Submit your VAT returns online with QuickBooks accounting software. You can prepare, track and file VAT returns—all in one place. Plus, our error-checking technology checks your VAT for common mistakes. Everything’s done in line with HMRC’s Making Tax Digital rules.

Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageJoin over 6.5 million subscribers worldwide

Our range of simple, smart accounting software solutions can help you take your business to the next level. Once you've chosen your plan, there's no hidden fees or charges.

Don’t feel outnumbered by VAT returns

Need to submit a VAT return to HMRC? Our simple, smart accounting software is Making Tax Digital ready.

Submit VAT returns straight to HMRC in seconds

QuickBooks extracts the data to compile your VAT return, ready for you to approve and submit directly to HMRC. Everything’s done in line with Making Tax Digital rules - it’s never been so straightforward.

Self Assessment? We can help

QuickBooks will help you prepare for Self Assessment by estimating your income tax using the transactions you've categorised. You'll be ready to file your return to HMRC with confidence.

More ways to get paid

Speed up the process and get paid without sharing your bank details. Our low cost options include a contactless card reader, Direct Debit collection and invoices that can be paid in a couple of clicks.

Spend less time on admin

Securely connect your bank and save time when your bank transactions are instantly pulled into QuickBooks and reconciled for you.

Snap receipts and bills

Whether you’re driving out to jobs, taking clients out to lunch or paying suppliers internationally – whatever your life looks like, we make it easy to track expenses. Use the QuickBooks app to snap receipts and track mileage on the go.

Be VAT confident

Let us help you catch common mistakes with our unique VAT error checker. It finds duplicates, inconsistencies and missing transactions—all at the click of a button, ready for you to review.

Plus everything else you’d expect from us

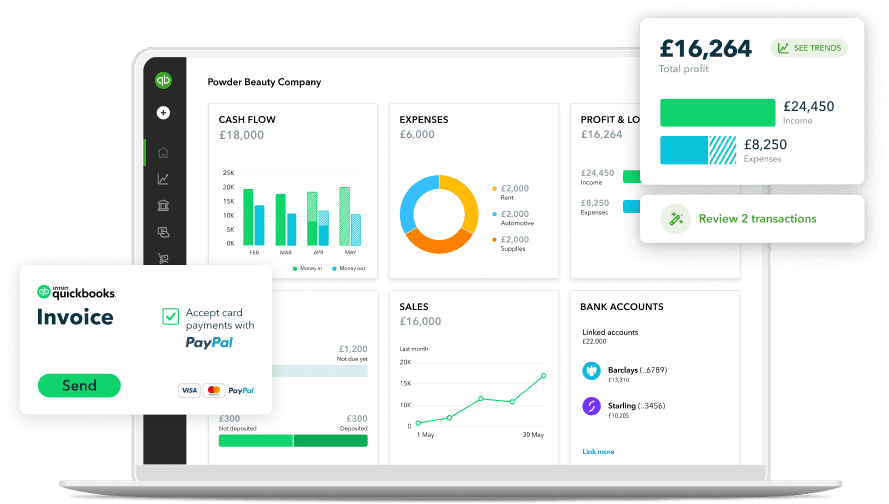

Get cash flow insights

Make smarter decisions with cash flow insights. Track projects and jobs to see where you’re making the most money.

View your finances in real time

Know where you stand with automated real-time bank feeds, auto-track invoices , expenses and payroll payments.

Automate everyday business tasks

Snap and extract receipt data, track mileage, set rules to auto-categorise expenses and auto-reconcile payments.

Pay your people

Pay yourself and your employees a salary each month by adding QuickBooks Payroll, which is HMRC recognised.

All this and more. Explore all our features

Get up and running with free support

Check out our short video tutorials and jargon-free guides, or contact our award-winning team of experts. Live chat, screen sharing and phone support are available free of charge.

New to QuickBooks? Once you've signed up, book a free 45 minute onboarding session* with one of our experts. They'll walk you through key features and answer your questions - your welcome email has all the details.

*Not available for the QuickBooks Sole Trader plan

Frequently asked questions

What our customers say

"Great product and helpful staff. I really like using QuickBooks. There are many brilliant time savings and help to improve accuracy when bookkeeping."

Beth Jenkins, Trustpilot

"Thanks for resolving our query on validation codes."

Dan McGovern, Trustpilot

"So pleasant and cheerful on the phone that it made everything easy to fix. It makes talking on the phone instead of voiceless emails a sheer delight. Thank you."

Heather Hill, Trustpilot

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.