Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi RTT account

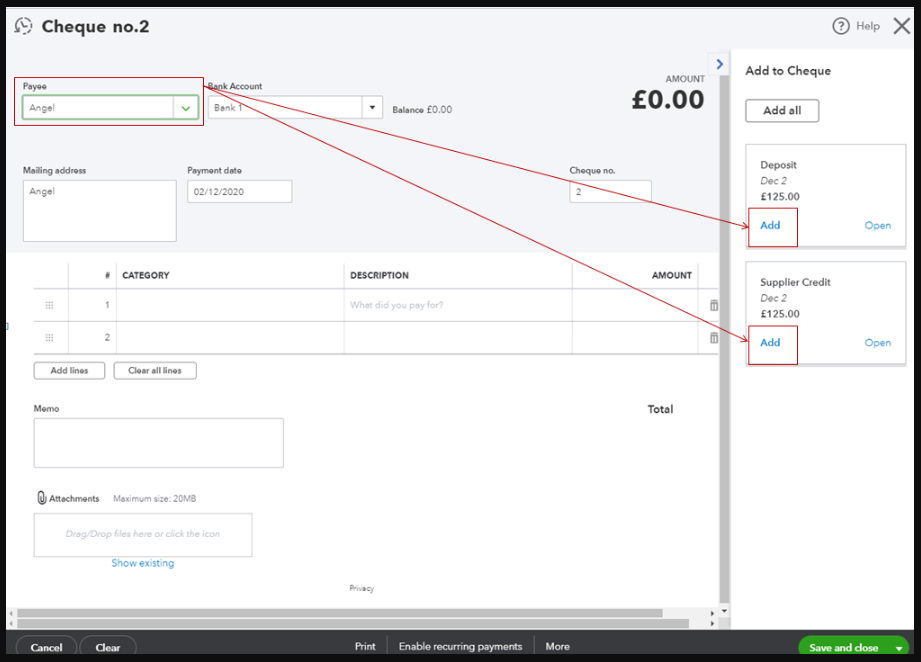

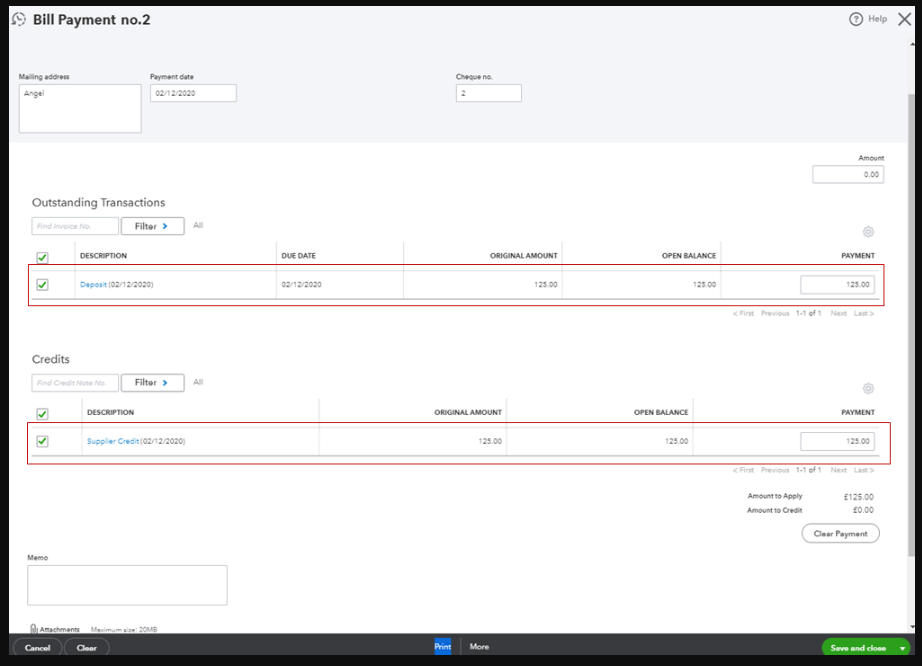

You will have to allocate the deposit to the suppliers/creditors account shown in your screenshot by selecting the supplier in the received from column and creditors/accounts payable in the account column in the adds funds to this deposit section. Although the open and overdue will be zero you will have to link the deposit and supplier credit together by creating a cheque payment > enter the suppliers name in the Payee box > the deposit and supplier credit will appear on the right hand side select add on both > save and close.

The solution will depend on whether you have an option turned on.

If in Company Settings you have the option "automatically match credits" turned on, as soon as you enter a Credit Note a Payment of Zero will be shown on the next line on the same date.

If you want to change which invoice this has been allocated to then click on the payment and select the invoice that you intended to pay off with the credit note.

If the automatic option is not turned on then go to the Supplier, select write cheque from dropdown, and then add invoice from list on right and credit note, if the invoice is more than the credit note adjust the amount next to the invoice to be same as the credit note and insure the total for the transaction at top is £0.

Any solution please? I have the same issue regarding supplier credits.

previous supplier payments were recorded as expenses, therefore no outstanding value to be paid.

then we received a refund from supplier, how to record this transaction correctly>???

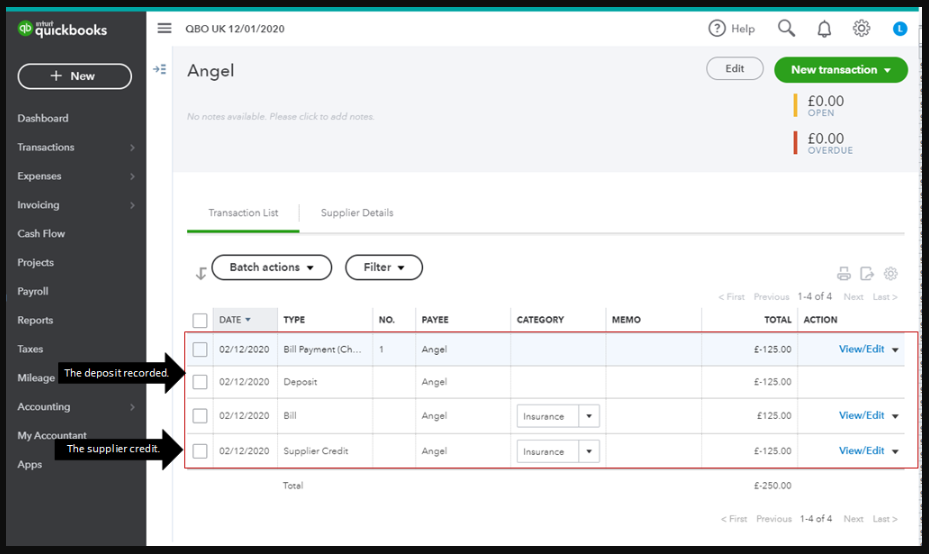

I added a supplier credit, then on banking, added a deposit for this supplier credit thinking they should be matched and recognized. However this supplier shows the credits are due to be received.

How to match them off?? plz give step by step instructions in terms of how to input supplier refunds. thx

Hi RTT account

You will have to allocate the deposit to the suppliers/creditors account shown in your screenshot by selecting the supplier in the received from column and creditors/accounts payable in the account column in the adds funds to this deposit section. Although the open and overdue will be zero you will have to link the deposit and supplier credit together by creating a cheque payment > enter the suppliers name in the Payee box > the deposit and supplier credit will appear on the right hand side select add on both > save and close.

thanks so much for your kind advice, my problem is not solved yet.

when i tried to add a bank deposit, plz see attached picture, there came an error message saying no tax can be tracked for debtor / creditor account, what does this mean?

why credits / refunds are so complicated on quickbooks?

only when we do not have more invoices to pay on the account, otherwise with another payment, this credit can be sorted by making a net payment taking in account of the credits automatically. hope this makes sense, but why??

Hello RTT account

In the case of the supplier refund.You would not put tax on the bank deposit as you will have already accounted for it on the supplier credit you have done so you would select NO VAT it will then allow you to save and close the transaction

In the case where money is paid back/received back on a refund it is a more complicated process in QuickBooks.,especially when there is not an open transaction.

Emma

thanks a lot Emma. thats solved my queries nicely:)

now bank deposit has been posted. so supplier account is showing 0 balance - all settled.

is that it? so in summary, for any supplier refunds, 2 steps are involved? 1. post supplier credit with VAT splits 2. add bank deposit to creditor account with NO VAT.

Hello RTTaccount

Then you would just need to offset those things against each other.Most users do a dummy bill for 1p for th same supplier>go to make payment>untick the 1p bill >tick the supplier credit and bank deposit>save and close. Then go back and delete the dummy 1p bill

You could also use a cheque to do the same thing it is user preference with that

Then yes that is it.

Emma

Thanks Emma for instant reply!

Also just re-read above John's advice, yes there is a 3rd step to follow to link the credit and the deposit:)

have to link the deposit and supplier credit together by creating a cheque payment > enter the suppliers name in the Payee box > the deposit and supplier credit will appear on the right hand side select add on both > save and close.

Query solved and learnt. still wish there could be a simpler function for allocation lol -- on my xmas wish list!

Hello RTTaccount

Great stuff.Glad that is resolved for you. Ha ,indeeed!

Anything else feel free to reach out to us here at the Community:)

Emma

Sorry I am totally lost.

I have the same problem. Created the credit note on the supplier account but can't allocate the bank deposit to the credit note. Could you possible list the steps or show screen shots?

Many thanks.

Viktoria

Hi there, @Ochilview.

Thank you for joining the thread. I can share with you the detailed steps on how to link the deposit to the supplier credit in QuickBooks Online.

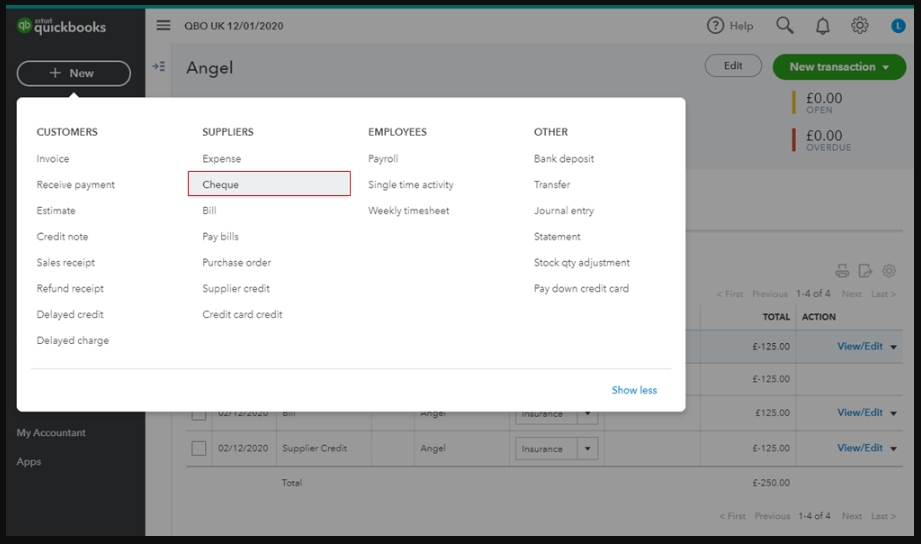

If you've already recorded a Supplier Credit and Bank Deposit for the refund or supplier's credit transaction, you can either choose a Cheque or Expense to link the deposit to the supplier credit.

Here's how:

To learn more about handling supplier credits and refunds in QuickBooks Online, you can check out this article. In case you want to pay your future bills using supplier credits, you can as well check out the instructions provided under Scenario 2: Pay bills using supplier credits.

If you have other QuickBooks questions, please feel free to leave a comment below. I'll be right here to provide additional assistance whenever you need it. Thanks for coming, keep safe!

I have refunded some supplier credit notes following the steps provided but they are still showing as outstanding on my aged payables report. This is also causing a difference between the aged payables report and trial balance, the difference being the credit notes. Have I missed a step somewhere?

Hi AlanGWA,

Thanks for joining this thread, the last step when recording a supplier refund is to link the supplier credit to the expense, to do this you go to the suppliers account and select new transaction > payment, on the following screen tick the expense against the credit note (make sure no other transactions are ticked) then save and close.

Please get back to us below if this does not resolve, thanks :)

I don't have a payment option under the New transaction option. My choices are-

Time Activity

Bill

Import Bills

Expense

Cheque

Supplier Credit

Pay down credit card

Hello AlanGWA,

Thanks for getting back yo us,

could you select cheque instead of payment as it is the same thing.

Once you have selected cheque then you can follow the steps GeorgiaC had told you.

These don't show up when I select Cheque anymore as this part has already been done, which is why I don't understand why they are still showing on my detailed report?

Hello AlanGWA, we'd need to look at this in more detail, could you post a screenshot of the supplier balance and where they show on the report either here or if you'd prefer private correspondence if you can PM us on FaceBook or Dm on Twitter under QuickBooks UK and we'll have a look?

Is there an email address I can use to contact you?

Hi Alan, there's not an email address however you can contact us on chat at this link and we'll be able to do a screen share with you as an alternative.

If you can send the link I will do that. Thank you

Please click the link here AlanGWA to reach the chat support :)

The chat link doesn't work and I spent over 2 hours on the phone to be told that the difference is fine, when I know that it isn't. Is there something else I can try?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.