Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support page

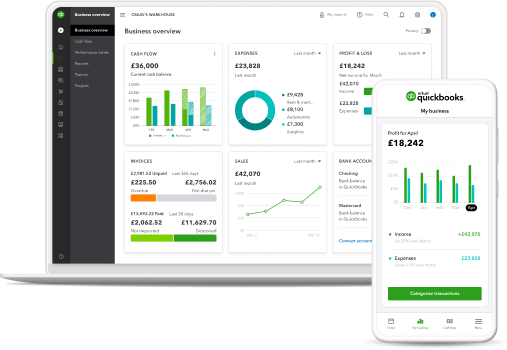

Nail your accounting and CIS all in one place

Auto-calculate and e-file CIS, invoice on the go, prepare and submit VAT, get income tax estimates and instant cash flow insights - all in one QuickBooks subscription.

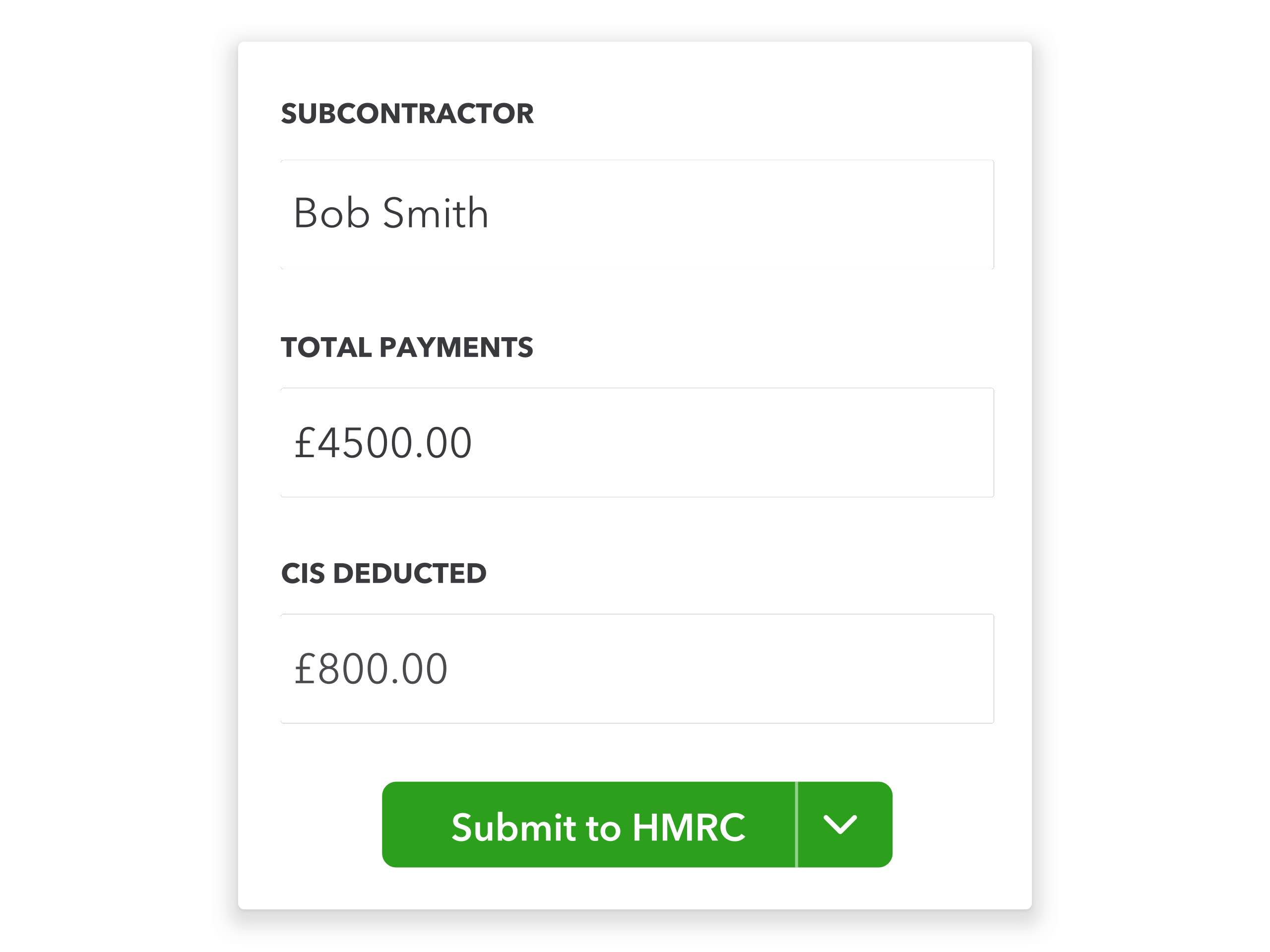

Speed through CIS sums and submissions

Manage unlimited contractors or subcontractors, auto-calculate CIS deductions, get custom reports and e-file directly to HMRC at no extra cost. It's the faster way to stay compliant.

Be confident about compliance

Rest assured that your CIS is all sorted, with accurate, automatic calculations and direct filing to HMRC. We’re up to date with all the latest changes including VAT reverse charge for construction.

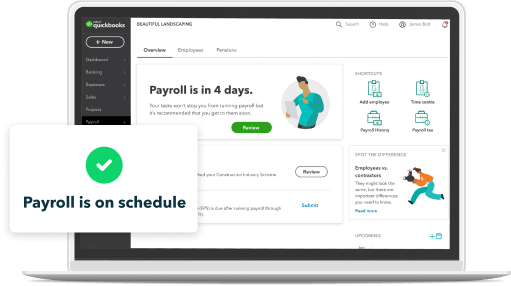

No-nonsense payroll

Save time on running payroll with easy-to-use software that covers payslips and pension contributions. Make adjustments on the go and get automatic HMRC updates. Paying contractors? We’ll calculate CIS so your wages are always spot on.

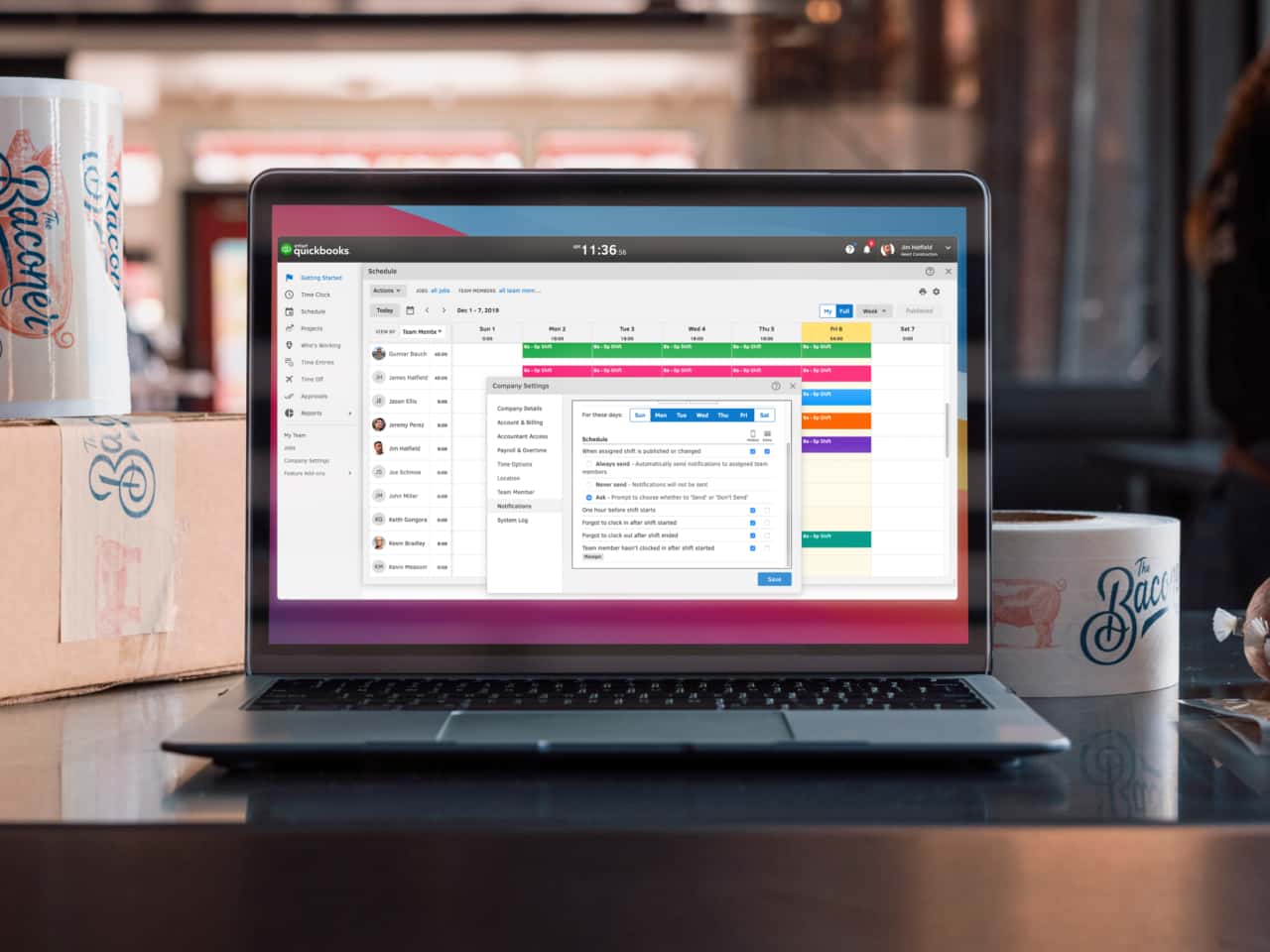

Easy mobile time tracking

QuickBooks Time helps you keep every project and employee on track. Your team can clock in using the simple mobile app, giving you real-time visibility of who’s working where, when and on what. Track time by project to understand your labour costs for more accurate job costing.

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.