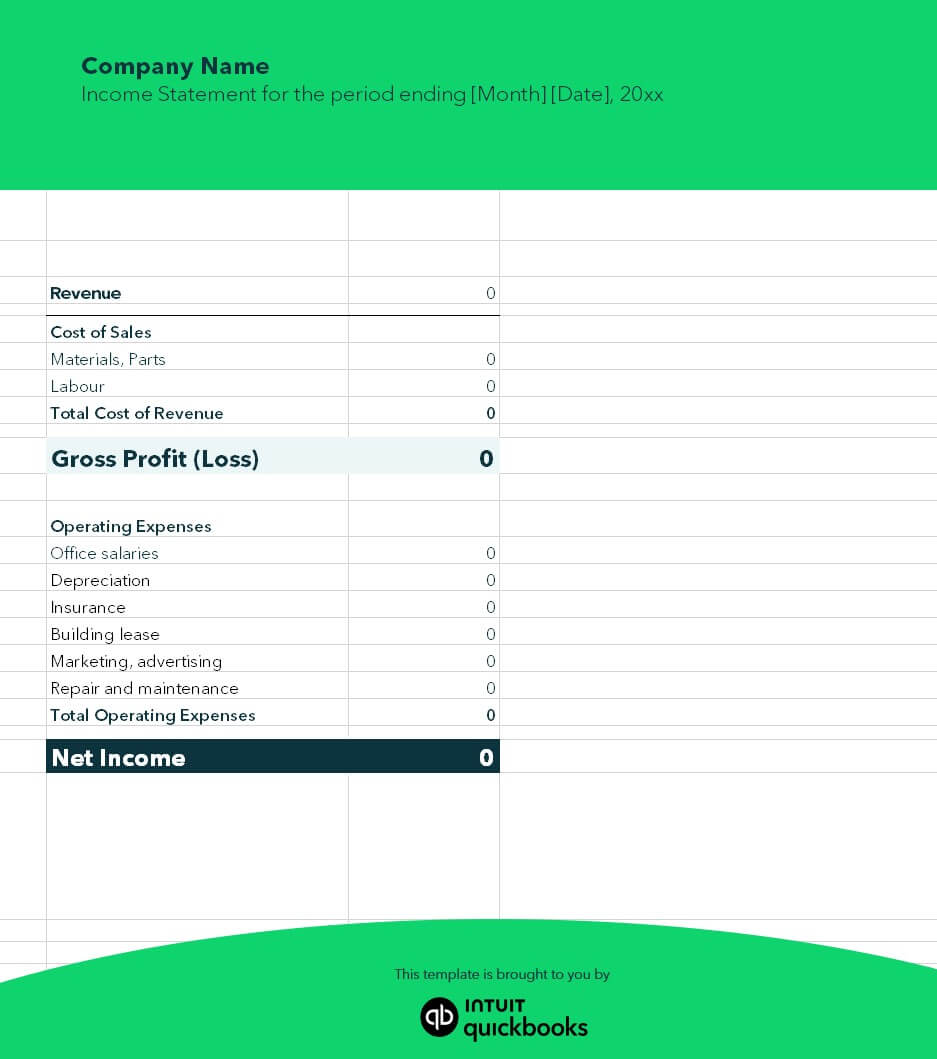

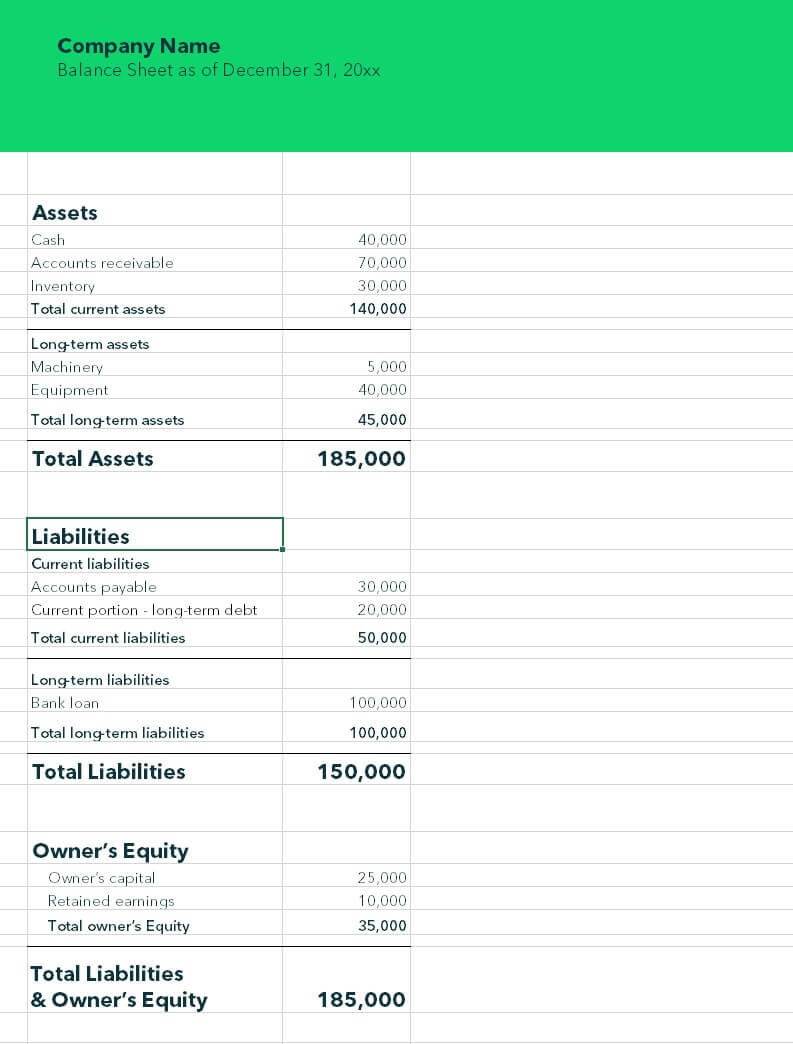

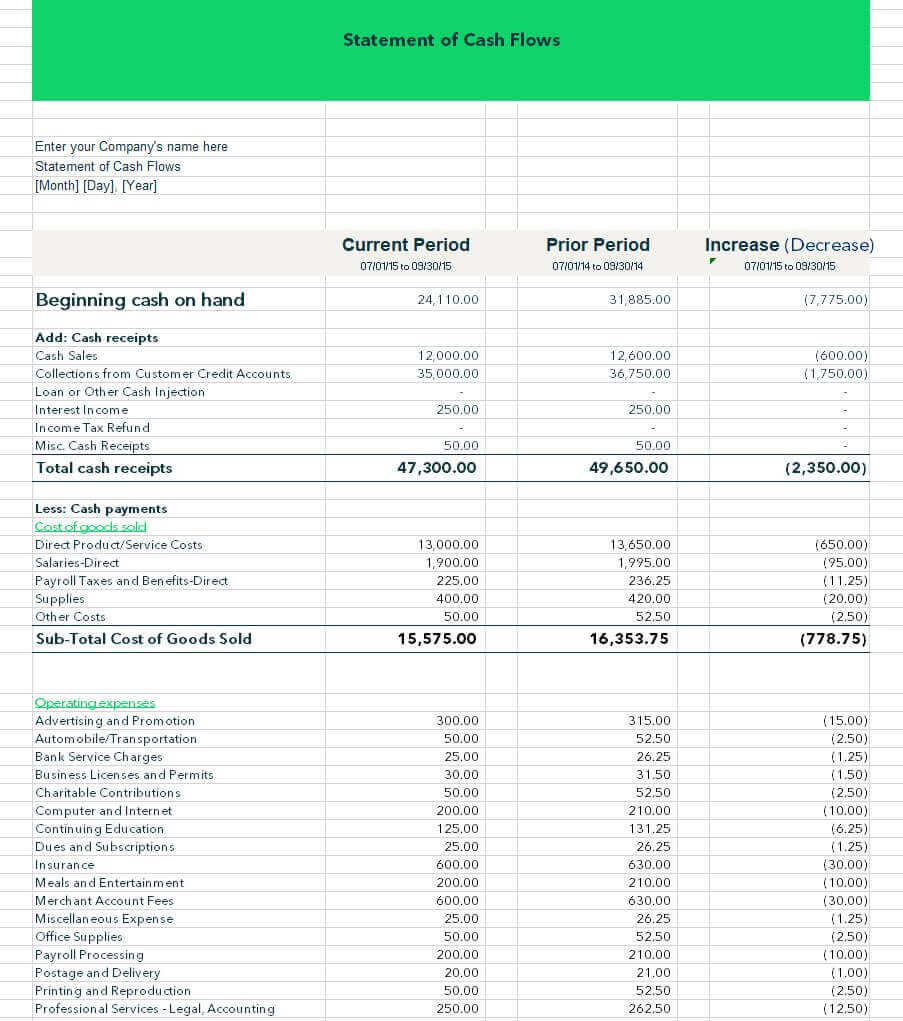

Handling your small-business' finances requires more than just knowing what’s in your bank account. Business owners use different types of financial statements, such as income statements, balance sheets and cash flow statements, to gain a better perspective of their company’s current financial state.

The three main financial statements each focus on a particular aspect of your finances and provide a snapshot of your business' financial performance. While an entire set of financial statements tells the complete story of an organisation, each report can stand on its own for different purposes and is often used for external reporting.

Our financial statement templates and examples will allow you to get a better handle on your accounting and can be a useful tool when courting investors or applying for a small business loan.

In this article you will learn about: