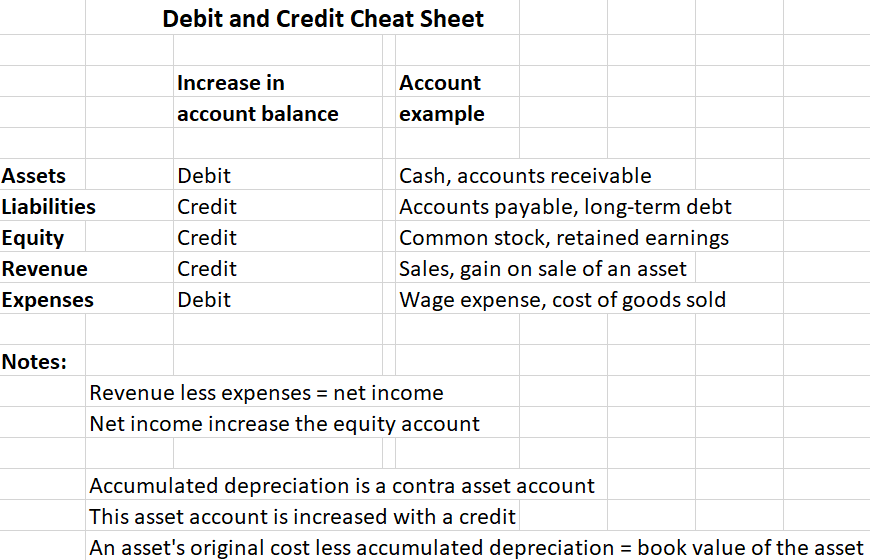

You need to implement a reliable accounting system in order to produce accurate financial statements. Part of that system is the use of debits and credit to post business transactions.

This discussion defines debits and credits and how using these tools keeps the balance sheet formula in balance. You’ll find a cheat sheet that explains debits and credits and a number of examples that explain the concepts.