A business’s marginal cost is the cost required to make one additional unit of a product. The marginal cost formula is the change in the total production costs—including fixed costs and variable costs—divided by the change in output.

What is marginal cost? Definition, Formula & Example

What is marginal cost?

Marginal costs include two types of costs: fixed costs and variable costs. Fixed costs don’t change as production increases. Variable costs change with production volume. Technically, marginal costs measure the cost to produce one more item. But manufacturers often look at batches of units to assess the merit of continuing production.

For example, let’s say a company produces 5,000 watches in one production run at $100 a piece. The manufacturer will want to analyse the cost of another multi-unit run to determine the marginal cost. The average cost of producing the first run is $100, but the marginal cost is the additional cost to produce one more unit.

How to calculate marginal cost

In the example above, the cost to produce 5,000 watches at $100 per unit is $500,000. If the business were to consider producing another 5,000 units, they’d need to know the marginal cost projection first.

The business finds the cost to produce one more watch is $90. If the business has a lower marginal cost, it can see higher profits. If the business charges $150 per watch, they will earn a $50 profit per watch on the first production run. And they’d earn a $60 profit on the additional watch.

Marginal cost formula and examples

To calculate the marginal cost, determine your fixed and variable costs. Fixed costs are expenses that are known for a prescribed period. They remain the same, no matter how many units your business produces. Fixed costs include leases, fixed-rate mortgages, annual insurance costs and annual property taxes.

Variable costs change when a higher production level requires increased capacity or other adjustments. These costs can go up or down. For example, larger manufacturers may decrease their overall unit costs by negotiating lower prices on bulk purchases. This is known as economies of scale. But other variable costs, such as labour, may go up as production increases. Variable costs include labour, raw materials, equipment repairs and commissions.

The marginal cost formula

To calculate the marginal cost, divide the change in cost by the change in quantity or the number of additional units. The formula is as follows:

Let’s look at the watch production example again. The total cost of the second batch of 5,000 watches is $450,000. Dividing the change in cost by the change in quantity produces a marginal cost of $90 per additional unit of output.

How production costs affect marginal costs

Any additional investment a business makes to increase production will affect its marginal costs. For example, let’s say the watch manufacturer needs to invest $300,000 in new equipment to increase production by 5,000 units. The total cost to produce another 5,000 watches would be $450,000 plus the $300,000 investment. So the marginal cost would increase to $150. The manufacturer would need to raise the $150 price per watch to see a profit or find a more cost-effective manufacturing process.

What is marginal revenue, and why is it important?

Marginal costs reflect the cost of producing one additional unit. Marginal revenue is the revenue produced from the sale of one additional unit.

When marginal costs meet or exceed marginal revenue, a business isn’t making a profit and may need to scale back production. So marginal revenue is an important business metric.

How to calculate marginal revenue

To determine which pricing strategy works best for your business, you’ll need to understand how to analyse marginal revenue. The formula is similar to the marginal cost calculation. It divides the change in revenue by the change in the quantity or number of units sold. The formula is as follows:

The key to sustaining sales growth and maximising profits is finding a price that doesn’t dampen demand. When it comes to setting prices by unit cost, you have two options. You can increase the sales volume by producing many items, charging a low price and realising a boost in revenue. Or you can produce fewer items, charge a higher price and realise a higher profit margin.

But be careful: relying on one strategy may only work if you have the market cornered and expect adequate sales numbers regardless of the price point. Ultimately, you’ll need to strike a balance between production quantity and profit.

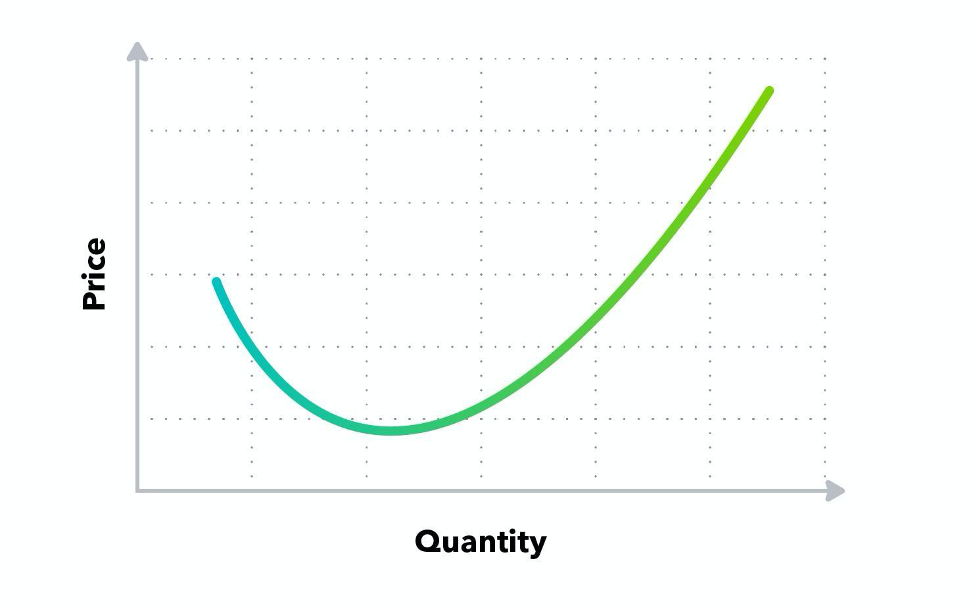

Understanding the marginal cost curve

The marginal cost curve is presented in a graph. Production quality is on the x-axis, and price is on the y-axis. On the graph, the marginal cost curves down before increasing. The u-shaped curve represents the initial decrease in the marginal cost when additional units are produced. The marginal cost rises as production increases.

The curve represents diminishing marginal returns. At some point, your business will incur greater variable costs as your output increases. The point where the curve begins to slope upward is the point where operations become less efficient.

Marginal cost vs variable cost: What’s the difference?

Variable costs are costs that change as a business produces additional units. But they are only one component of the marginal cost. To calculate the marginal costs, you need to add the variable costs to the fixed costs to get your total cost of production. Then you can divide by the change in output. If you need to buy or lease another facility to increase output, this variable cost influences your marginal cost.

How to use marginal costs in your business

Knowing your marginal cost and how it relates to your marginal revenue is critical for pricing and production planning. You may need to experiment with both before you find an optimal profit margin and sustain sales and revenue increases.

Related Articles

Looking for something else?

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.