Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

I'm trying to figure out how to mark my vendor bills as paid without the payment going through the business checking acct. The owner is having to pay some bills using personal checks and I'm not sure how to record this in QuickBooks Desktop version. I know I need to do a Journal Entry, but not sure what accounts to use for the JE. Any help would be greatly appreciated!

Solved! Go to Solution.

I've got you covered, boyd2828.

Mixing personal and business funds isn't advisable. Though, you may encounter situations that'll require you to do so. I'd suggest following these steps to record the funds accurately.

For more details about the process, please see this article: Create a Journal Entry in QuickBooks Desktop.

I'd also recommend consulting with an accountant for proper guidance. In case you don't have any, you can visit our Find an Accountant website to find one.

Additionally, I'm adding these articles that'll help you learn more about accounts receivable and payable workflow in QuickBooks Desktop.

Feel free to comment down below if you have any other concerns or questions about recording QuickBooks transactions. I'm always glad to help in any way I can.

Joining the thread to help with your question about how to manage the bill, boyd2828.

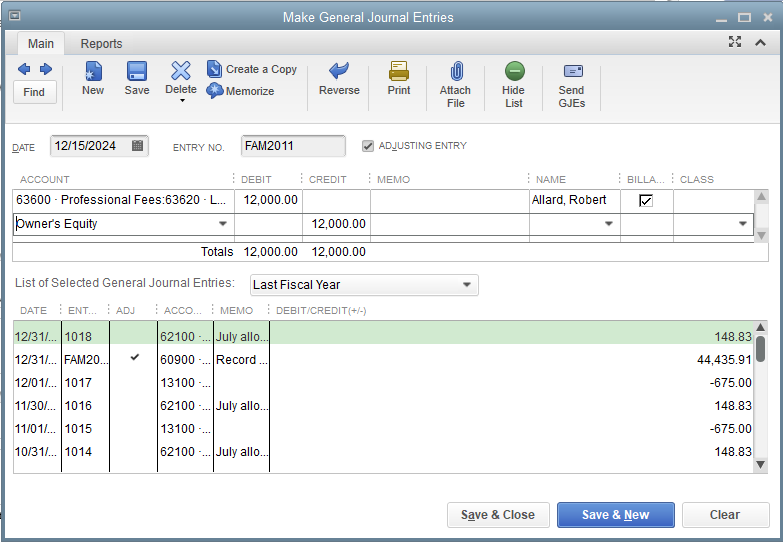

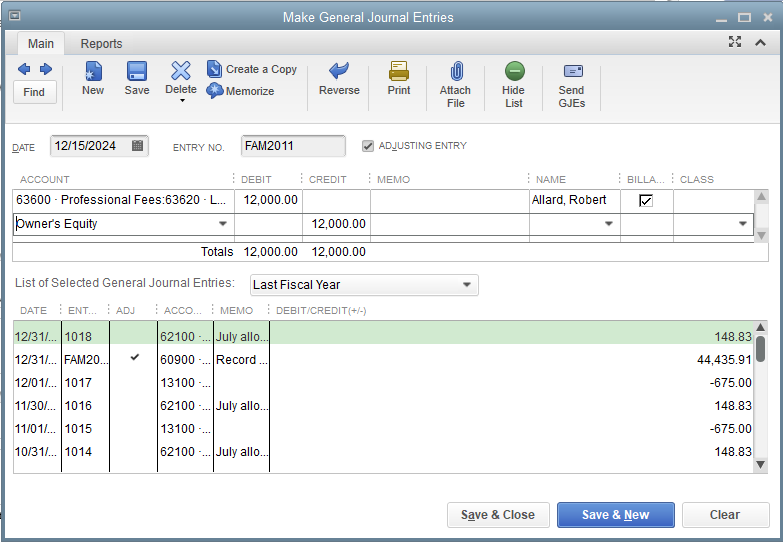

There's no need for you to create a credit memo or delete the vendor bill. For the journal entry that you'll be making, use the Accounts Payable instead of the Expense account. This way, it will automatically create a credit that can be applied to the open bill. Here's how:

Feel free to check out these articles just in case you might need them in your future tasks:

Please know that you can always count on us if you need anything else while working in QuickBooks. We'll make sure everything is sorted out.

Hello, boyd2828.

Yes, the Owners account and Owners Equity are the same. There isn't a need for you to create a new account. You can use the Owners Equity to track the amount paid by the owner.

You can follow the steps provided by my colleague in creating a journal entry. But also, use the Accounts Payable so you can apply it to the open bill.

I'm adding these helpful articles for more insight in managing your books:

Let us know if you have further questions or concerns. We're always here to help you.

I've got you covered, boyd2828.

Mixing personal and business funds isn't advisable. Though, you may encounter situations that'll require you to do so. I'd suggest following these steps to record the funds accurately.

For more details about the process, please see this article: Create a Journal Entry in QuickBooks Desktop.

I'd also recommend consulting with an accountant for proper guidance. In case you don't have any, you can visit our Find an Accountant website to find one.

Additionally, I'm adding these articles that'll help you learn more about accounts receivable and payable workflow in QuickBooks Desktop.

Feel free to comment down below if you have any other concerns or questions about recording QuickBooks transactions. I'm always glad to help in any way I can.

Okay thank you so much! I'll do a Journal Entry for those with a Debit going towards the Expense Acct. and a Credit to Owner's Equity Acct., but what should I do with the company bills my boss paid out of his personal account that I entered into Vendor Bills?? Should I do a Credit Memo towards those or just delete them as a vendor bill and just do the Journal Entry? Yes, I have told my boss he should NOT being paying company bills with a personal check, but he hasn't listened, so as bad I as I hate to, I have to deal with it in QB and move on. :)

Joining the thread to help with your question about how to manage the bill, boyd2828.

There's no need for you to create a credit memo or delete the vendor bill. For the journal entry that you'll be making, use the Accounts Payable instead of the Expense account. This way, it will automatically create a credit that can be applied to the open bill. Here's how:

Feel free to check out these articles just in case you might need them in your future tasks:

Please know that you can always count on us if you need anything else while working in QuickBooks. We'll make sure everything is sorted out.

Okay, so just so I'm clear, for the Journal Entry instead of a Credit to the Expense account, I'll Credit the A/P account and still Debit the Owner's Equity account?? This is what our CPA told me to do, but it's confusing to me, so that's why I got on this QB for help. :)

From our CPA:

"Just enter the ones he is paying as an expense with an offset to A/P – Owner".

I guess she's having me set-up the A/P-Owner account to keep track of what my boss has paid out of his personal account, but if I used the Owners Equity account wouldn't that be the same??

Hello, boyd2828.

Yes, the Owners account and Owners Equity are the same. There isn't a need for you to create a new account. You can use the Owners Equity to track the amount paid by the owner.

You can follow the steps provided by my colleague in creating a journal entry. But also, use the Accounts Payable so you can apply it to the open bill.

I'm adding these helpful articles for more insight in managing your books:

Let us know if you have further questions or concerns. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.