- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- Re: How to match auto bank feed to supplier credits and bills as when a 'find match' from the Ban...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hi-How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment feed is initiated ONLY bills appear NO cr? If I go to "Pay Bills"I can select the cr BUT then I end up creating dupl.payment as the bank feed shows that payment already. Pls help asap Tks

Solved! Go to Solution.

Labels:

0 Cheers

Best answer November 01, 2021

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hello DavidHomer, thanks for posting on this thread, To answer your question what you can do is do the supplier credit to mark the refund and then do a bank deposit to record the amount being returned to your bank and you will be able to match the refund in Quickbooks banking to the deposit. The final step would be to go to pay bills, select the supplier and you should then see the credit note to tick and the deposit to tick and they will offset against each other to clear any credit amount under the supplier. Any questions just add them onto the thread.

0 Cheers

11 REPLIES 11

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Thanks for posting in the Community, @Hom.

When using the Find Match option on the Banking page, you'll only see the bill, not the supplier credit.

Based on the information you've shared, you'll need to link the supplier credit to the bill first. This won't create a duplicate since the downloaded transaction from your bank is different from the one you have in QuickBooks Online (QBO).

Here's how:

- In QBO, go to the + New option at the top left.

- Select Expense or Cheque (both both of them recognise and record the expense).

- Choose the supplier name in the Payee drop-down.

- Leave the Ref/Cheque no, Date, Amount and Memo fields blank.

- In the Add to Expense or Add to Cheque section, tick Add for the outstanding bill and supplier credit.

- Select Save and close.

Once done, you can now match the downloaded bank transaction. For further guidance on how to do it, check out this article and proceed to the Match an existing transaction section: Categorise and match online bank transactions in QuickBooks Online.

For more insights about managing supplier credits in QBO, please refer to this article: How do I handle supplier credits and refunds?

Let me know if you have any other questions or concerns by leaving a comment below. I'll be more than happy to help. Have a good one!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hi Thanks for the response a week ago. Followed the instruction to set the 1st part of the course ie select the inv.& Cr notes matching the auto bank feed payment amount. The step +New>Expense>Leave Ref/Cheque no, Date, Amount and Memo fields blank>Add to Expense>Save and close produced an error message

"Something's not quite right. You must specify a date"' PLUS one cannot really leave the amount 'BLANK' as when the inv and cr notes are selected, it adds the amount to total and the fields are populated.

I may have missed something in your instructions.

What I am looking for is to 'match the auto feed payments to the supplier bills and credits 'easily' as QBO unlike other packages do not display credits of suppliers for matching-only inv!. Hope you can assist again. Many thanks [email address removed]

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

You're almost there, Hom!

As mentioned, you'll only see the bill, not the supplier credit when matching transactions. So what you need to do is to link them.

Once you select the supplier name in the Payee drop-down, the Add to Expense or Add to Cheque section appears. From there, click the Add on both Bill and Supplier Credit.

Before clicking Save and close, please make sure that the bill and supplier credit have the green checkmarks.

If you need detailed guide, you'll want to check these articles:

- Categorise and match online bank transactions in QuickBooks Online

- Reconcile an account in QuickBooks Online

Post again here if you need anything else. Wishing you all the best!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hi,

Good day to you. I have the same issue that you have mentioned the solution here, but unfortunately, after following all the steps still in my banking area of QuickBooks I am not able to match the expense. Therefore, I am not able to finish my reconciliation.

Would you please advise me regarding this issue?

I highly appreciate your kind assistance.

Sincerely yours,

Parisa.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

I appreciate you for following the steps provided by my colleague on how to match the transactions, @Parisa.

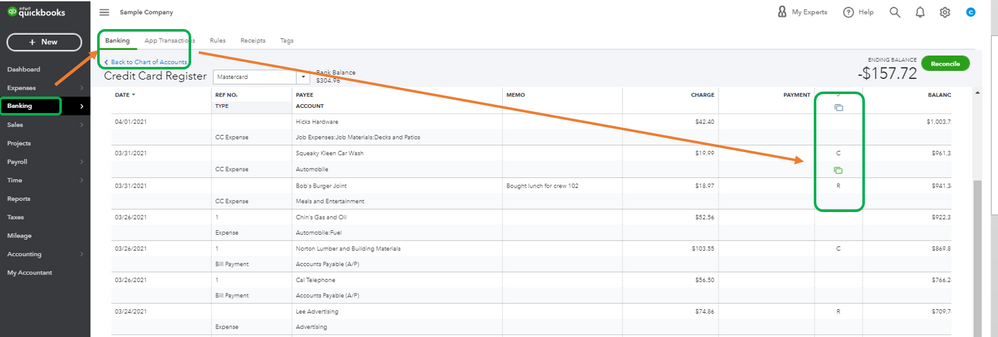

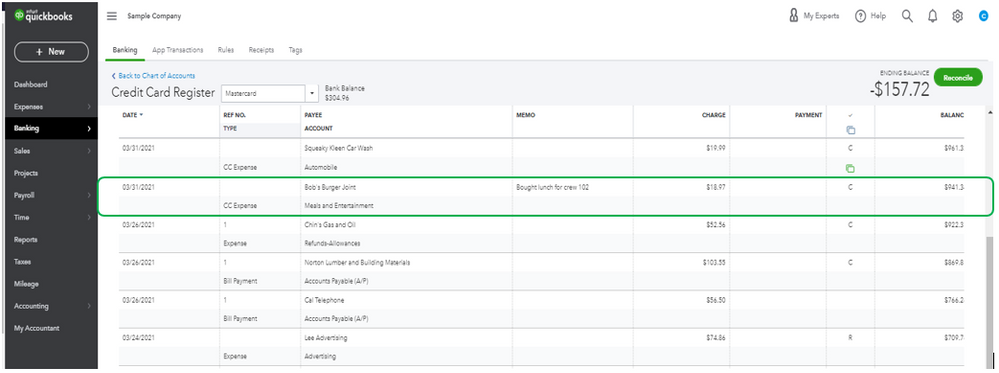

Since you're still unable to match the expense transactions, let's check your bank register and verify that they're not matched to another downloaded transaction or have been reconciled. There will be two Green squares in the Reconcile status column if they've been matched. Additionally, an R will signify that it's reconciled. Both of these will prevent a transaction from being able to be matched.

If it's already reconciled, you can clear the transaction in the bank register and match it with the expense, you can follow these steps:

- On the left panel, select Accounting > Chart of Accounts.

- Click the View register link of the bank account where the check was added.

- Find and select the transactions. Under the Reconcile (indicated by a checkmark) column, click the blank field until you see the letter C.

- Press the Save button after.

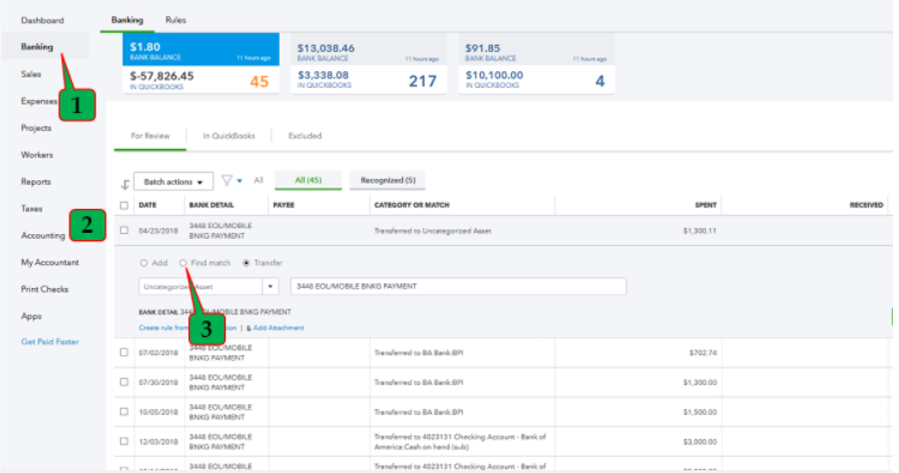

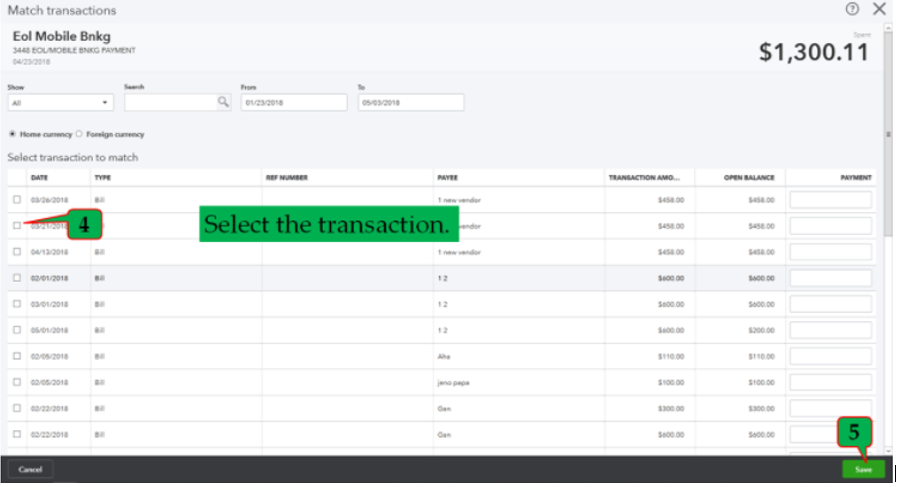

In case QuickBooks doesn't still recognize the match, you can manually match the transactions:

- Click Banking.

- Under For Review tab, select the transaction.

- Select the Find match button.

- Select the transaction.

- Click Save.

You can refer to this article, for detailed steps: Categorise and match online bank transactions in QuickBooks Online.

Also, you can create a bank rule so transactions are automatically added. The bank rules will speed up the review process. For more details, you can visit this article: Set up bank rules to categorise online banking transactions in QuickBooks Online.

Once everything is matched, you can now reconcile the transactions. Check out this guide on how to do it in QuickBooks Online:

- Reconcile an account in QuickBooks Online

- Fix issues the first time you reconcile an account in QuickBooks Online

That's it. This should help you point in the right direction. Let me know if you have further questions. I'll be here to answer them. Have a great day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Yeah doesn't work unless you have some open bills.

Take this scenario - you pay your business insurance £500 you create a bill, pay the bill, match the payment and the bill and it's all done.

6 months later you change insurance provider and they refund you £250 of your remaining insurance so you have a credit in the banking section, there is no existing bill it's closed and paid off.

QuickBooks is so horrible to use it's easiest just to exclude these and hope your accountant doesn't notice.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hello DavidHomer, thanks for posting on this thread, To answer your question what you can do is do the supplier credit to mark the refund and then do a bank deposit to record the amount being returned to your bank and you will be able to match the refund in Quickbooks banking to the deposit. The final step would be to go to pay bills, select the supplier and you should then see the credit note to tick and the deposit to tick and they will offset against each other to clear any credit amount under the supplier. Any questions just add them onto the thread.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Re: step 5, I don't seem to have an "Add the Expense" or "Add to the Cheque" section. Can you walk me through that?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

I'm glad to walk you through where to see the Add the Expense or Add to the Cheque option, LO21.

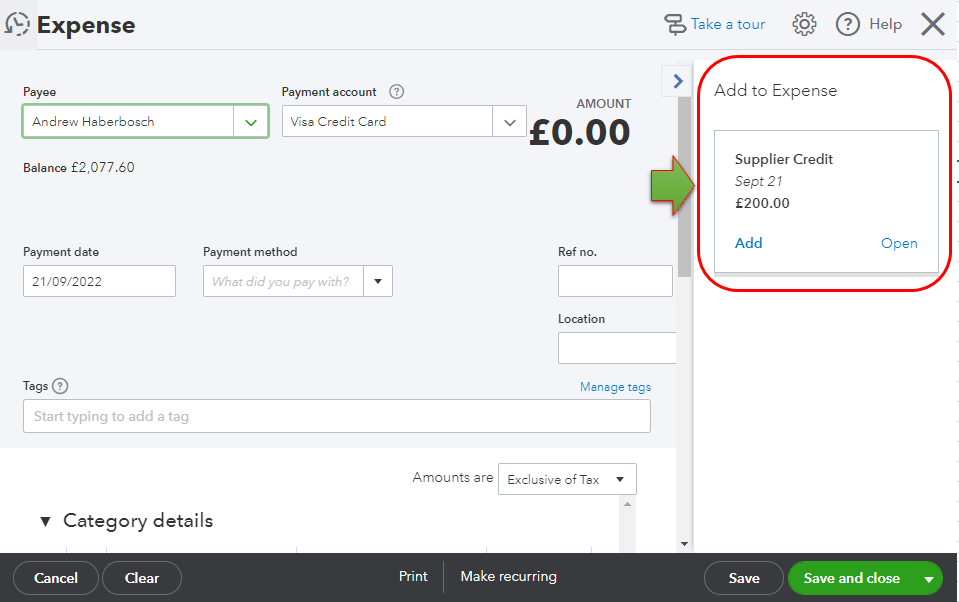

You'll want to make sure that the supplier has an outstanding credit. That way, the Add to Expense or Add to Cheque option will show up once you select a Payee. I'm adding this screenshot as your guide.

I'm adding these articles as your guide while managing bank transactions and supplier's creditds.

Get back to me if there are other features you want to see while working on your bank transactions. I'm always right here to help you.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Final step didn't work.

I added a deposit and account was the supplier account. Matched on bank feed

When I go into supplier account I do not see the deposit to match to the credit note .

help.

thanks

Jenny

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to match auto bank feed to supplier credits and bills as when a 'find match' from the Bank payment

Hi Jenny, thanks for joining this thread - please un-match the deposit in the categorised bank feed and then go back to the suppliers account to create the cheque to link the deposit to the supplier credit.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...