Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageGet started with QuickBooks

Discover essential onboarding tools and resources to get up and running in QuickBooks in no time

Learn your way around QuickBooks Online Accountant

Training

Get free training and become a certified ProAdvisor. Boost your skills and serve your clients better.

Webinars

Stay up to date with all things QuickBooks with easy-to-follow webinars to answer your queries.

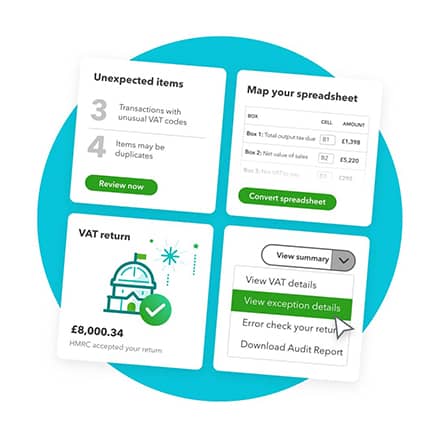

Get set up for Making Tax Digital

Making Tax Digital rules are changing. Plan ahead with QuickBooks to make sure you and your clients are ready ahead of the April 2022 deadline and beyond. Take a look at our MTD guide for more information.

Discover help and support

Access our QuickBooks community to find answers to your questions, talk shop, or get inspired.

Set up your clients for success

Does your practice have a lot of clients who need to get up to speed with QuickBooks? Contact our team about arranging a free bespoke onboarding session, tailored to your practice and clients’ needs.

Access ProAdvisor benefits

Our ProAdvisor Programme gives you access to free tools and resources to grow your practice.

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.