Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi Everyone,

When the Starling bank feed's went live, i connected this up with my client, my client used Pots but there was no way to link the pots so i set up a bank account manually in the COA and put opening balances for these pots, which from this it all seemed to be great.

Now my client has just called up whilst reconciling, within the reconciliation period there was some money moved from the main account to one of the pots, Quickbooks have pulled this up on the bank feed which we transferred to the Pot, but it does not appear on the bank statement.

So the only way we can reconcile is by unticking the movement of money, I have no idea how this will work as i'm guessing Starling works in the way of its all one account but just split up, which doesnt really help when you cant connect the pots, so the movement of money cant be tracked in QBO.

any support or guidance would be great, i've tried speaking to Starling direct with no luck.

thanks,

Ryan

Solved! Go to Solution.

Hi there, @fusé-Osaka.

Welcome to the Community. I'm here to provide some clarification about how the process works in QuickBooks Online.

Yes, you're right. When you exclude a transaction from your bank feeds, it will disappear from the For Review tab and will not be added to QuickBooks.

Once you set up the pots as sub-accounts, all the transactions that you enter will roll up and reflect in the main account. If the pots/spaces aren't part of the reconciliation, I recommend creating it as a separate parent account in QuickBooks.

By doing so, you'll still be able to track transfers. However, I recommend seeking expert advice from an accountant to ensure your books will be accurate and error-free.

For additional reference, you can use the following articles to learn more about setting up sub-accounts, as well as how to move funds between accounts in QuickBooks:

Fill me in if you have additional questions about handling pots in QBO. I'm always here to help. Take care always.

Hello Ebbage,

Looks like starling just have the one account that gets split into the different pots but all come under the same one.

I would recommend that on the banking page if you just exclude the transaction then it will not appear on the reconcile so that you are not left with a transaction that follows you each time. that you are unable to reconcile with.

Hi Ashleigh,

It is just confusing to the client as this is a transaction which appears as they do their own bookkeeping, so if we exclude them then i guess we will just need to know an update of any of the balances as the end of year.

I'm just conscious of if the transfer amount within the starling accounts increases alot that you will have alot of transfers to exclude.. there surely must be a more convenient way!

Thanks,

Ryan

Thanks for getting back, Ebbage.

Your bank statement and QuickBooks balance should match when reconciling. Transactions that are not in your statement but are showing in the Banking page must be excluded.

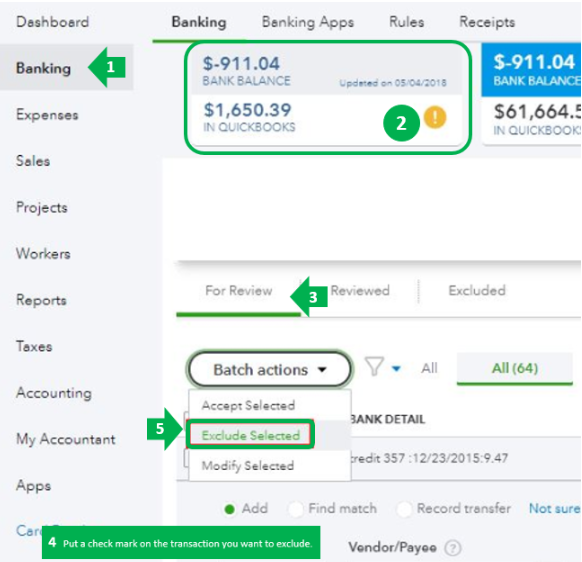

Here's to exclude:

You may find this article handy to learn more about the process of excluding downloaded transactions in QBO.

However, the best source of information for a question like this will always be an accountant for best accounting practices.

Let me know if you have any follow-ups or other questions. I'm always here to help. Wishing you a good one.

Hi,

I am facing the same issue and was hoping to fund the answer here.

I am wondering if you exclude transaction of moving money from the main account to pots/space from your bank feed, QBO thinks this money was spent/disappear, doesn't it?

Hi there, @fusé-Osaka.

Welcome to the Community. I'm here to provide some clarification about how the process works in QuickBooks Online.

Yes, you're right. When you exclude a transaction from your bank feeds, it will disappear from the For Review tab and will not be added to QuickBooks.

Once you set up the pots as sub-accounts, all the transactions that you enter will roll up and reflect in the main account. If the pots/spaces aren't part of the reconciliation, I recommend creating it as a separate parent account in QuickBooks.

By doing so, you'll still be able to track transfers. However, I recommend seeking expert advice from an accountant to ensure your books will be accurate and error-free.

For additional reference, you can use the following articles to learn more about setting up sub-accounts, as well as how to move funds between accounts in QuickBooks:

Fill me in if you have additional questions about handling pots in QBO. I'm always here to help. Take care always.

Hi,

Thank you very much for your guidance.

I followed your instruction and created new parent accounts under "Cash on hand" category for each spaces/pots.

I simply transferred each transections into these and now my bank balance matches.

Thank you very much for your advice.

Ive just come across this and new to quick books and have a starling account. Can I set up sub accounts on Quick books self employed?

Hello Cait-S,

Currently, there isn't an integrated way to change to set up your subaccounts in QuickBooks Self-Employed. Let's consider manually selecting the category you need to use every time you review your bank transactions.

In the same manner, here's an article you can read to learn more about the categories of your transactions: Schedule C and expense categories in QuickBooks Self-Employed.

On top of that, I've also included this reference for a compilation of articles you can use while working with us: Banking for QuickBooks Self-Employed.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.