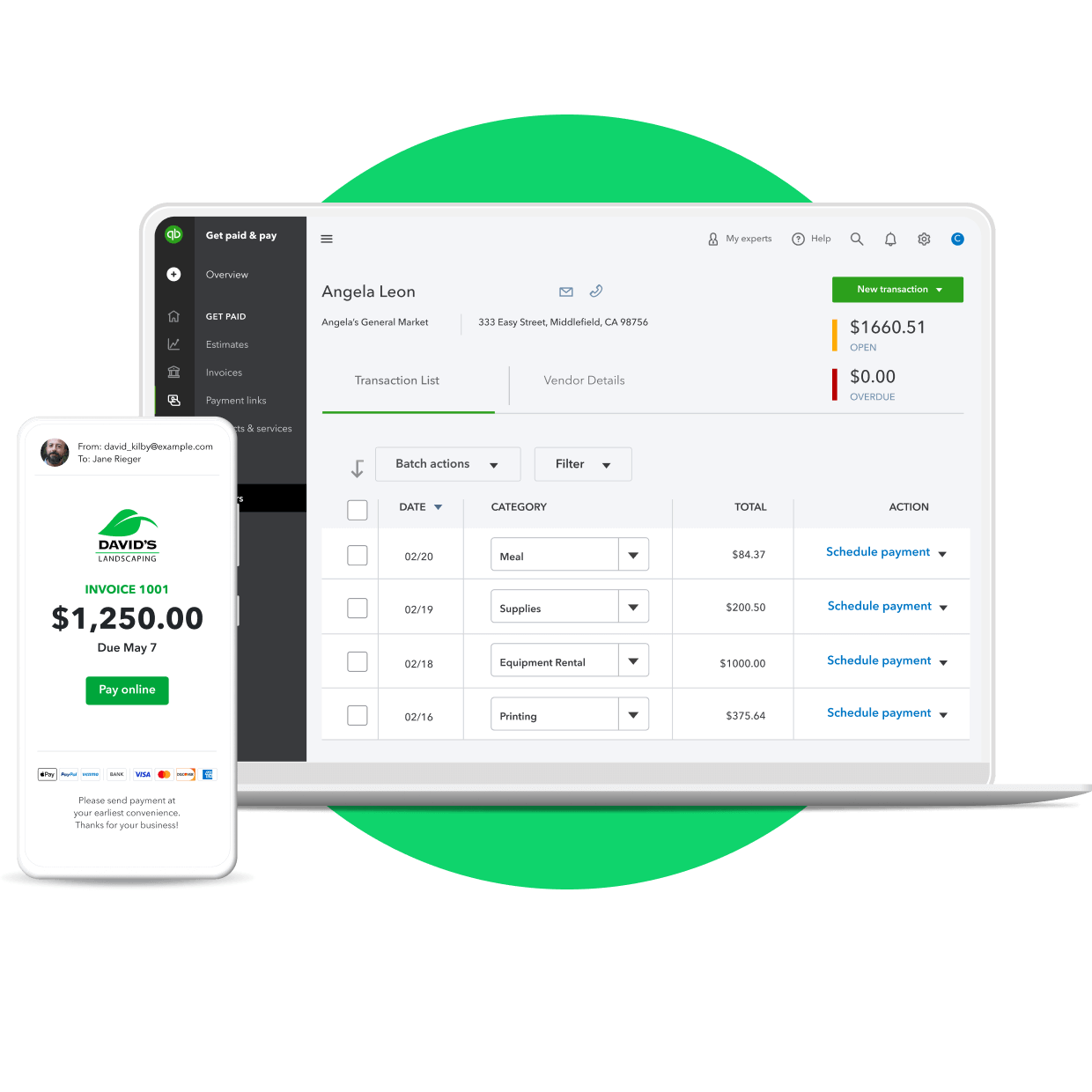

Accounts receivable are created when a customer purchases your goods or services but does not pay for them at the time of purchase. Businesses with accounts receivable typically issue invoices at a later date. QuickBooks helps you manage accounts receivable by tracking invoices, payments, and identifying your delinquent accounts. In just a few clicks you can send statement reminders to customers that are late paying you.

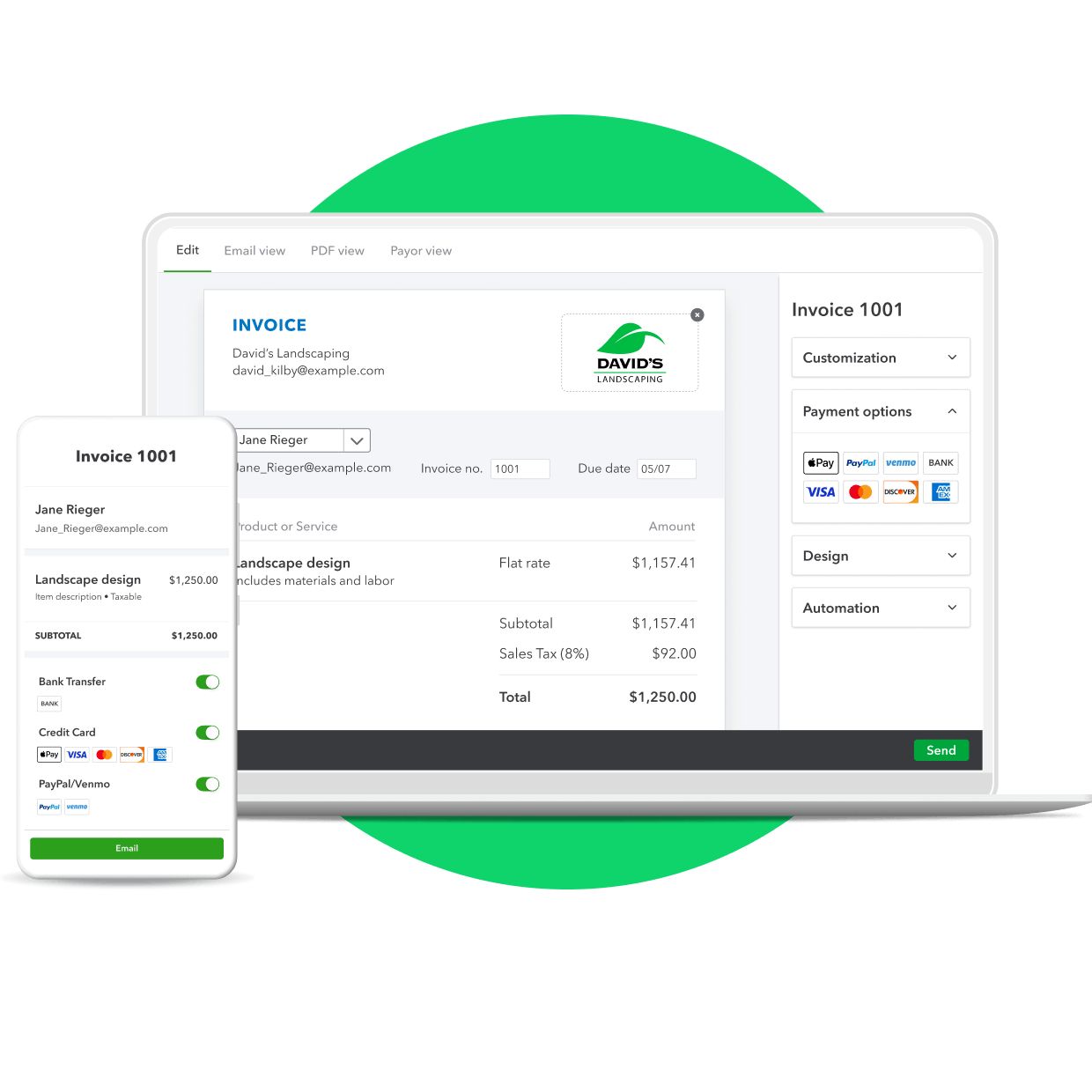

Get paid faster

It’s important to set up a process for regularly invoicing your customers and reviewing your accounts receivable (the amount of money that customers owe you). You can speed up accounts receivable by invoicing customers regularly, accepting payments online through your invoice, and by using discounts to incentivize early payments. QuickBooks makes it easy to customize and send invoices, accept flexible online payment options, track incoming payments for each invoice, and generate reports.

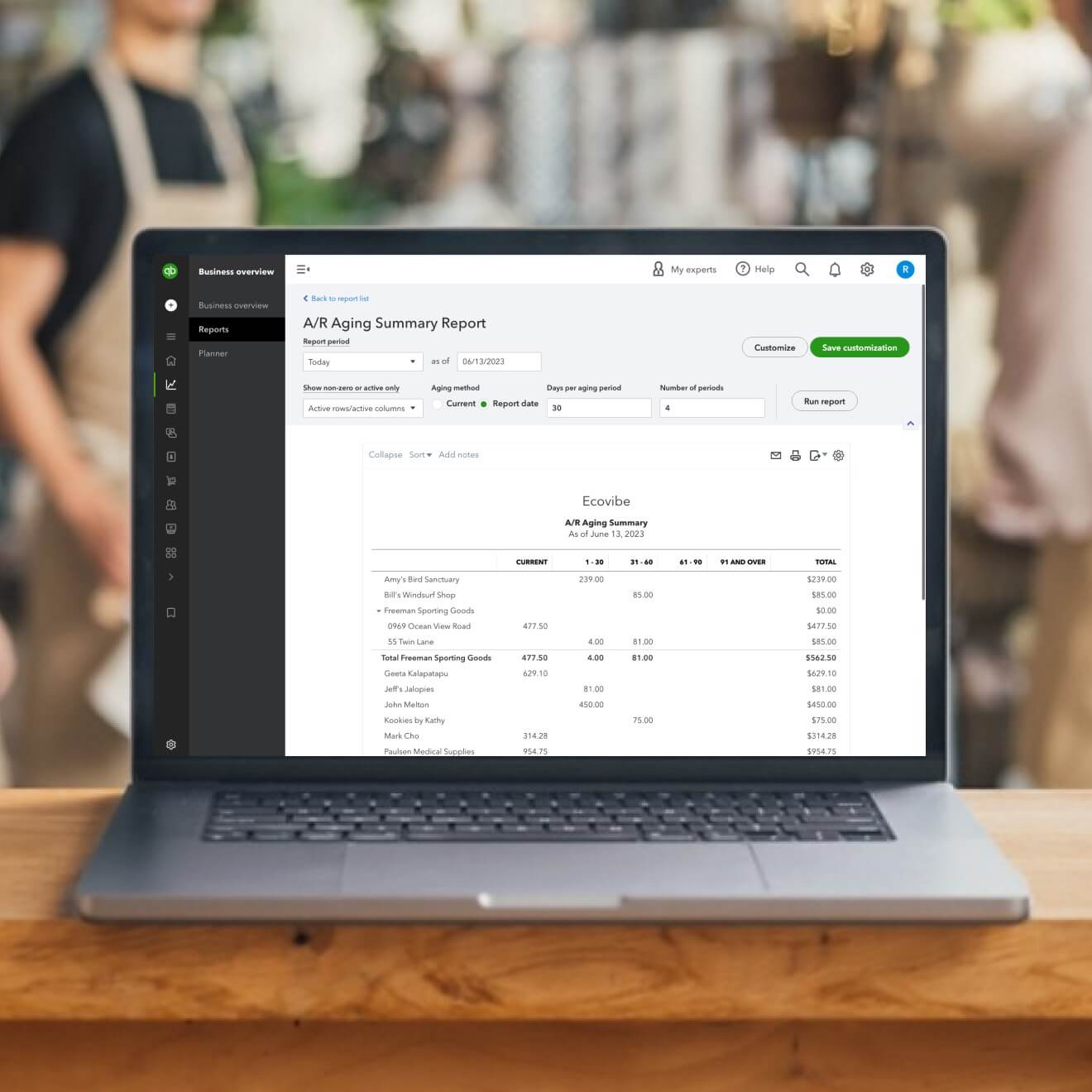

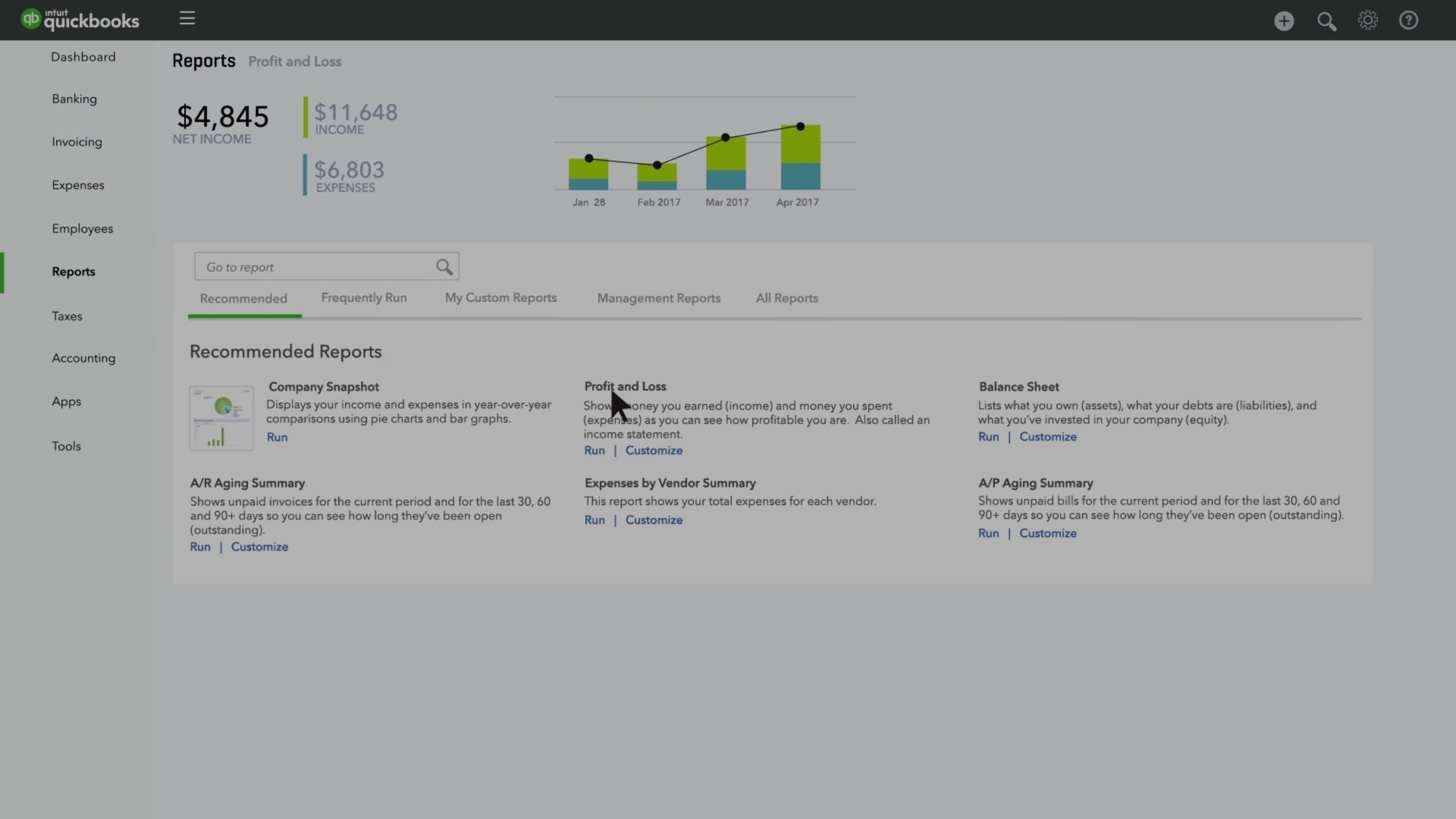

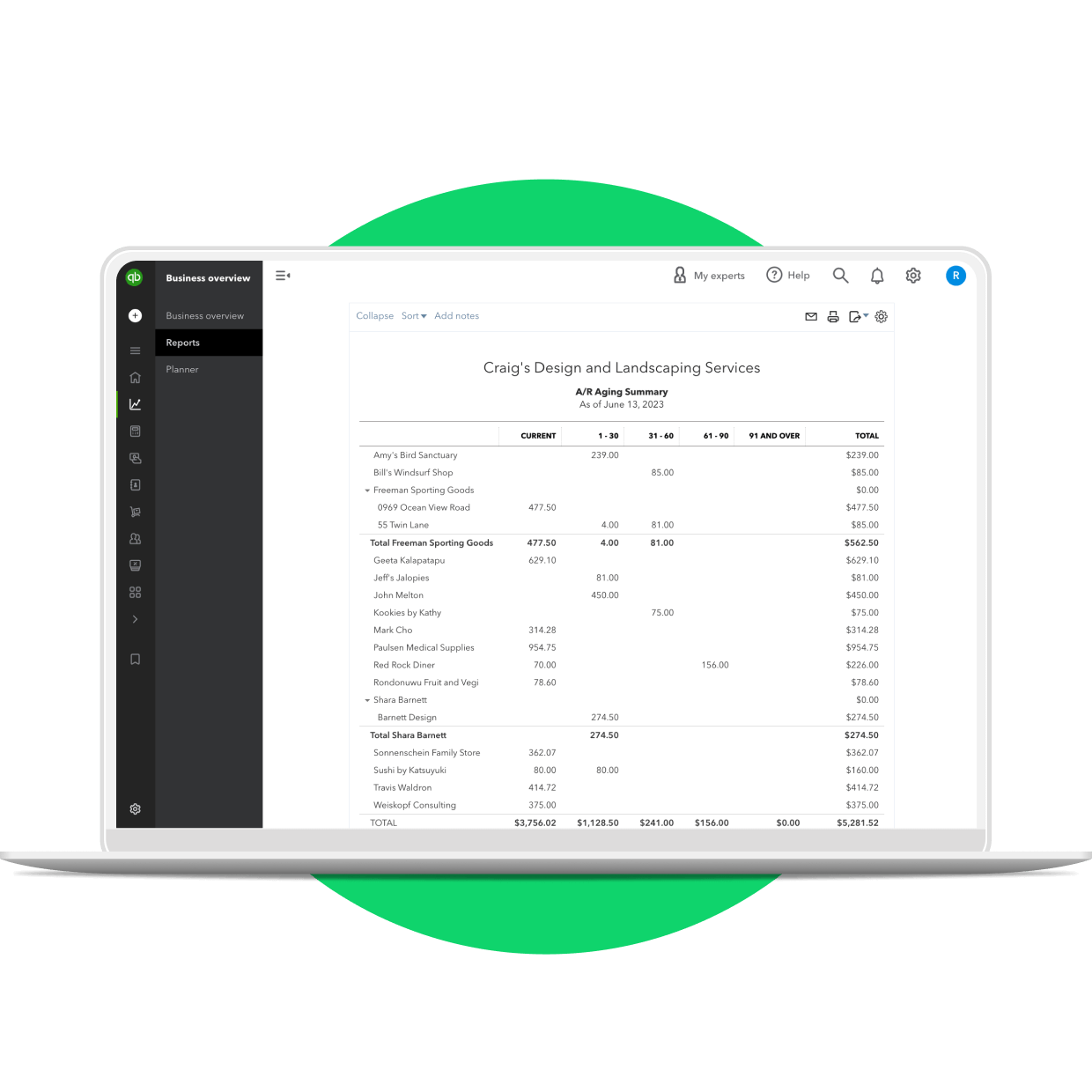

Access reports

Once an invoice is sent, your customer will typically pay within 30 days to 60 days. If you have too much money tied up in accounts receivable, you may not have the cash you need to pay your bills today. QuickBooks makes it easy to run the A/R aging report to see which customers are late with their payments, and to review your cash flow statement to see how much cash you have on hand to pay bills.

Understand accounts receivable

Accounts receivable overview

Accounts receivable is recorded on a business’s balance sheet as a current asset, as it is a promise for payment for goods or services that you provided your customer. The frequency at which you send invoices typically dictates the frequency at which you will receive payment. It’s important to set up a process for regularly invoicing your customers and reviewing your accounts receivable.

Accounts payable

In order to efficiently manage the business, small business owners must also be aware of how much money is going out of the business (accounts payable). Accounts payable is the money owed to suppliers, such as payment for office supplies, computer equipment, utilities, advertising expenses, and more. Accounts payable are typically expected to be paid within a short period of time, often 15, 30, or 90 days.

Managing cash flow

It is crucial for small businesses to accurately track and manage both their accounts receivable and accounts payable to manage their cash flow and stay financially healthy. Businesses can control their cash flow – the delay between the time they have to pay their suppliers and the time that they collect cash from customers – to ensure that there is enough money coming in to pay the bills today.

More than accounts receivable. Run your entire business with QuickBooks.

Send instantly payable invoices

QuickBooks makes it easy for small businesses to get paid fast by accepting payments right through the invoice. Enable online payments to add a button to invoices for your customers to pay instantly online.

Manage bills

Easily track your bills, the amount owed for each, and the associated due date so that you always pay on time and avoid a late fee. QuickBooks tracks and organizes all of your business data in one place, including bills.

Manage sales tax

Sales tax is a fee charged by government agencies, and in order to collect it, your customers pay the tax to you and then you are required to track the taxes payable to each agency and pass it on by making tax payments. QuickBooks makes this process easy by calculating and tracking sales tax for you.

Accounts Receivable in QuickBooks

See how to run and customize reports, like the A/R Aging report, in QuickBooks

More than software. Learn how to grow your business.

When and How to Write Off Uncollectible Debt

Sometimes, no matter how hard you try to collect money owed to you, it becomes clear the debtor is not going to pay. When this happens, you generally have the ability to write off the bad debt. Here’s what you need to know about writing off bad debt.