We're here for you.

Top Employment Hero Reports | Get started tutorial

Important Employment Hero reports

Here is an overview of important Employment Hero reports.

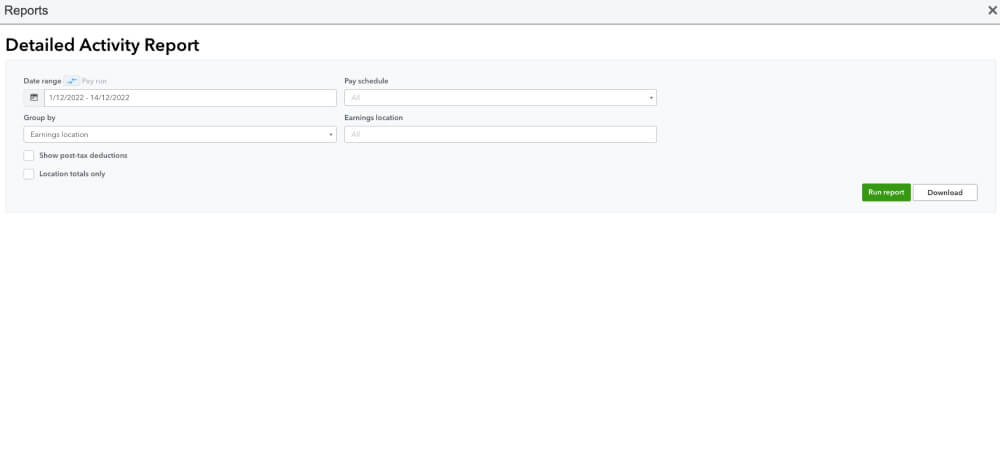

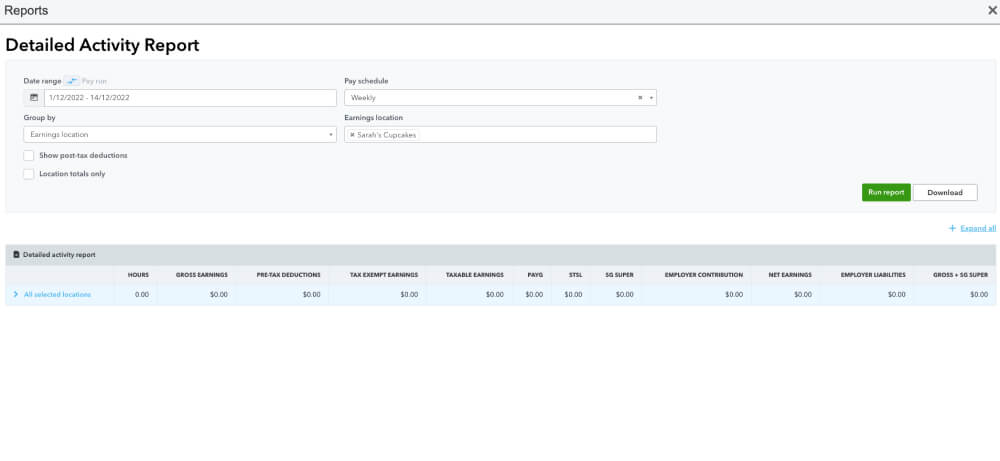

1: Detailed activity report

A breakdown of activity per employee over a given period showing:

- Gross wages

- Pre tax deductions

- Tax exempt wages

- PAYG withheld

- STSL amounts

- Superannuation guarantee contribution

- Employer super contribution by employee.

You can filter the report by location or pay schedule. When displayed, the report shows a compressed view of total wages per employee. To see a full breakdown export the report to Excel or PDF.

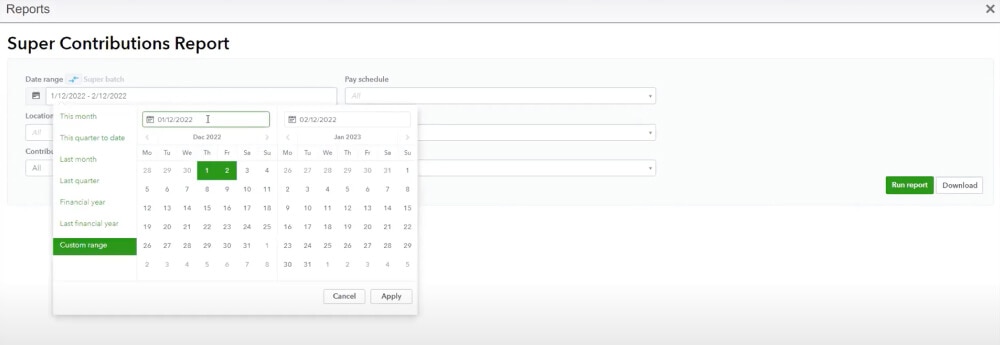

2: Super contributions

View all super contributions over a selected period. You can filter by location, contribution type, pay schedule and employee. The report can be grouped by employee or super fund.

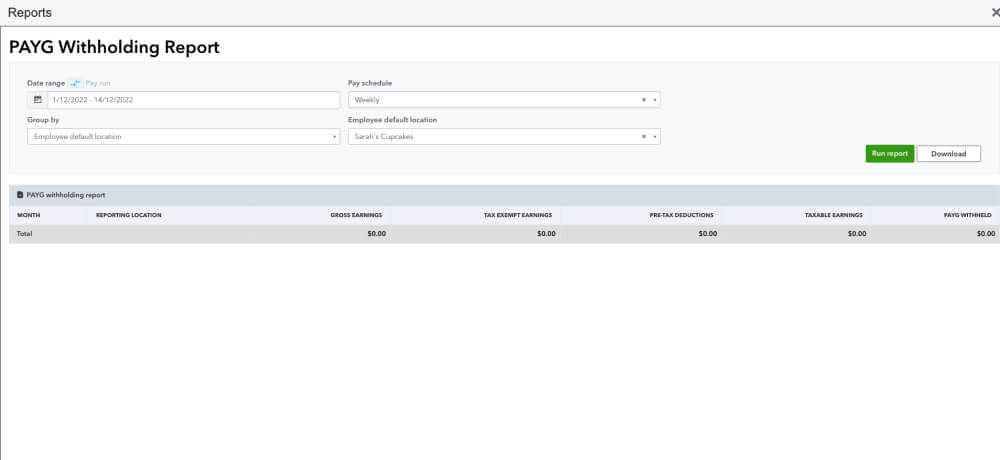

3: PAYG withholding

A breakdown of the PAYG withheld per month or for a given date range.

This report acts as supporting documentation to W1 and W2 fields on IAS and BAS lodgements.

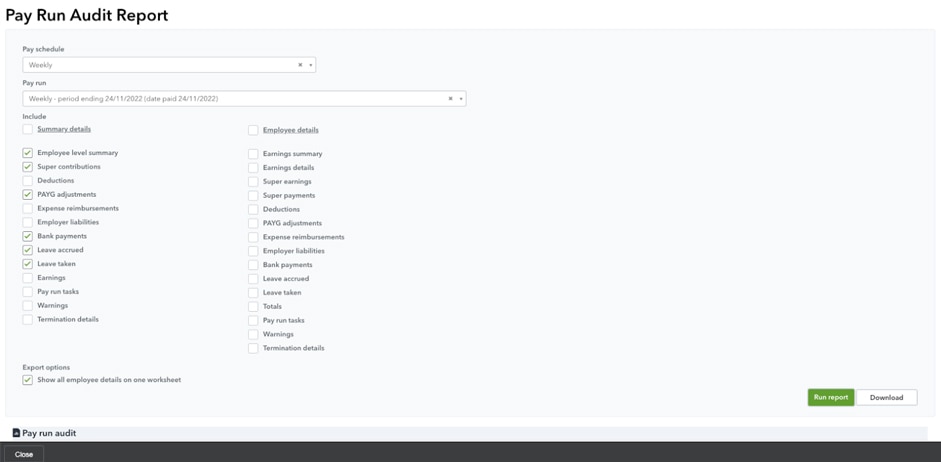

4: Pay run audit report

A useful report for managers who need to approve payroll before it is finalised and paid. The report shows details including:

- Earnings

- Super payments

- Bank payments

- Leave

- Deductions

The details can be used to cross check timesheets and data for payments.

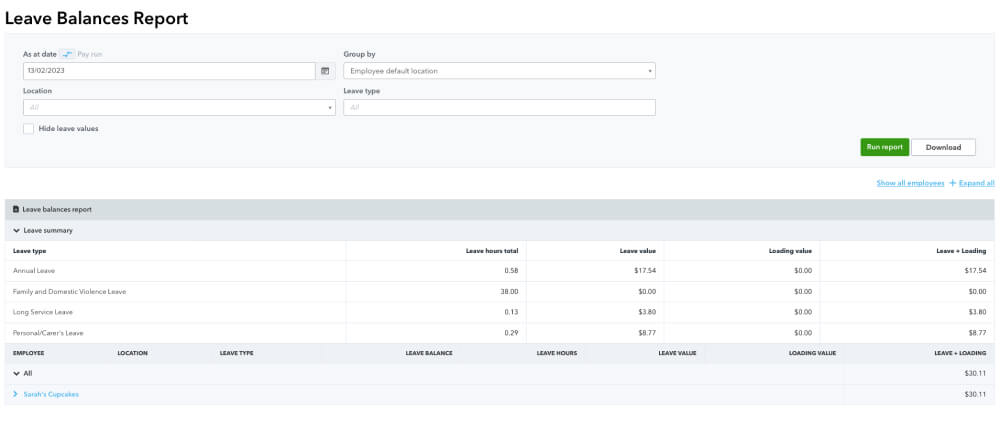

5: Leave balances

Shows the current leave balances for each employee. The top section shows a summary of all leave types. The bottom employee section expands to show leave details per employee.

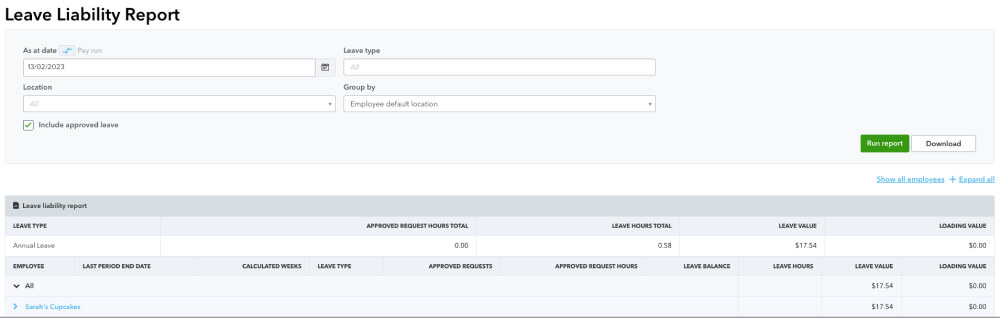

6: Leave liability

The report shows the current leave balances for each employee, displaying leave entitlements eligible to be paid out on termination e.g. Time in lieu, Annual Leave, Long Service Leave. This report is useful for showing what leave entitlements need to be paid out upon termination.

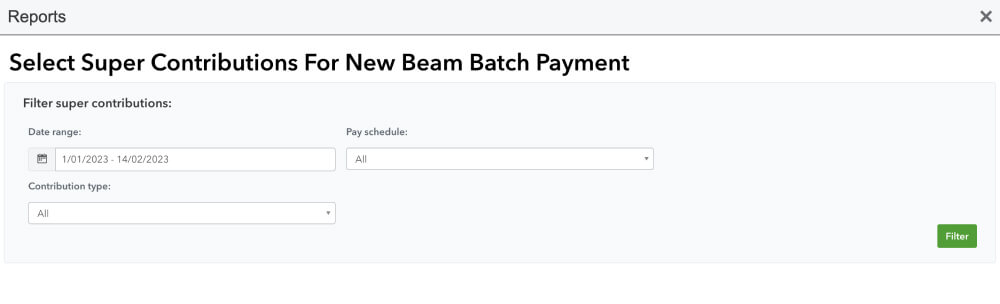

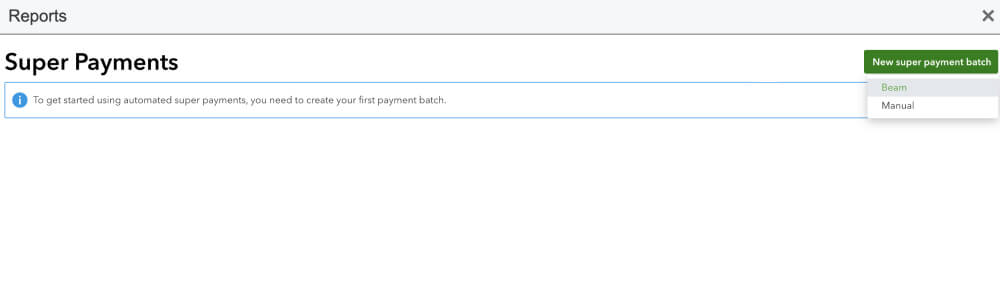

7a: Super payments

With this report you can see the total amount paid and the status of the payment, inclusive of any super funds that have been returned back as a result of missing information or error on the overview screen.

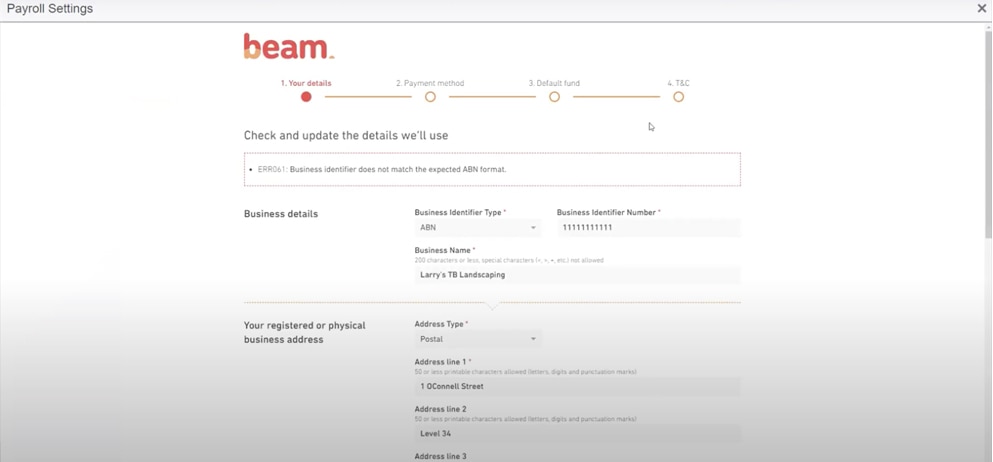

7b: Super payments

You can also use this to manage automated superannuation payments. You can pay employee super contributions directly to any registered super fund in Australia by using the in-built integration with the Beam super fund clearing house. Employment Hero is 100% SuperStream compliant and holds a gold certification with the ATO.

7c: Super payments

Once set up with the Beam super fund clearing house, you can process superannuation payments for the period at the click of a button.

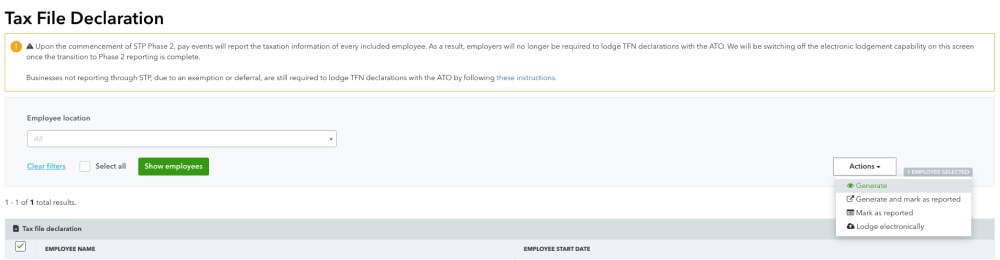

8. Tax file declaration report

This feature generates a Tax File Declaration report for new starters that can be submitted to the ATO. If a Tax File Declaration report wasn’t lodged at the time the employee was added, you can use this report to run and submit to the ATO.

As STP2 takes full effect, TFN declarations will no longer need to be sent to the ATO as tax details will be submitted each time a STP lodgement takes place.

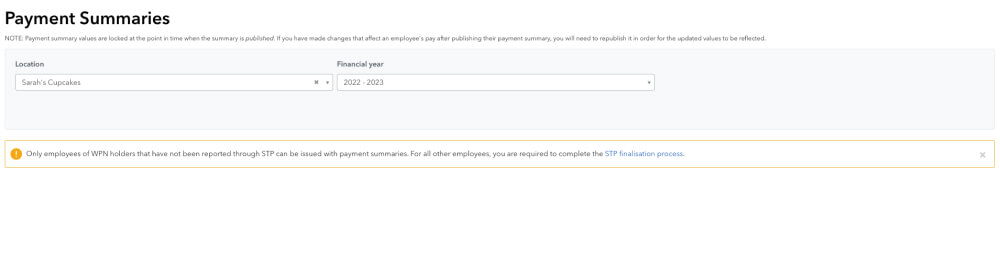

9: Payment summaries

Generation and printing of the payment summaries for all employees for a financial year. This report is only applicable for businesses that are exempt from reporting Single Touch Payroll (STP).