Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am using QuickBooks Desktop 2020.

I have been trying to sort out a supplier refund for the following issue i have, but i just can't see what steps i'm missing.

For the Electricity bill, i am charged a regular monthly amount.

The amount previously in credit was £203.96. I then paid £59 for the next 3 months, making the total credit on the account £380.96. For the 4 payment i have entered them as cheques, and used accounts payable as the account, and the customer:job as the supllier name.

I then received a bill showing the actual usage as £264.98 which i entered as a bill to the supplier, meaning the current balance is now £115.98 in credit which shows correctly in the quickbooks supplier balance. The electric company has now sent a refund for £115.98 to my bank account.

How can i record it correctly, as currently i don't have the £115.98 showing in the bank account, rather the supplier balance shows -£115.98, and also it shows £264.98 as amount due when i go to pay bills.

I can guide you on how to record the amount in QuickBooks Desktop, @jack1289.

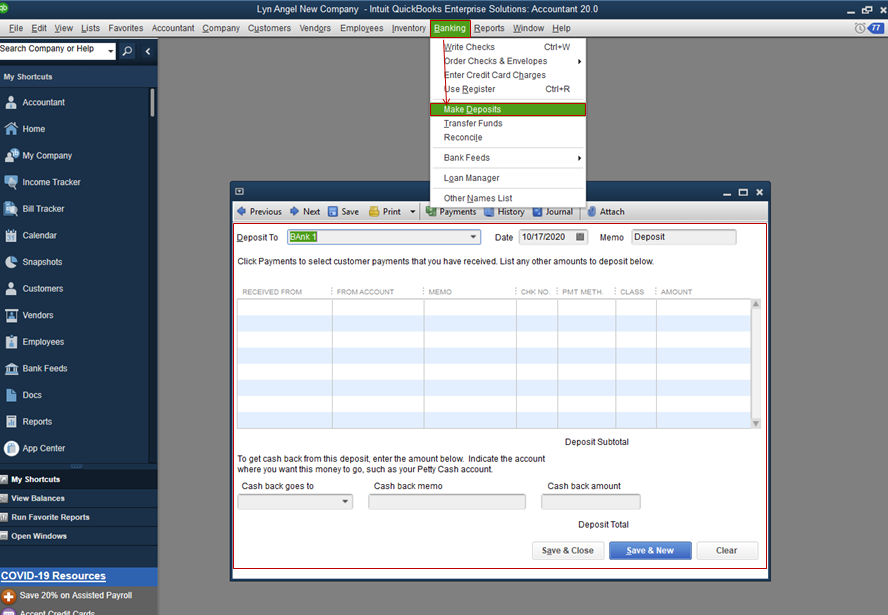

You can record the refund (£115.98) as a deposit. I'll show you how.

You can also read this article to learn more about supplier refund in QuickBooks Desktop.

Please let me know in the comment section if you have any follow-up questions. I'm always here to answer them. Take care and enjoy the rest of the day!

Hi @Angelyn_T ,

Is it possible to give a bit more detail regarding the exact steps, as i made a deposit, for the £115.98 and put the account as accounts payable, as per the article, and now the supplier balance shows as £0, however when i go to pay bills, it still shows the bills as not being paid, and when i go to pay bills and select credit it doesn't let me select all the credits.

I appreciate you for getting back to this thread, @jack1289.

I'm here to give you additional details on how to apply the credit amount (deposit) on the existing bill.

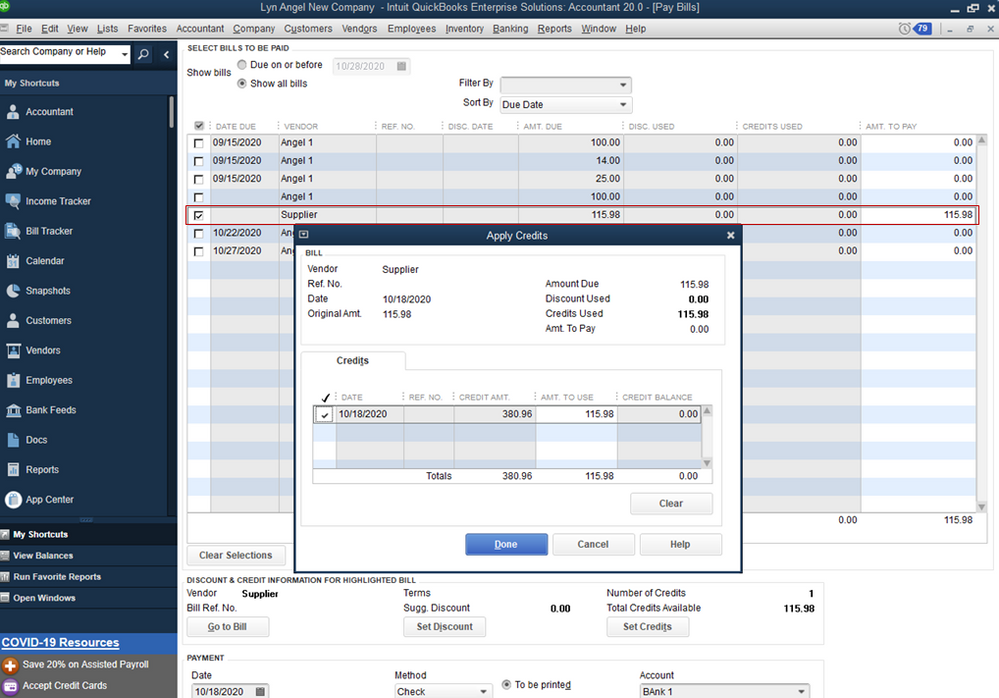

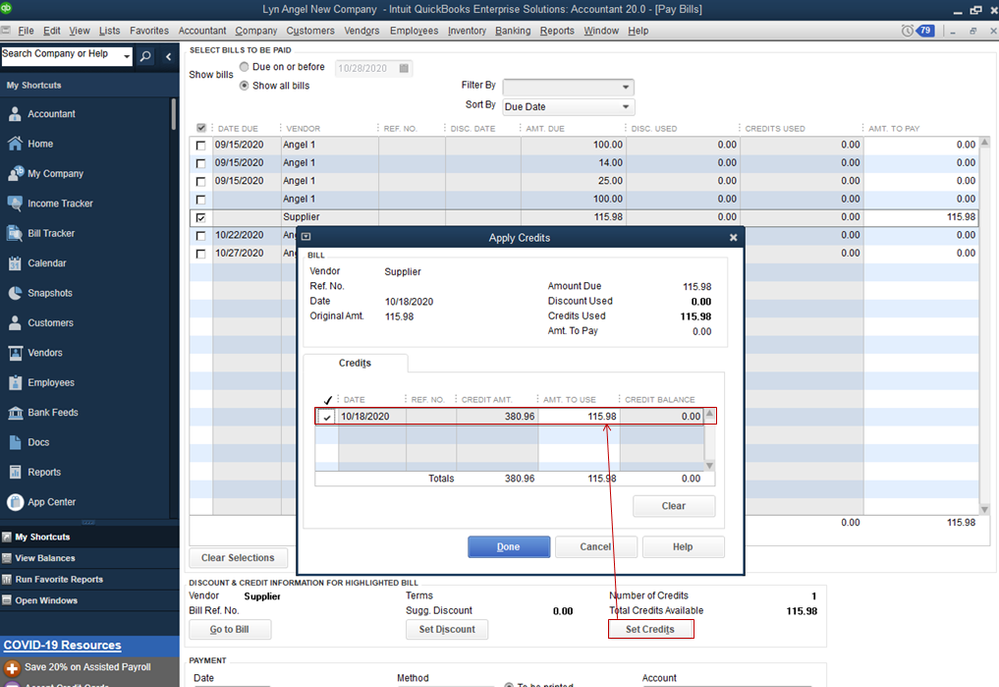

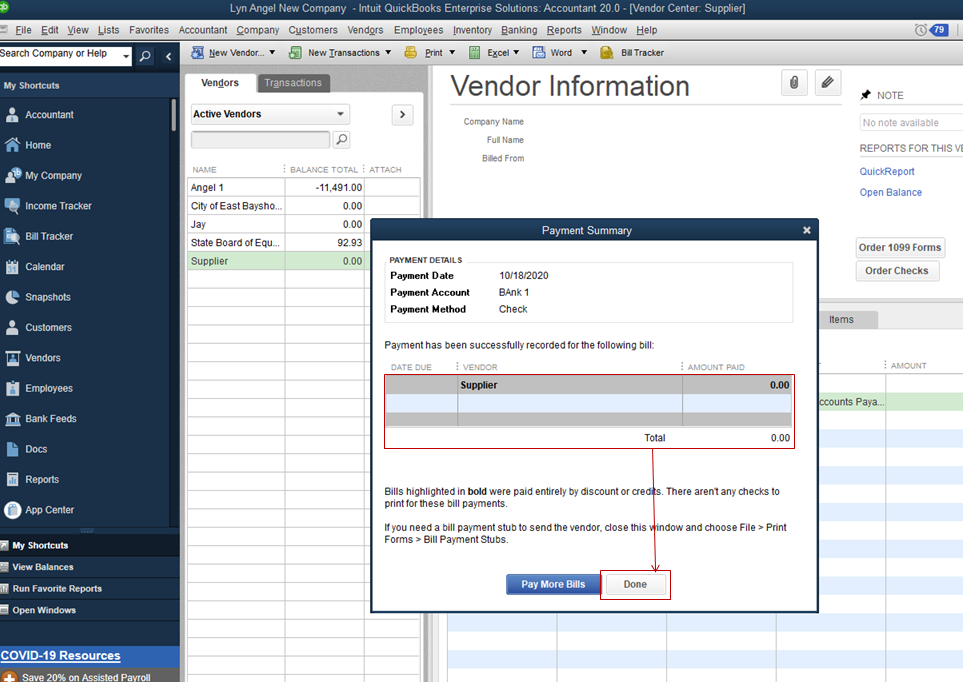

When paying the open bill, you can click on the Set Credits button to apply the deposit recorded. I'll show you how.

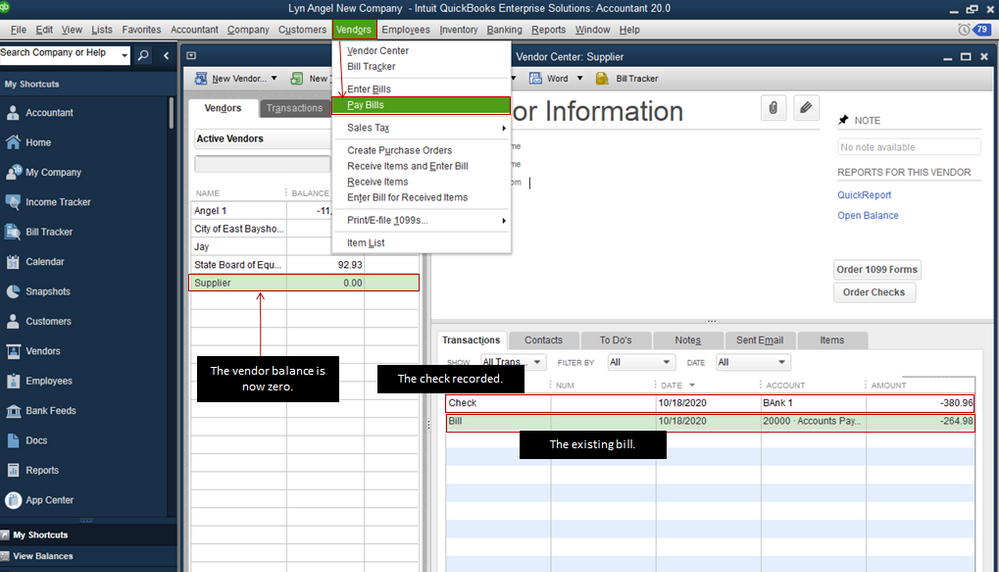

After these steps, you can review your transactions under the supplier's name. The bill is now marked as paid.

As you continue working with QuickBooks, you can read the topics from our help articles as your future references. Here's the link: Find articles, video tutorials, and more.

That should point you out in the right direction today. Keep me posted if you have any other questions. I'm more than happy to help. Have a good day!

Hi @Angelyn_T ,

I tried your steps but something still looks wrong.

Picture 1 attached shows the balance before the bill of £380.96.

Picture 2 shows the detail to make that balance.

Picture 3 shows the bill entered for £264.98, resulting in the credit of £115.98 which shows in picture 4.

Picture 5 shows the deposit made for £115.98 back to the bank account, and picture 6 shows the supplier balance now at £0.

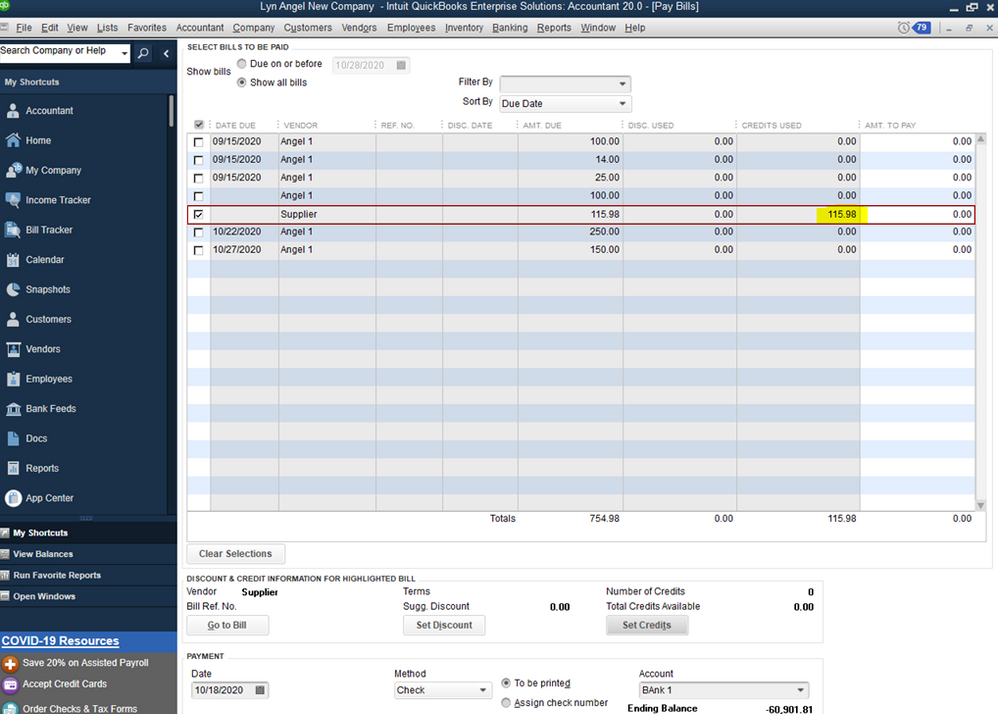

Picture 7 shows the pay bills menu.

The issue is that there are 2 entries, and how do i make it so that i can apply all the credits against the bill, as i tried it before and it wouldn't let me apply all the credits against the bill.

Thanks for providing screenshots, @jack1289.

Allow me to jump in on this thread and share additional info about recording your supplier refund.

Since your unable to apply all the credits against the bill, I recommend contacting our QuickBooks Support Team. One of our representatives can securely look into your books and further verify the cause of the issue. You can have the full contact information by going to the Help menu of the desktop company file. Then, you'll get real-time assistance via the Start a Message option.

Here's how:

Additionally, I'm adding our Accounts Payable workflow as a reference. There, you can learn more about managing and tracking the money you owe your suppliers.

Feel free to leave a comment below if you have any other questions about bills and credits. I'll be always around to lend a hand.

hi @Angelyn_T ,

My question hasn't really been answered. I can apply credits, but as per the screenshots i can't apply all of them against the actual bill, and also is the £115.98 which is the actual refunded amount meant to show up in the pay bills area?

Hello Jack1288,

Thanks for coming back to us,

we would advise you to ring into the desktop support team on 0808 168 9535, they will be able to set up a screen share with you and help guide you on what to do to resolve this issue you are having.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.