Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello Userrenov8homeimp,

Welcome to the Community page,

Are you saying you still need to import the information to do your tax return for April 2019 to March 2020?

Are you just wanting to input that information so you have it in your Quickbooks account?

Hi

Yes unfortunately I still need to input the information so I can do my tax return. Then I would like to get up to date and keep using quickbooks.

Welcome back to the Community, userrenov8homeimp.

Thanks for adding more details about your concern. This gives me a better picture of how to fix the issue.

In QBO, you can input the previous year’s transactions and record the VAT return. Make sure to add the VAT codes so they’ll show in the tax form.

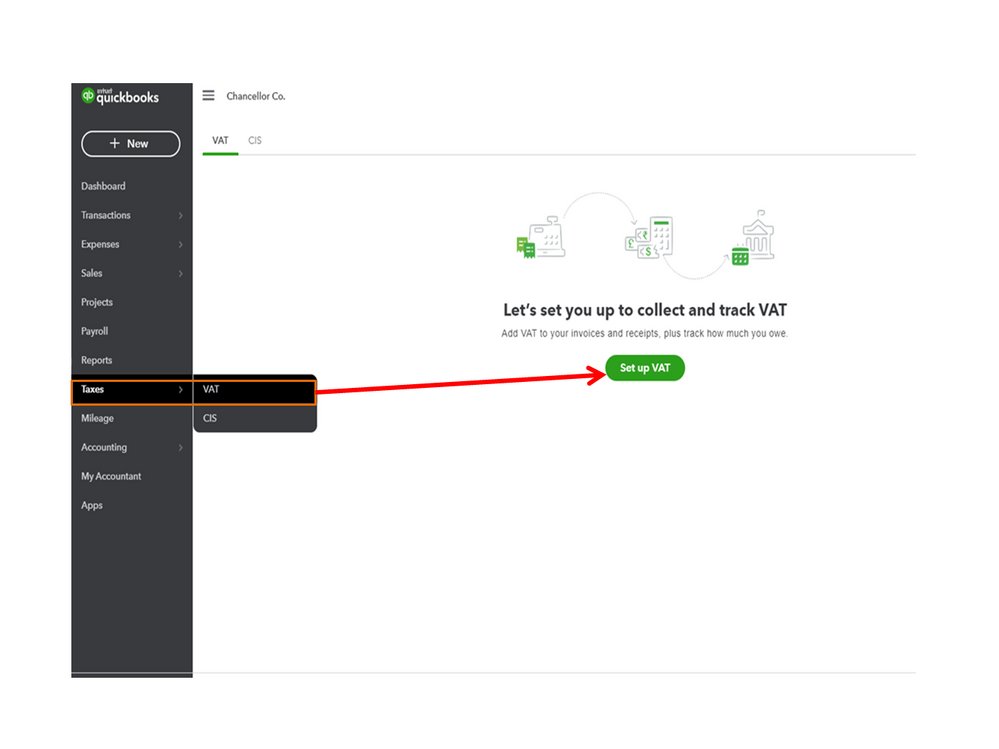

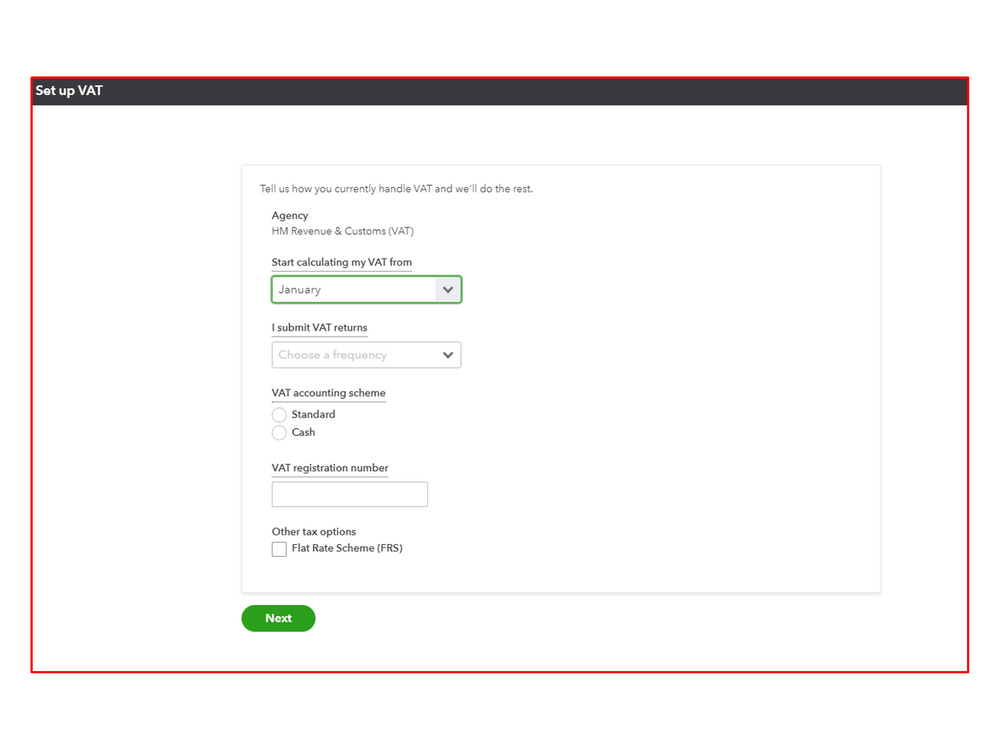

Before proceeding, let’s set up the VAT feature to apply taxes on the transactions. Let me guide you through the process.

Check out this article for more details. It includes instructions on how to add a tax rate, edit the VAT settings, etc: Set up and edit VAT settings, VAT codes, and VAT rates.

After setting up everything, enter past transactions in the same order they were created or received. For example, invoices, bills, payments, credits from suppliers. Click here to learn more about the process.

Since this is from the previous year’s tax return, you can only record the payment in QBO. This is because you’ll no longer be able to submit it using the program.

When tracking the transaction, type the correct date on the VAT settings to pull up the return. Let me show you the steps on how to record the historical payment.

Here’s how:

Moving forward, transactions with VAT codes will show in the tax form. From there, you can process it using the online program.

I’m also adding these guides to help with your future tasks. These resources contain some links on how to file and send tax forms and payments.

Feel free to visit the Community if you have any other concerns or questions. I’ll be around to answer them for you. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.