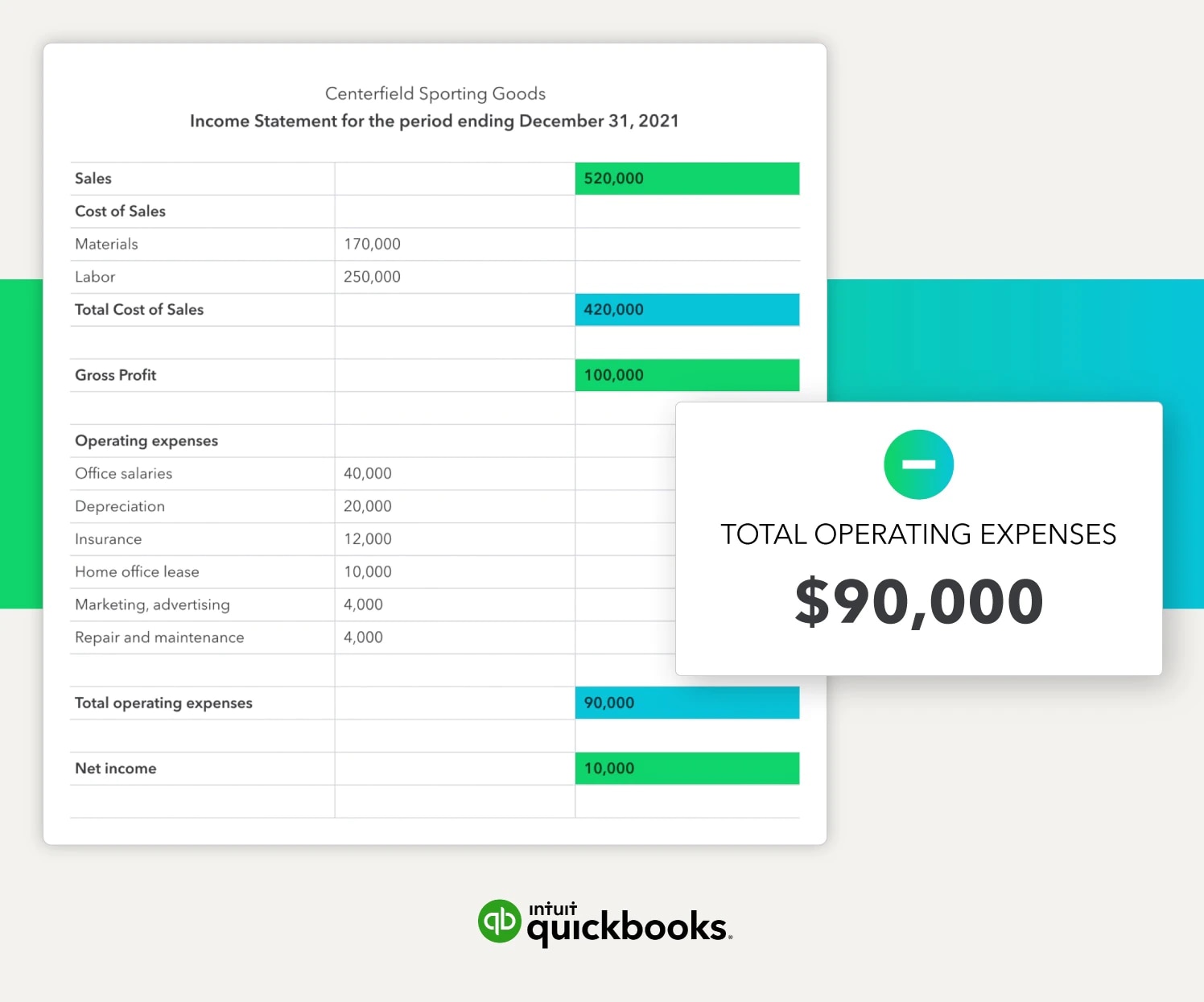

Income statement

An income statement shows a company’s revenues and expenses for a period of time. It provides information relating to returns on investments, risks, financial flexibility, and operation capabilities. The income statement formula generates an income statement. Most companies produce a multi-step income statement, which documents how a firm produces net income.

How does a multi-step income statement differ?

In a multi-step income statement, you first find your gross profit and then your operating income for a period of time.

Assume, for example, that you’re a small furniture manufacturer, and that you’re creating a multi-step income statement for May. Most of your business activity will flow through gross profit.

Your material, labour, and overhead costs post to the cost of goods sold account. In May, you sold $1,200,000 in furniture, and your cost of goods sold (material and labour costs) totalled $900,000. So you made a $300,000 gross profit.

But you also incurred expense line items—advertising costs, sales commissions, and home office costs—to operate your business in May. Let’s say those expenses totalled $170,000 for the month. You can subtract your $300,000 profit from your $170,000 expenses to find your $130,000 operating income for May.

Operating income vs. non-operating income

You can generate operating income from day-to-day business activities. In May, furniture sales produced $130,000 in operating income. Your company also earned non-operating income, including $2,000 in interest income and $4,000 from an equipment sale. So your net income for May now totals $136,000.

Your business must produce a majority of its net income from operating income activities because operating income is sustainable. Non-operating income is inconsistent and unpredictable. No company can rely on it to produce annual profits.

Review the Centerfield company’s income statement for the period ending December 31, 2021. Sales totalled $520,000, and the cost of sales totalled $420,000. So their gross profit was $100,000. And Centerfield had operating expenses of $90,000. That gave them $10,000 in operating income for the period. Since the company did not generate any non-operating income, its operating income was its net income balance.