Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am using QuickBooks desktop.

I have a tenant who didn't pay the rent, and it has been agreed to take the owing payments from the Rent deposit held.

The rent deposit is held in a separate bank account, which i have setup in QuickBooks, and the money deposited when it was received under the account "Tenant Security Deposits Held", which is under "Other current liability" account type.

We used to send the tenant an invoice when the rent was due, so under their customer it shows the owing invoices, and the correct balance.

How do i record the deposit being transferred to the rental bank account, and also apply the amount to the open invoices, so that the balance owing is reduced.

Solved! Go to Solution.

Good day, Jack!

I'd like to clarify that the movements of funds between bank accounts and categories are recorded separately.

Yes, you can record a transfer from one bank to another if that happened in reality. However, this is just a plain transfer to show the movement of funds between bank accounts and cannot be used to pay the invoice.

What we want to achieve here is to also move the funds from the Other Current Liability account to the Accounts Receivable (Debtors) account so that we can apply it as payment to the invoice. I will guide you through the steps, but I highly suggest letting an accountant review the transactions.

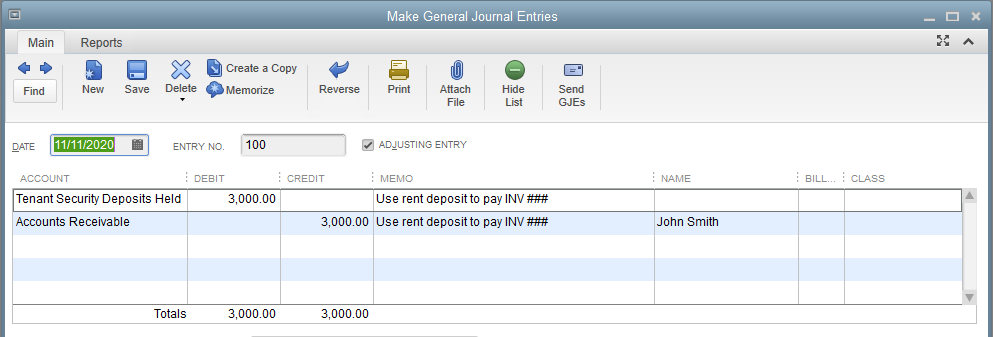

Create a journal entry to move the funds from Other Current Liability to A/R (Debtors):

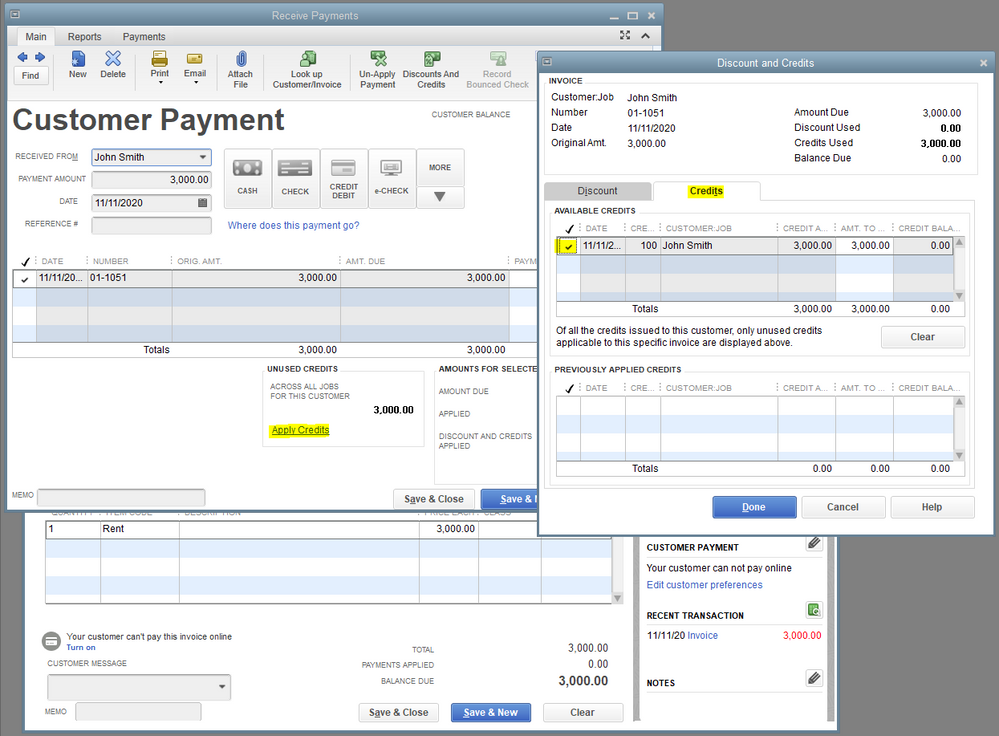

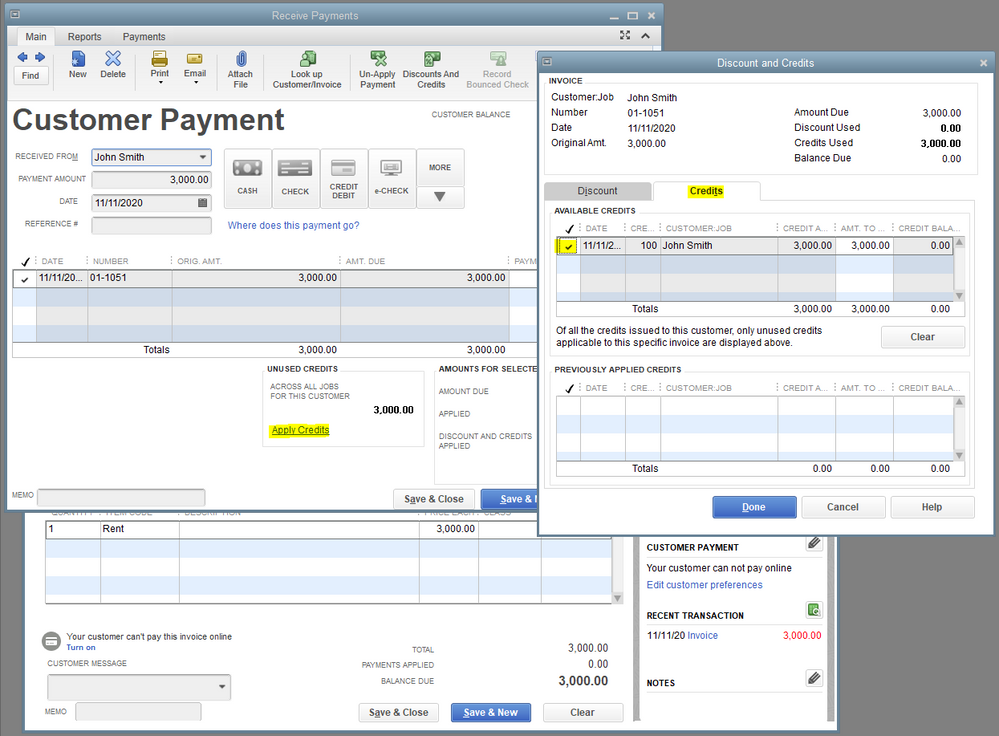

Pay the invoice using the created credits from the journal entry:

When you check your Tenant Security Deposits Held account, you should see the decrease from the journal entry we created.

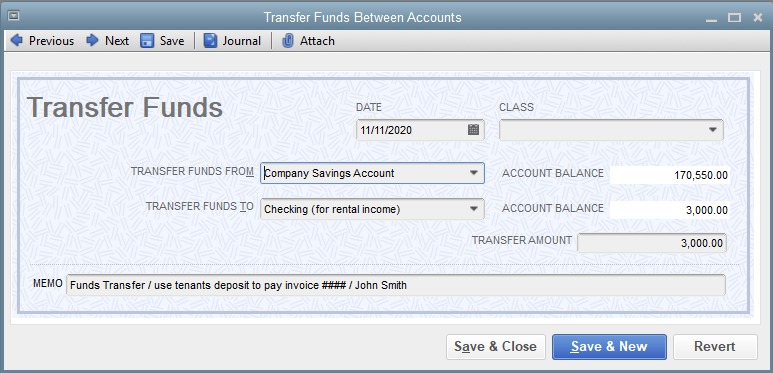

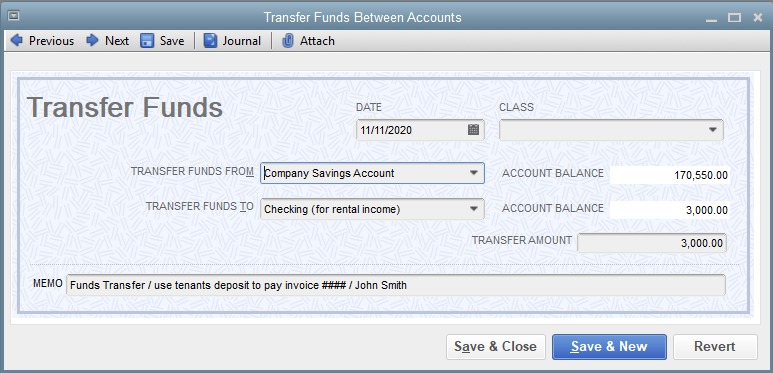

With regards to the bank transactions, create a transfer to move the funds from the bank account that holds the funds to your bank account for rental deposits.

To sum this up, your liability is decreased, your customer's invoice is paid, and the movement of funds in the actual bank accounts is also recorded in QuickBooks.

If you have other questions in mind, please don't hesitate to go back to this thread.

Hello Jack1289,

So the AP or AR just needs to be at the top line, if you follow the instructions on that box you will be fine.

So the first line in a journal entry is the source of the transactions, all the subsequent lines are targets of the transaction. Accounts Receiveable needs to be at the top and can only be in there once, you would need to create multiple journals if you need more than one AR account on it.

I'll show you some steps on how to apply the payment to an invoice, jack1289.

Before doing so, I recommend consulting with your accountant for advice to make sure your reports are accurate. To start, you'll want to write a check from the bank account where the tenant security deposits held is deposited. This is to take out the amount, so we can deposit it to the correct bank.

Here's how:

I've got a sample screenshot for reference:

Next, let's create a bank deposit to the correct bank account by following these steps:

Please see this sample screenshot:

Finally, we can apply the deposit to the invoice.

Here's are the steps:

Feel free to read this article for more information: Get started with customer transaction workflows in QuickBooks Desktop.

I'm always around if you need more help with the steps above or other concerns with QuickBooks Desktop. Take care and stay safe.

@RenjolynC Thanks for your reply.

in regards to the first step is there a reason why you have said to write a cheque. As i have both the bank accounts, the one where the deposit is held and the account where the rent is sent to, can you just do a bank transfer via the banking menu, or will this not work.

Hello there, @jack1289.

With QuickBooks Desktop, you can simplify the recording of your transactions faster and easier. With that being said, allow me to share some information on how to record transactions in QuickBooks.

When you make a funds transfer in QuickBooks, you move money from one bank account to another in the company file. Using this option is easier if you move the money via an online electronic transfer. Also, the funds are recorded directly to the account.

While if you write a check, you can create a credit memo for it and use it in paying your tenant's open invoice.

Get back to us here if you have other questions about managing your tenant's payments. I'm always here to help you manage and record your transactions.

Hi,

If i do it as a funds transfer rather than write a cheque, am i still able to pay towards the open invoice or not?

Good day, Jack!

I'd like to clarify that the movements of funds between bank accounts and categories are recorded separately.

Yes, you can record a transfer from one bank to another if that happened in reality. However, this is just a plain transfer to show the movement of funds between bank accounts and cannot be used to pay the invoice.

What we want to achieve here is to also move the funds from the Other Current Liability account to the Accounts Receivable (Debtors) account so that we can apply it as payment to the invoice. I will guide you through the steps, but I highly suggest letting an accountant review the transactions.

Create a journal entry to move the funds from Other Current Liability to A/R (Debtors):

Pay the invoice using the created credits from the journal entry:

When you check your Tenant Security Deposits Held account, you should see the decrease from the journal entry we created.

With regards to the bank transactions, create a transfer to move the funds from the bank account that holds the funds to your bank account for rental deposits.

To sum this up, your liability is decreased, your customer's invoice is paid, and the movement of funds in the actual bank accounts is also recorded in QuickBooks.

If you have other questions in mind, please don't hesitate to go back to this thread.

Hi @JessT ,

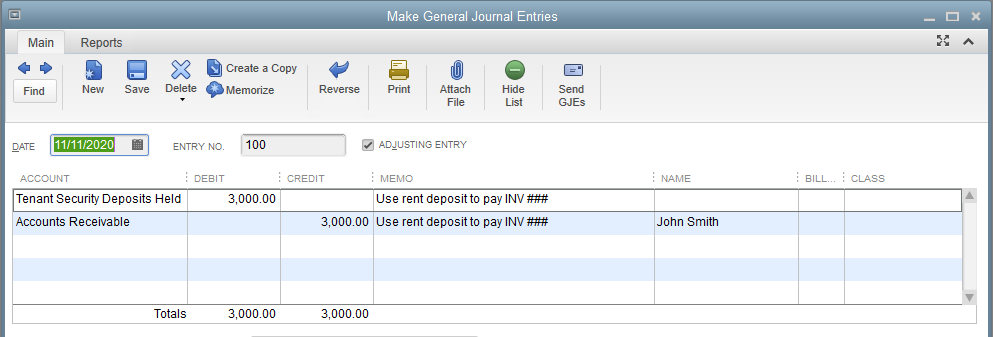

As you can see in the screenshot below, i am getting an error when trying to make the journal entry.

The error pops up when trying to select the Accounts Receivable on the second line.

How do i fix this?

Thanks

Hello Jack1289,

So the AP or AR just needs to be at the top line, if you follow the instructions on that box you will be fine.

So the first line in a journal entry is the source of the transactions, all the subsequent lines are targets of the transaction. Accounts Receiveable needs to be at the top and can only be in there once, you would need to create multiple journals if you need more than one AR account on it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.