Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello Community Users, We just wanted to pop in and update this thread. If you want to edit or delete a transaction on an already filed VAT return and you are on the FRS scheme it is a case of creating a journal entry. We've included the help article here(as there are screen shots of how to and further links) just look at the edit/delete section We've included part of the explanation below as well.

Because of the way Making Tax Digital works on the Flat Rate Scheme, you can't edit or delete transactions in a return that has already been filed.

If you need to make changes, you'll need to create a journal entry to reverse the original transaction by reversing the amounts of the debits and credits. Then, if needed, create a new transaction with the correct information. The best way to make sure it's reversed correctly is to use the transaction journal for the transaction you want to change and reverse the amounts that are in the debits and credits column. Enter the applicable VAT code(s) in the VAT column of the journal entry next to the line(s) that had VAT in the original transaction.

Any questions just ask

Hi annabeadle1

At the present time your are unable to directly amend transactions that are within a previously filed period if you are using FRS.

When you refer to amend, what are you attempting to do to the transactions?

Hi John

I was attempting to change an amount and delete a line.

Has this always been the case - I thought I had been able to make changes previously?

Anna

Hello Anna,

This recently changed once MTD was implemented. You will need to make any changes as an adjustment on your open return, if this change will mean you are due to pay more or less VAT.

Thanks,

Talia

I have the same problem as the person who asked the question. I accidentally accepted a bank transaction that was already counted and included in the filed VAT return. This is because the VAT return has been created and filed from the manually uploaded bank statements. But my client, unknowingly, connected direct feed for the same bank and lots of transactions got duplicated and I had to cancel them, accepting only those that happened in the new VAT quarter. Accidentally, one transaction was accepted which belongs to the previous (already filed VAT quarter - flat rate). So, I do need to cancel this transaction not to double tax this income. What is the best way to do that please?

You can exclude the transaction, Sadalbarie. This way, it will not double the tax income.

I'll walk you with excluding the transaction.

First, we'll have to undo it. Here's how:

Then, let's exclude it. Here's how:

This transaction will go to the Excluded tab. If you wish to permanently delete it, here's how:

Once you're ready, you can submit the VAT return.

If you have more questions, please don't hesitate to let us know. We're just around to help you.

Thank you. But I don't feel you understood my question.

Quickbooks does not allow me to "undo" a bank transaction that is dated in the VAT period that has already been filed. If it could then, of course, I would know how to exclude it afterwards.

Thank you for clarifying your concern, Sadalbarie.

Yes, you're right. You'll be unable to undo the transaction already.

You'll have to adjust the current period instead. This will reflect the changes that should have been made on the previous one.

I'll add the article on how you can adjust the VAT liability for better guidance.

Let us know if you need more help. Just click the Reply button below.

I am afraid, there is still misunderstanding.

I don't need to adjust the filed VAT return - it was correct. However, because of the later bank feed update, one of the income transactions duplicated the same transaction that was already included via file upload. The date on this duplicated transaction belong to the quarter that has already been filed and this is the reason why it's absolutely not possible to remove/delete/void/adjust/undo/cancel this transaction. When I go to Taxes, I can see that Exceptions report includes this duplicated income receipt as if it was previously omitted. But, it wasn't! I don't want this Exceptions report to show me the income that was already taxed. How to remove/adjust it please?.. When I try to do anything with this duplicated income, I get this message:

"Any transactions in a VAT period marked as filed can’t be changed on the Flat Rate Scheme. If you need to update or correct something, just create a new transaction." So, I tried to create another transaction that reverses the duplicated income. This corrects the bank balance, but not the Exceptions report in Taxes. The income still shows up as if it was omitted in the already submitted return - but it wasn't.

I'd like to ease your confusion, Sadalbarie. You will adjust the current VAT return.

When you change or delete transactions from the previously filed VAT, it will show in the Exception column or report. This is to make sure no VAT collected are missed or duplicated.

Although, I'd suggest reaching out to our customer care support, so an agent can take a better look at your VAT filings. Here's how:

We're just around if you need our assistance.

Hi there

did you get an explanation how to resolve this as I have just done the exact same thing. I have filed my first vat return succesufuly but then fiddling in the banking section I have added an extra payment by accident for the submitted vat period. My quick books balance is now showing extra by the amount i added and also have a new vat return created. I just want to delete the extra payment i added by accident? HELP

Hi there, JamesPondAqu.

To delete the extra payment you accidentally added, I suggest excluding this transaction from Banking page.

Here's how:

1. Click Banking from the left panel. Then select Banking section.

2. Choose For Review tab.

3. Select the transaction by putting a checkmark in the box.

4. Click Batch actions, then select Exclude Selected.

Once done, If you want to permanently delete the payment after excluding the transaction, follow the steps below.

1. From the Banking page, go to the Excluded tab.

2. Select the transaction you want to delete.

3. Click the Batch actions and choose Delete.

4. You'll be prompted with Are you sure? These transactions will not be recoverable, Hit the Yes button to confirm.

Please check this article on how to review your downloaded bank transactions to avoid duplicate entries: Download, match, and categorise your bank transactions in QuickBooks Online.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Hi there, I am having a similar problem to other posters in this thread, but having reviewed all the answers I am none the wiser; I am not an accountant and I am having trouble with the jargon.

I have accidentally 'added' a transaction in my current account from a banking feed as an expense to the VAT Suspense account. Since learning the tool I realise I should not have done this (instead I should have made a payment via the Taxes page and later matched the payment in Banking), but now I can't Undo what I have done.

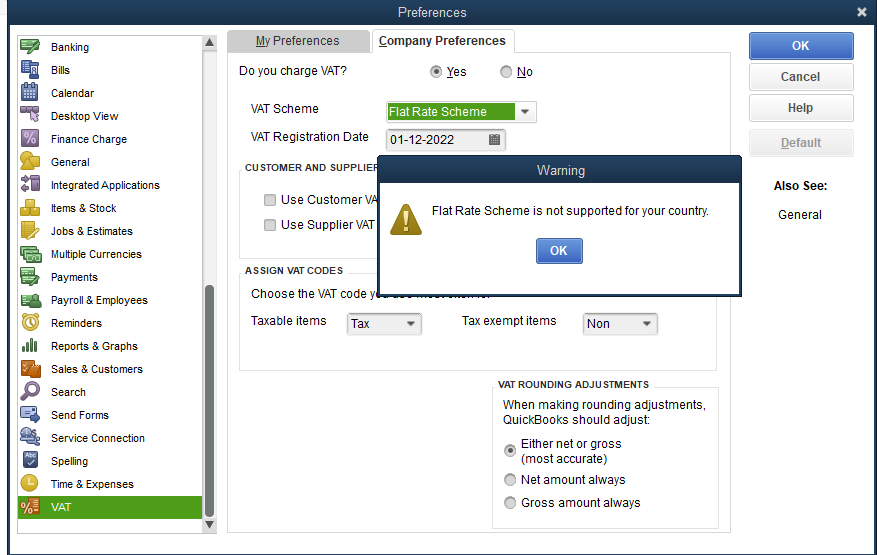

I get the error message 'Any transactions in a VAT period marked as filed can’t be changed on the Flat Rate Scheme. If you need to update or correct something, just create a new transaction.' Unfortunately, the supplied tooltip link just points to a general page about FRS and doesn't address this immediate issue I have.

I am using Taxes to keep track of VAT returns and payments, but I am not MTD (Making Tax Digital).

Can anyone recommend the best course of action in an easy to understand set of steps?

Thanks!

Lee

Good day, leeg75.

In QuickBooks Online, we can undo the transactions we've added into the register through Banking. That way, we can make corrections to these transactions. You can follow these steps:

You'll want to check these articles if you need more help with VAT:

I'll be here if you need more help with this. Have a great day!

I spoke to Francis in customer support further about this as I wasn't able to use the 'undo' feature - it just produced an error message.

The secret is to switch off Flat Rate Scheme (FRS) in the Taxes settings first. then I was able to 'Undo' the transaction and then switch FRS back on once I was happy.

Problem solved.

thanks for your help

Lee

Thank you thank you thank you. I have spent hours on this problem and it is solved with just clicking off flat rate. Thanks again for sharing .

Thanks ever so much! I had the "Any transactions in a VAT period marked as filed can’t be changed on the Flat Rate Scheme. If you need to update or correct something, just create a new transaction. Find out how"

message as well. What annoyed me was the the "Find out how" link takes you to the FRS main page which is about as helpful as a chocolate fireguard.

Hello Community Users, We just wanted to pop in and update this thread. If you want to edit or delete a transaction on an already filed VAT return and you are on the FRS scheme it is a case of creating a journal entry. We've included the help article here(as there are screen shots of how to and further links) just look at the edit/delete section We've included part of the explanation below as well.

Because of the way Making Tax Digital works on the Flat Rate Scheme, you can't edit or delete transactions in a return that has already been filed.

If you need to make changes, you'll need to create a journal entry to reverse the original transaction by reversing the amounts of the debits and credits. Then, if needed, create a new transaction with the correct information. The best way to make sure it's reversed correctly is to use the transaction journal for the transaction you want to change and reverse the amounts that are in the debits and credits column. Enter the applicable VAT code(s) in the VAT column of the journal entry next to the line(s) that had VAT in the original transaction.

Any questions just ask

WHAT I CAN DO

Hi BUNYAN ENGNERING, thanks for joining this thread - please begin a chat with our desktop team on this link so that we can check the regional settings on your account.

BUT..... If a Flat rate period has already been filed and I now make a correcting journal, that did not exist at the time of the filing, I can not change that new transaction either. A simple error in that posting can become yet another journal.

Why does it have to effect new transactions that were not previously filed?

Thanks

Hello mugelbbub, thanks for dropping by on this thread

This is a limitation of FRS in QuickBooks currently when the transaction has a standard 20% VAT code applied and is dated within a filed period. If you do need to correct a transaction, you can reverse the journal and then create as new.

We have passed feedback onto our Product team so that this can be considered as an area of enhancement in the future. If there is anything else that we can help you with, please do get in touch.

HI

Thanks for being prompt.

Yes am aware of what to do about it just think it is odd that a new transaction that was not in QBO when the period was filed is also effected by this restriction.

Fingers crossed !

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.