Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Have finalised the payroll year and thought it would be great to use Easter to move over to online quickbooks and payroll from 2020 desktop pro quickbooks and standard payroll service (subscription). Registered and paid. However, I can't use the export file to quickbooks online as it is finding an error that I am unable to repair. Error says "Target Chaining: Target 55976 in transaction 55975, points to 'next' target 55999 which is NOT in that transaction. " Then it gives me details. It is a payroll payment made in June 2014 to an employee. When I open up the payment detail for the cheque which of course is cleared, I can see it is an errored txn as there is a recorded payment amount, but the rest of the payroll detail is blank. However, at the time the payment was of course paid with no issue. I am unable to try to populate the detail on the cheque as it was not the last payment to the employee and of course a long time after all the payroll details to HMRC. Anyone any ideas on how to resolve?

Hello there, Susan in OZ,

This error might've been from a damage transaction. You've mentioned about opening the affected one and the payroll detail is blank. If there are deleted transactions linked to a transaction, it may cause an error when exporting.

You'll want to delete and recreate these transactions to correct it. After that, try to export again.

If the same error persists, I recommend just exporting the lists, such as customer, vendor and Chart of Accounts. And start anew with QuickBooks Online.

Check out these articles for reference:

I'll be around if you have further questions.

Hi Mary, thank you for the reply. Unfortunately Quickbooks doesn't seem to allow me to delete the txn. Unless I'm trying to do it in the wrong place. I opened up the payment detail and all it would let me do was view. Is there another way to delete the txn? Thank youS

Thanks for getting back to us, @Susan in OZ.

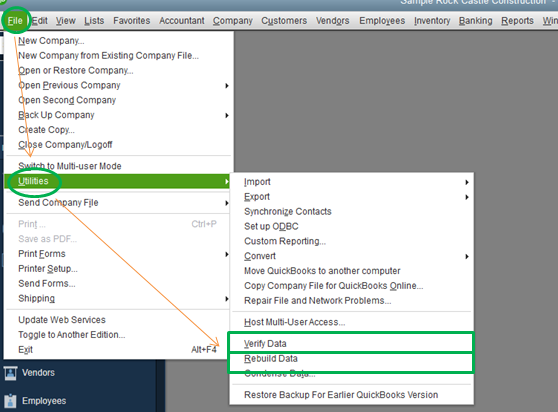

Since you're unable to delete the affected transactions, your data might be damaged. If that's the case, run the QuickBooks built-in diagnostic and repair tools called rebuild and verify data utilities. These tools will repair and notify you of any possible data damage within the file.

Here's how:

If QB detected no problem with your data, hit OK. However, if it finds an issue, you will be prompted to Rebuild Now or View Errors. Choose Close, then perform the steps below. Here's how:

For additional information about the process, consider checking out this article: Resolve data damage on your company file.

Please leave a comment in this thread if you have any other issues or concerns, and I'll get back to you right away. I'm more than willing to assist. Enjoy the rest of the weekend!

Hi Fritz,

Thanks for trying to help. I located the txn in error in the qbwin.log file. It wasn't tagged lvl_error but a chain error. I went back to the payroll txn as in my commentary in the first txn. I tried changing the date, tried adding missing detail in the payment detail etc.. to amend by filling in the missing detail. However, it just would not let me change anything stating you cannot change payroll payments because not the last payment to the employee and submitted to HMRC. I just don't seem to be able to edit the txn. It is a very old txn . Does this mean I'm just stuck? Can a Quickbooks support individual do something more? I can see now that historically the payment made was tried to be deleted as the wrong amount of pay. However, the balance of $261.50 still stuck on the cheque. It looks like at the time in bank reconciliation a journal entry was made of -$261.50 to enable reconciliation. I think at the time June/July 2014 there were QB issues with payroll detail changes. Must have been for this to have occurred. Never had any issues since then. Really do need QB support to look at this I think.

I appreciate the troubleshooting steps you've performed, Susan in OZ.

Since you're unable to modify the transactions to correct it, I would recommend reaching out to our Customer Care Support Team. They have available resources and tools to do a screen-share and able to take a look into your account. That way, they can further verify the old transactions that need to be corrected.

Here's how to contact them:

Check out our support hours and contact us at a time convenient to you.

We’d like to know if you have other concerns with QuickBooks so please don’t hesitate to post them here.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.