Sending Out Customer Statements

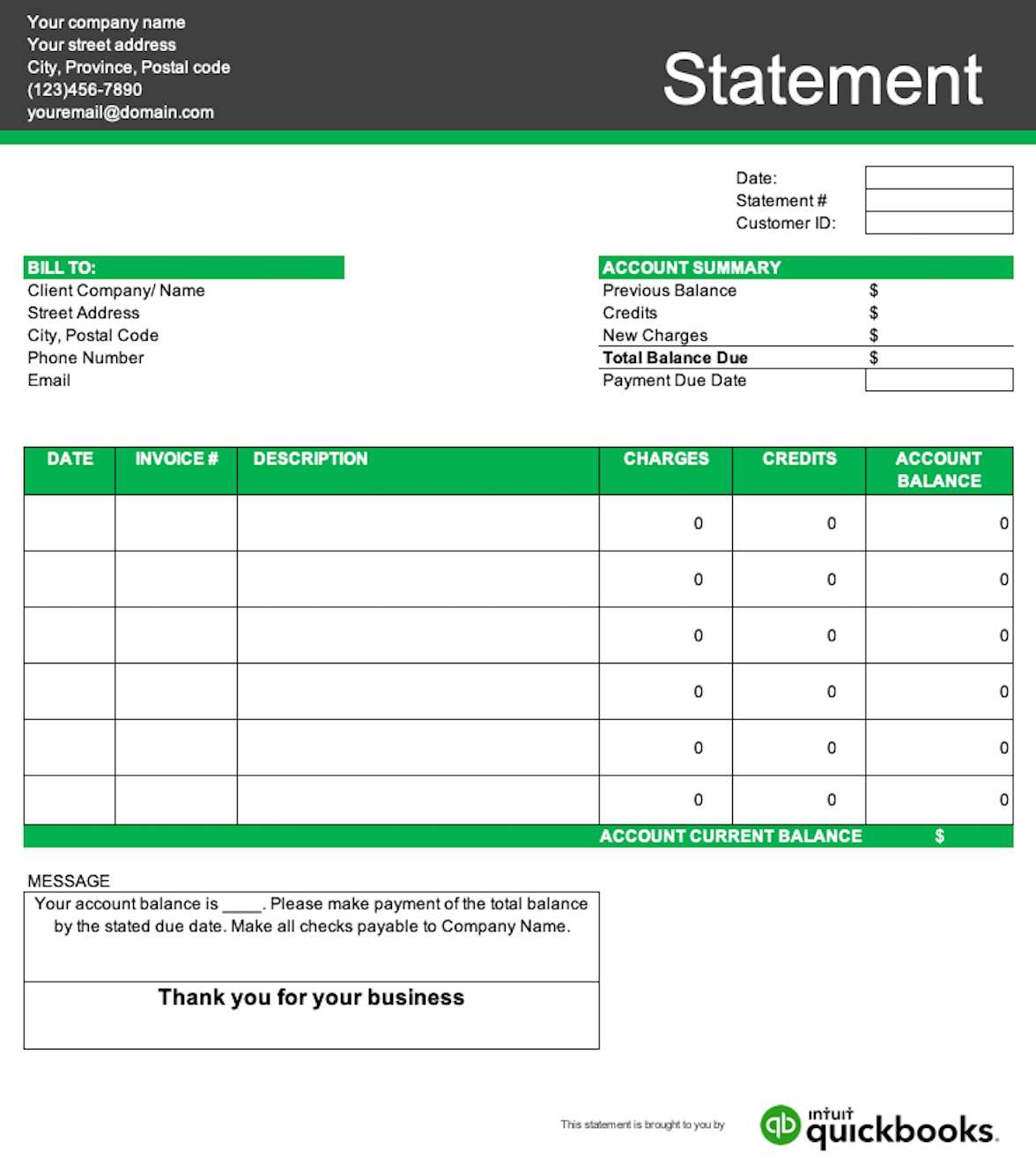

A statement of account might look like a monthly statement issued to a client. Typically, companies issue monthly statements to their clients with up-to-date transactions, as shown through a PDF file and sent through email. Sending off a statement of account to a client at the end of the month is a good way to point out if they have overdue accounts. Accounts receivable is the money owed to a business by the client, which can be found in these statements.

If a customer’s statement displays a zero balance, they are up to date on all payments. Typically, customers who have zero balances do not need to be sent this document unless they specifically request it. However, these customer statements are still used internally within a business to keep track of financial reports and transactional history for managing customer relations and in case of disputes.

Suppose your small business in Kenya offers customers the ability to make purchases on credit. In that case, these statements should always be sent out to the clients at the end of the month to bring awareness to the overdue credit and outstanding payments.