2022 QuickBooks Tax Release Notes

New tax season is here and we’re excited to announce new product features and updates to help you power through your tax and BAS workload.

ATO Changes

To be aware of the key changes and new measures you’ll need to consider when preparing your client’s 2022 returns, you can see an overview of the key changes by the ATO here.

Tax Forms 2022 are now available

The LodgeiT 2022 Tax forms are now available. All relevant field values including work-related deductions and rental property addresses will roll forward from 2021 returns.

ITR ATO Benchmark

The individual income tax return ATO benchmark is an optional feature for current-year returns only. Based on the client's occupation, it allows you to receive real-time messages for your clients regarding income and deductions that are unexpected.

Messaging for clients is available for the following labels: interest income and dividend income, work-related expenses, cost of managing tax affairs – other expenses incurred, other deductions – other (D15), rental interest, cost of sales and total expenses for sole traders.

The ATO Benchmark became available on 1st July 2022.

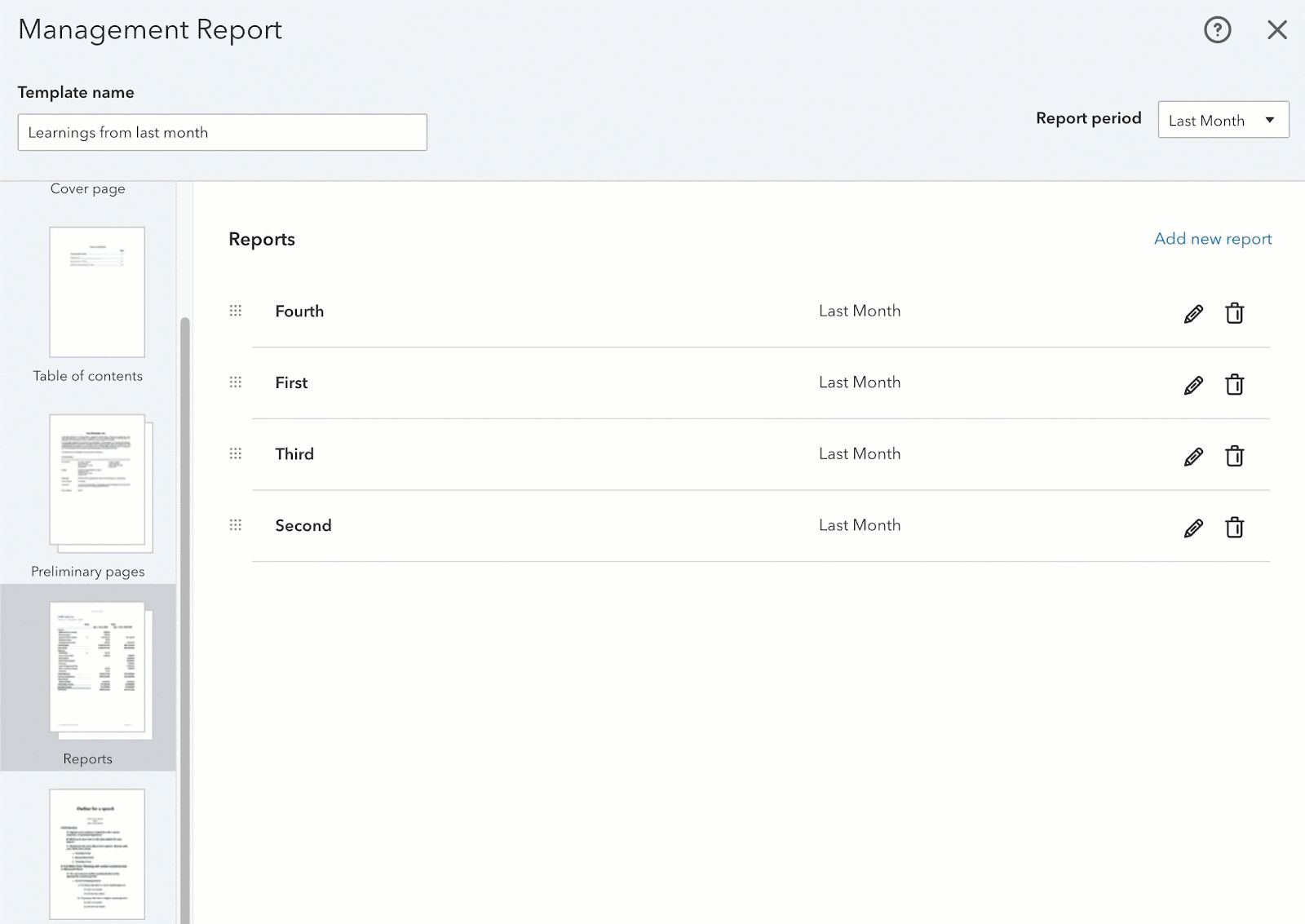

Customise SPFR Financials

You can now modify the structure of financials on SPFR. Add, rename, delete, drag & drop, collapse groups and line items to get a look you want.

Additionally, you can duplicate your reports to keep changes for the next reporting period.

QuickBooks Import for BAS Analysers

We’ve enhanced the BAS data import from QuickBooks Online into the GST Trade, Payroll and Pay/Refund analysers to find different facts faster and easier.

Other Improvements

- You can export all client relationships to CSV and Excel.

- The integrated account validator now allows summing of any values through a given timeframe by selected type.

- The lodgment and payment due dates are now included as e-sign template variables.