QuickBooks is made for accountants and bookkeepers.

Our intuitive solutions are easy to use, affordably priced and come with no hidden fees or charges.

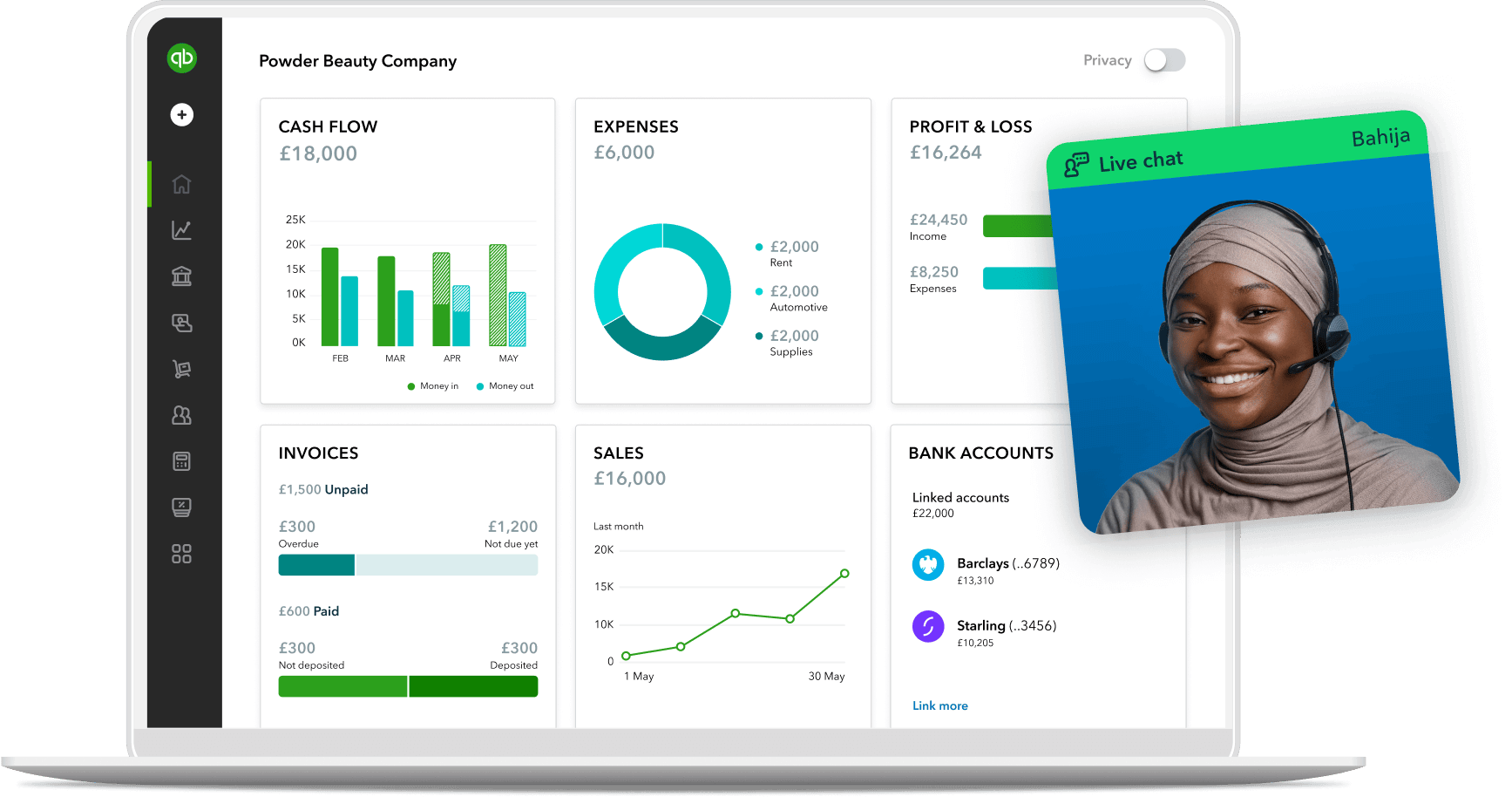

Plus you and your clients will benefit from expert product help from real people 7 days a week, and FREE 1 on 1 onboarding.

Switch to QuickBooks today.