Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for visiting the Community today, info1365.

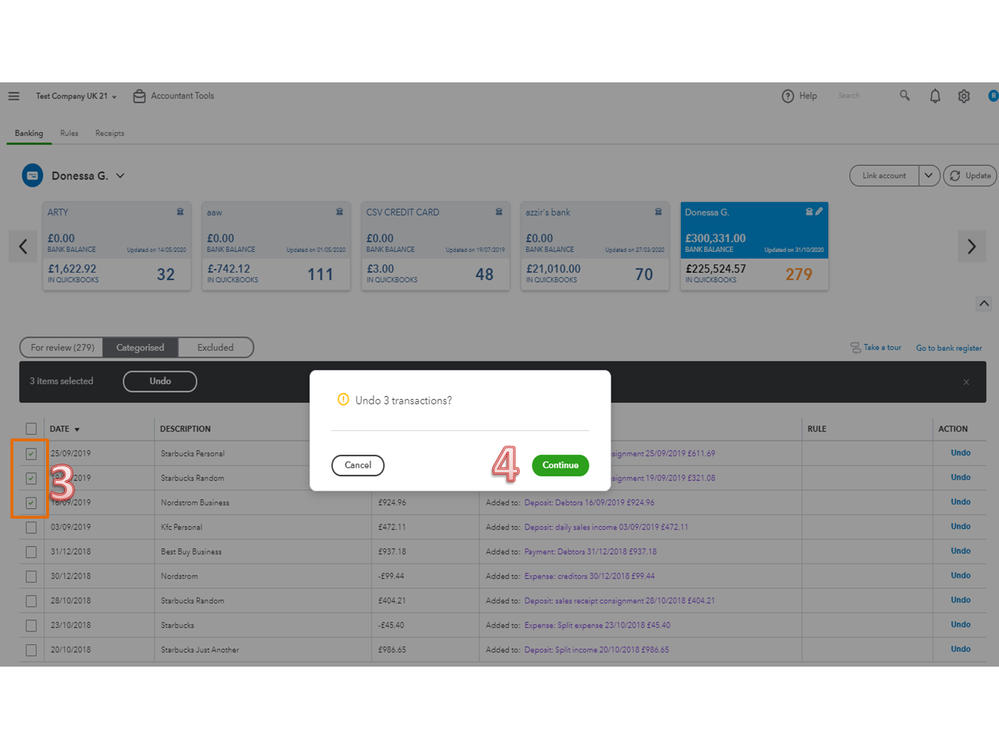

Double sale can happen when the payments for invoices are added instead of matching them. Let’s undo the downloaded transactions and properly record them in QBO.

Here’s how:

The entries will now show in the For Review column. From there, mark the box for the payment and choose to Find Match. For detailed instructions, follow the steps in this article: Categorise and match online bank transactions in QuickBooks Online.

Here are great resources that contain links to help get acclimated to the app's processes and features:

Let me know in the comment section if I can be of further assistance. I’m always ready to help and make sure you’re taken care of. Have a good one.

Thanks - Now I have another question

When I tried to match the invoices on bank tab, I do not get the option for GoCardless Charges. This gives me invoices which had been collected by Gocardless but no option for comission charges

Hi there, info1365.

You can add the deposit instead of matching it. Then, create a Receive Payment option to link the deposit you just added and select Undeposited funds under the Deposit to field. Once done, create a Bank deposit to add the processing fee or charges.

To add the deposit just go to the Banking page and click transaction. Click Add instead of Match. Doing this will post a credit to the customer. Then, you can follow the steps below to proceed.

To combine payments, you'll need to create a Bank deposit. For more details, you can follow step 2 on this link: Record and make bank deposits in QuickBooks Online.

Check out these references for more information on how to handle bank downloaded transactions:

Let me know if you have other questions. I'm just here to help. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.