- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- Re: As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT code should I be using?

Solved! Go to Solution.

Labels:

0 Cheers

Best answer June 09, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT code should I be using?

I'm here to confirm your two questions about VAT, @your.perfect.smi.

There isn't a need to record any VAT on purchases since your dental clinic isn't VAT registered. Also, I'd suggest using No VAT as the code for this. This is in line with the HMRC's guidelines for businesses that aren't VAT registered. For more details, see this article's No VAT section: UK VAT Codes.

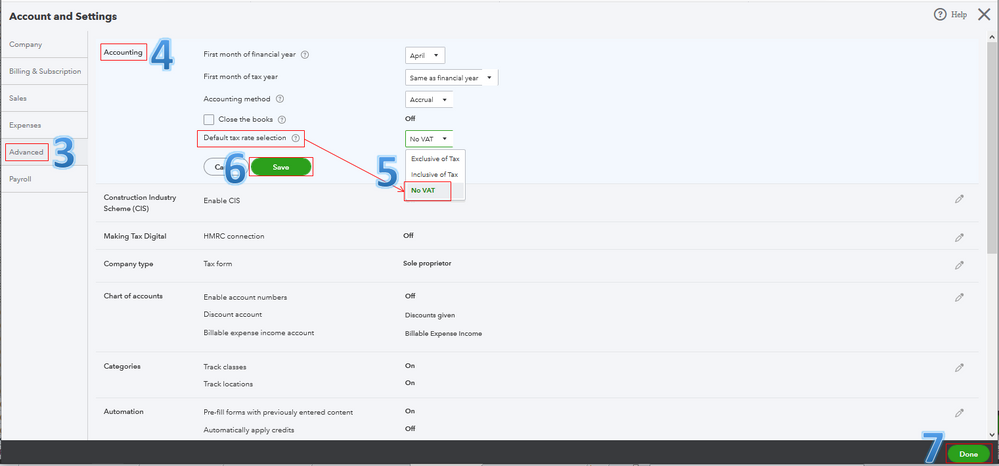

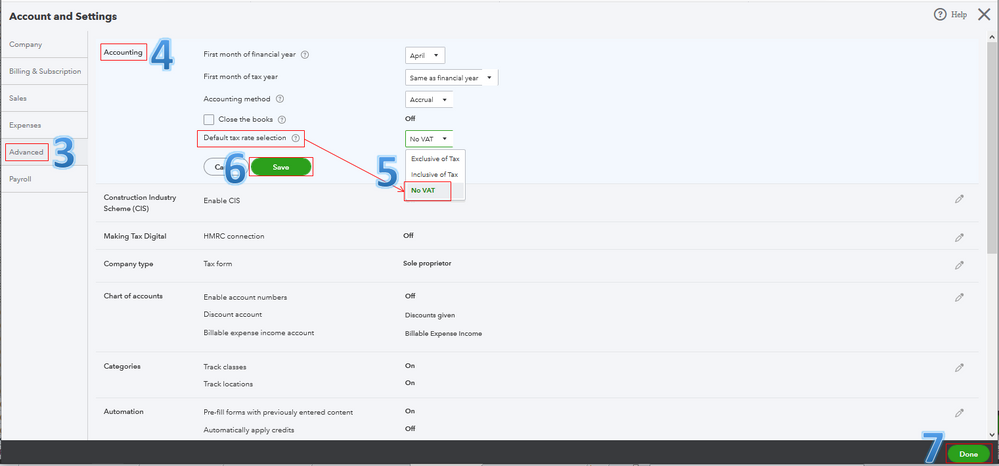

Moving forward, I recommend selecting No VAT as the Default tax rate selection in the settings. This way, the system won't include any VAT each time you create expense transactions. I'll guide you how.

- Go to the Settings (Gear) icon at the upper right.

- Select Account and Settings under Your Company.

- Choose Advanced from the left menu.

- Click Accounting.

- Select No VAT from the Default tax rate selection drop-down.

- Hit Save.

- Choose Done.

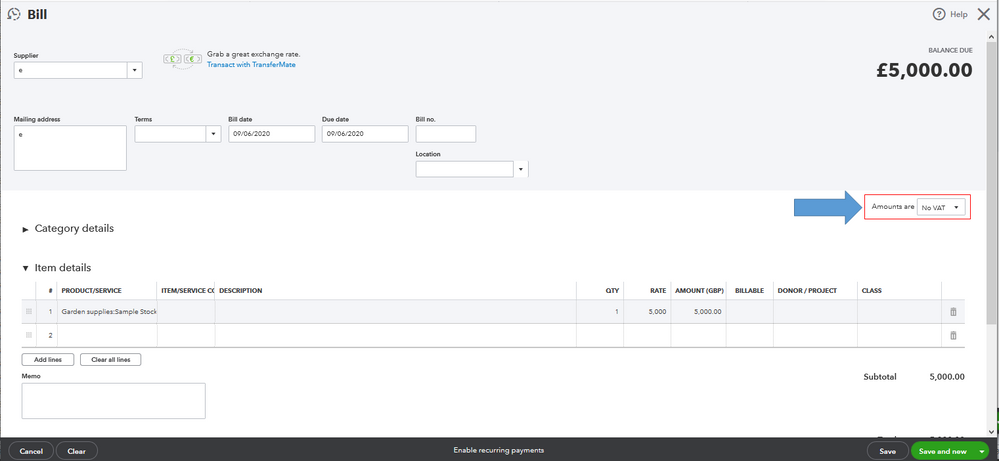

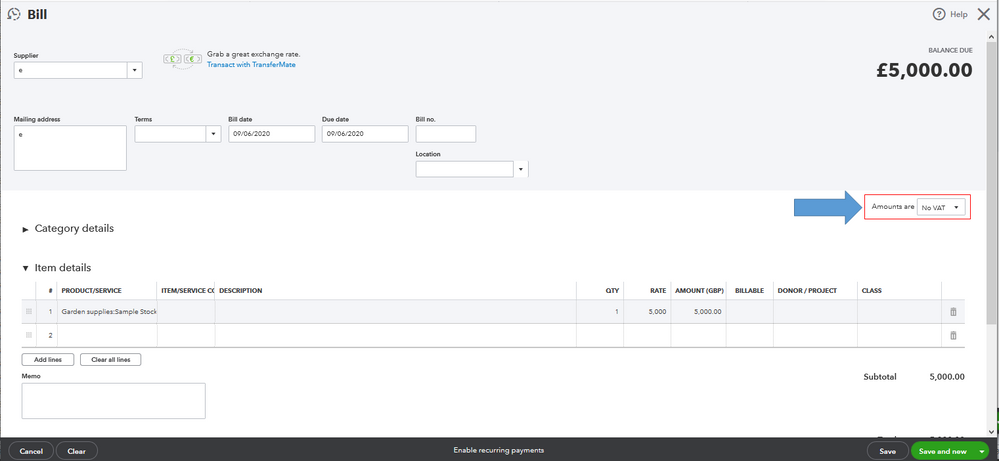

The first screenshot below shows you the last five steps. Also, you'll be able to see the Amounts are field as automatically No VAT in the second screenshot.

If you have another business that is VAT registered, I suggest going to the VAT Centre. From there, you can edit your VAT settings, codes, and rates. You can also set up an additional tax rate, group rate, or custom tax within this page. For more information, visit this website: VAT Centre.

I'll be right here to help if you need anything else. Enjoy the rest of your day, @your.perfect.smi.

3 REPLIES 3

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT code should I be using?

I'm here to confirm your two questions about VAT, @your.perfect.smi.

There isn't a need to record any VAT on purchases since your dental clinic isn't VAT registered. Also, I'd suggest using No VAT as the code for this. This is in line with the HMRC's guidelines for businesses that aren't VAT registered. For more details, see this article's No VAT section: UK VAT Codes.

Moving forward, I recommend selecting No VAT as the Default tax rate selection in the settings. This way, the system won't include any VAT each time you create expense transactions. I'll guide you how.

- Go to the Settings (Gear) icon at the upper right.

- Select Account and Settings under Your Company.

- Choose Advanced from the left menu.

- Click Accounting.

- Select No VAT from the Default tax rate selection drop-down.

- Hit Save.

- Choose Done.

The first screenshot below shows you the last five steps. Also, you'll be able to see the Amounts are field as automatically No VAT in the second screenshot.

If you have another business that is VAT registered, I suggest going to the VAT Centre. From there, you can edit your VAT settings, codes, and rates. You can also set up an additional tax rate, group rate, or custom tax within this page. For more information, visit this website: VAT Centre.

I'll be right here to help if you need anything else. Enjoy the rest of your day, @your.perfect.smi.

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT code should I be using?

Thanks for your reply. Unfortunately I have only just seen it and until now I have been recording vat, will this matter? Going forward I can start to use Non vat

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

As a dental clinic, not VAT registered do I need to record VAT on purchases? If not, what VAT code should I be using?

Thanks for coming back, @your.perfect.smi.

I'd recommend consulting with an accountant if you're not sure about making VAT adjustment. You can check out this link here to: Find an accountant or bookkeeper near you.

I've also added this handy article about adjust your VAT liability in case you'll need to. It contains detailed steps on adjusting different VAT boxes in QuickBooks.

Feel welcome to message me anytime if you need help with anything else. I'll be around to assist you every step of the way. Take care and have a wonderful weekend.

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...