Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello there, carlaschocolatebouquets,

You'll want to categorize the transaction as Transfer in your QuickBooks Self-Employed. Transactions tagged as Transfer is excluded from our calculations for estimated taxes or business expenses.

Here's how:

You can check this article for reference: Transfers between accounts in QuickBooks Self-Employed.

Let me know if you have more questions.

Hello there, carlaschocolatebouquets,

You'll want to categorize the transaction as Transfer in your QuickBooks Self-Employed. Transactions tagged as Transfer is excluded from our calculations for estimated taxes or business expenses.

Here's how:

You can check this article for reference: Transfers between accounts in QuickBooks Self-Employed.

Let me know if you have more questions.

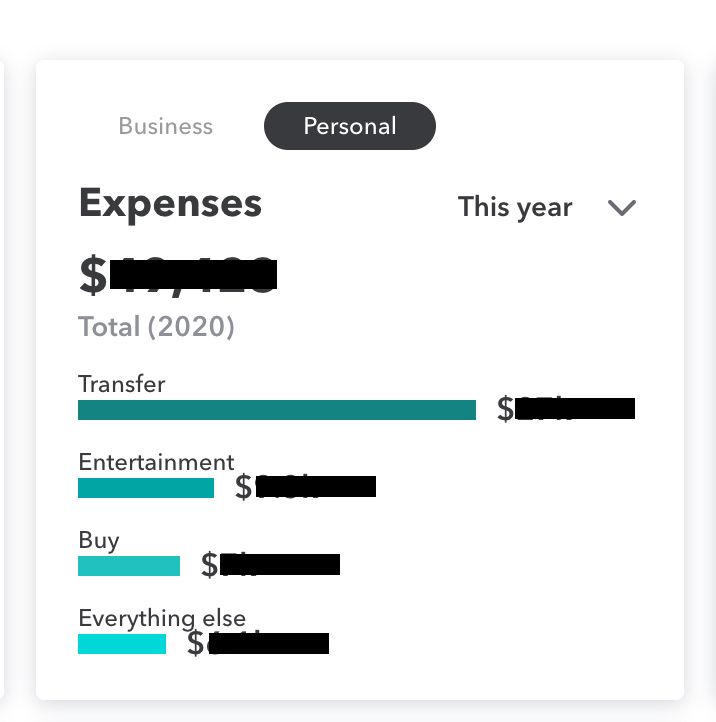

What about transfers between Personal accounts? If I transfer from my Checking account to my Brokerage account, it is showing as an expense (type: "Transfer") in my personal expenses calculation for the year.

Hi, dakoch.

Moving money between your checking and savings accounts, you will see an expense, which is the money leaving your checking account, and an income transaction, that same money being deposited to your savings and should be marked as Transfers

The following articles are good references in categorising and managing your transfers in QuickBooks Self-Employed:

If you have other questions, don't hesitate to drop a reply below. I'll zip right back to help you out.

Thanks for the quick reply!

I have both my Personal and Business account transfers categorized as "Transfers", as well as Credit Card Payments. It might be a product bug, but personal transfers are not being excluded from the Personal > Expenses calculation and display on the homepage dashboard.

Thank you for reaching out to us, dakoch.

Only the transfers from the Business category will be removed from the list since it's the basis for your tax estimation. The transfers under Personal will stay, but will not be included to estimate your tax.

lf you have other questions about your reports, please don't hesitate to go back to this thread.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.